New York residents can click the image above and input their address and see if Charter’s expanded service area will include their home or business.

The New York State Public Service Commission (PSC) today announced approval of a $13 million settlement agreement with Charter Communications after the cable company failed to build-out its cable network as required in last year’s approval of Charter’s acquisition of Time Warner Cable. The $13 million settlement is the largest cable company financial settlement of its kind in state history and possibly the largest in the nation’s.

“In its approval of the merger, the Commission required Charter to undertake several types of investments and other activities,” said Commission Chair John B. Rhodes. “While Charter is delivering on many of them, it failed to expand the reach of its network to un-served and under-served customers at the pace it committed. We are taking these additional steps to ensure full and complete compliance.”

Charter Communications was required, as a condition of approval of its merger with Time Warner Cable, to expand its broadband service to 145,000 unserved/underserved homes and businesses in New York over the next four years. Rural broadband expansion was one of the conditions Stop the Cap! recommended to the New York regulator in our testimony regarding the merger proposal.

In the first year, Charter failed to meet its buildout requirements, only reaching 15,164 locations — less than half of the 36,250 it agreed to serve by May, 2017. The cable company first tried to blame utility companies for dragging their feet allowing Charter to place its cables on their utility poles, an argument that failed to impress the PSC. Even if utility companies instantly cleared the way for Charter, the cable company admitted it would not be ready to proceed because of necessary preparatory work needed to begin the buildout.

As a result, Charter has been forced to place $13 million in an escrow-type account that New York can tap into in amounts of up to $1 million increments to penalize the company for further delays. Charter can win back all $13 million if it stops missing its six-month buildout targets. Each time it does miss a deadline, the State reserves the right to withdraw funds in amounts that will vary based on the seriousness of the violation. Some forfeited funds will be used to acquire computers and internet training for low-income New Yorkers. The rest will be channeled into New York’s general fund.

As a result, Charter has been forced to place $13 million in an escrow-type account that New York can tap into in amounts of up to $1 million increments to penalize the company for further delays. Charter can win back all $13 million if it stops missing its six-month buildout targets. Each time it does miss a deadline, the State reserves the right to withdraw funds in amounts that will vary based on the seriousness of the violation. Some forfeited funds will be used to acquire computers and internet training for low-income New Yorkers. The rest will be channeled into New York’s general fund.

Charter’s new targets require the company to expand its cable service in increments of 21,646 homes over six periods through May 18, 2020.

Many rural New Yorkers with no access to broadband service have complained Charter has not been forthcoming about whether the broadband expansion will reach their individual home or business, so the cable company has also agreed to launch a new website where New Yorkers can input their home or business address to learn if they are included in the broadband expansion. Charter warns that inclusion on the build-list database is not a guarantee that a home or area will be actually be reached.

“Build plans, timelines, and all other information provided are subject to change and areas designated for build may not be built,” the website states.

“Build plans, timelines, and all other information provided are subject to change and areas designated for build may not be built,” the website states.

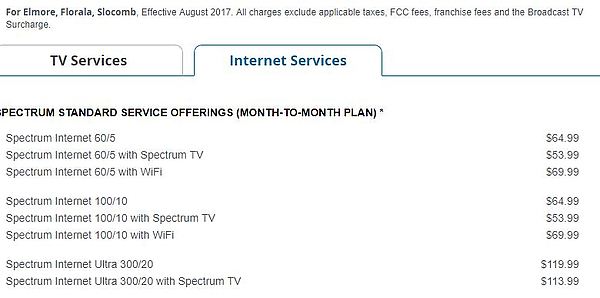

Charter is also required to deliver broadband speeds up to 100Mbps statewide by the end of 2018 — something the company has already accomplished in almost every part of the state where it provides service. The company is not subject to broadband rate regulation, and Charter charges a $199 setup fee for customers who seek to upgrade to speeds in excess of 60Mbps (except in former Time Warner Cable Maxx service areas, where 100Mbps is already the standard broadband speed). Charter must also make 300Mbps available to all New York residents by the end of 2019, something the company will likely achieve in most parts of the state sometime late next year.

Charter Communications is by far the largest cable company serving New York State. The company provides cable television, internet and telephone service in the major metropolitan areas of Buffalo, Rochester, Syracuse, Albany and the boroughs of Manhattan, Staten Island, Queens and parts of Brooklyn. Cablevision, now owned by Altice, covers the other boroughs and Long Island, as well as part of the Hudson Valley and Westchester County.

Subscribe

Subscribe