Comcast is planning to debut its new streaming TV platform under the NBC “Peacock” brand next April with a lineup of original shows starring well-known talent including Alec Baldwin, Demi Moore, Christian Slater, and Ed Helms.

Comcast is planning to debut its new streaming TV platform under the NBC “Peacock” brand next April with a lineup of original shows starring well-known talent including Alec Baldwin, Demi Moore, Christian Slater, and Ed Helms.

Peacock will most closely resemble the advertiser-supported Hulu platform, with 21 million Comcast cable television customers getting access for free. Comcast is reportedly also negotiating with other cable, satellite, and telco TV providers about bundling free basic Peacock subscriptions for their cable TV customers as well. Those who never subscribed to cable TV or cut the cord will be offered the option of a lower cost, commercial-filled subscription or a more expensive ad-free option, presumably at prices similar to what Hulu charges ($5.99-11.99).

Peacock’s subscription model is designed to protect Comcast’s cable TV revenue. For existing Comcast cable TV customers, giving ad-supported subscriptions away for free may add to the value proposition of keeping a cable TV subscription. By charging subscription fees to everyone else, Comcast is not ‘giving away the store for free.’ If it did, it could upset other pay television companies that are facing ever-rising retransmission consent fees and programming costs for Comcast/NBC-owned TV stations and cable networks including CNBC, MSNBC, and the USA Network.

Peacock’s subscription model is designed to protect Comcast’s cable TV revenue. For existing Comcast cable TV customers, giving ad-supported subscriptions away for free may add to the value proposition of keeping a cable TV subscription. By charging subscription fees to everyone else, Comcast is not ‘giving away the store for free.’ If it did, it could upset other pay television companies that are facing ever-rising retransmission consent fees and programming costs for Comcast/NBC-owned TV stations and cable networks including CNBC, MSNBC, and the USA Network.

Comcast is confident its long experience offering streaming TV Everywhere services including live streaming and on demand programming will mean it will not face the kinds of scaling mistakes other streaming services have had. Bonnie Hammer, the NBCUniversal executive appointed to run Peacock, believes the service’s deep content catalog, starting with 15,000 hours of NBC and Universal Studios TV shows and movies complimented with other acquired and original productions will give viewers plenty to watch.

“I’m not sure anybody else out there can do what we can do,” Hammer told the Wall Street Journal. “We expect to have great content and a great product [that] is really easy to use.”

In addition to scripted content, Peacock will also feature live and recorded news and sports programming from NBC.

Among the shows featured on the Peacock platform:

Original Drama Series

ANGELYNE (limited series)

Limited series based on The Hollywood Reporter feature that explored the identity of L.A.’s mysterious billboard bombshell.

BATTLESTAR GALACTICA

BATTLESTAR GALACTICA

Battlestar Galactica reboot.

BRAVE NEW WORLD

Based on Aldous Huxley’s 1932 novel, Brave New World. The series envisions life in a utopian society that bans monogamy, privacy, money, and never discusses history.

DR. DEATH

Inspired by a podcast by the same name. Dr. Death follows the true story of Dr. Christopher Duntsch (played by Jamie Dornan), a rising star in the Dallas medical community who also emerges as a deadly sociopath. Duntsch’s successful neurosurgery practice gradually deteriorates into a horror show of permanently disabled or dead patients. Two fellow doctors, played by Alec Baldwin and Christian Slater, fight an entrenched medical bureaucracy designed to protect money-making doctors to get his practice shut down.

ONE OF US IS LYING (pilot)

Based on the novel One of Us Is Lying, the crime series follows the unfolding of events after five people spend an afternoon in detention, but only four leave alive.

UNTITLED REAL HOUSEWIVES SPINOFF (no details provided)

Original Comedy Series

A.P. BIO (Season 3)

Picks up where the original NBC TV series left off. When disgraced Harvard philosophy professor Jack Griffin (Glenn Howerton) loses out on his dream job to his rival Miles Leonard (Tom Bennett), he is forced to return to the small town Toledo, Ohio and work as an advanced placement biology teacher at the fictional Whitlock High School. Jack makes it clear to his class that he will not be teaching any biology. Realising he has a room full of honor-roll students at his disposal, Jack decides to use them for his own benefit: getting revenge on Miles. Eager to prove that he is still king of the castle, Principal Durbin (Patton Oswalt) struggles to keep Griffin under control.

PUNKY BREWSTER (pilot)

PUNKY BREWSTER (pilot)

This continues of the iconic 80s sitcom about a bright young girl raised by a foster dad features Punky as a now single mother of three trying to get her life back on track when she meets a young girl who reminds her a lot of her younger self.

RUTHERFORD FALLS

A small town in upstate New York is turned upside down when local legend and town namesake, Nathan Rutherford (Ed Helms) fights the moving of a historical statue.

SAVED BY THE BELL (reboot)

When California governor Zack Morris gets into hot water for closing too many low-income high schools, he proposes they send the affected students to the highest performing schools in the state – including Bayside High. The influx of new students gives the over-privileged Bayside kids a reality check.

STRAIGHT TALK

Straight Talk examines what happens when two opposing ideologies are forced into an odd coupling. The main characters will be challenged by one another, making the moral lines at which they once stood harder to define.

Original Unscripted Shows

THE AMBER RUFFIN SHOW

A weekly show featuring Amber’s “signature smart-and-silly take on the week.” The show will de-emphasize talking with guests and spend more time on comedy routines.

WHO WROTE THAT

A docuseries designed to showcase Saturday Night Live’s comedy writers.

Original Made-for-Peacock TV Movie

PSYCH 2: LASSIE COME HOME

Based on the USA Network show Psych, Santa Barbara Police Chief Carlton Lassiter is ambushed on the job and left for dead. In a vintage Psych-style Hitchcockian nod, he begins to see impossible happenings around his recovery clinic. Shawn and Gus return to Lassie’s side in Santa Barbara and are forced to navigate the personal, the professional, and possibly the supernatural. Separated from their new lives in San Francisco, our heroes find themselves unwelcome in their old stomping grounds as they secretly untangle a twisted case without the benefit of the police, their loved ones, or the quality sourdough bakeries of the Bay Area. What they uncover will change the course of their relationships forever.

Legacy Shows in the Peacock Catalog

Bates Motel

Brooklyn Nine-Nine

Cheers

Chrisley Knows Best

Covert Affairs

Downton Abbey

Everybody Loves Raymond

Frasier

Frasier

Friday Night Lights

House

Keeping Up with the Kardashians

The King of Queens

Married … with Children

Monk

Parks and Recreation (exclusive, available Oct. 2020)

Parenthood

The Office (exclusive, available Jan. 2021)

Psych

Psych

The Real Housewives

Royal Pains

Saturday Night Live

Superstore

30 Rock

Top Chef

Will & Grace

100 Dias Para Volver (Spanish-language)

Betty in NY (Spanish-language)

El Barón (Spanish-language)

Preso No. 1 (Spanish-language)

Peacock’s Legacy Movies Catalog

American Pie

Back to the Future

A Beautiful Mind

Bourne franchise

Bourne franchise

The Breakfast Club

Bridesmaids

Brokeback Mountain

Casino

Dallas Buyers Club

Despicable Me franchise

Do the Right Thing

Erin Brockovich

E.T. The Extra Terrestrial

Fast & Furious

Fast & Furious

Field of Dreams

Jaws

Knocked Up

Mamma Mia!

Meet the Fockers

Meet the Parents

Shrek

Subscribe

Subscribe Charter Communications has set the stage for a Wall Street-pleasing boost in average revenue per user (ARPU) with a major broadband rate hike planned for this fall.

Charter Communications has set the stage for a Wall Street-pleasing boost in average revenue per user (ARPU) with a major broadband rate hike planned for this fall. WASHINGTON, Aug 1 (Reuters) – The U.S. Federal Communications Commission (FCC) last week voted 3-2 to tighten rules governing the franchise fees paid by cable companies to local authorities, a move that cities warn could result in public access channels going off the air or in municipalities losing free service.

WASHINGTON, Aug 1 (Reuters) – The U.S. Federal Communications Commission (FCC) last week voted 3-2 to tighten rules governing the franchise fees paid by cable companies to local authorities, a move that cities warn could result in public access channels going off the air or in municipalities losing free service.

As some Netflix shareholders grumble about

As some Netflix shareholders grumble about

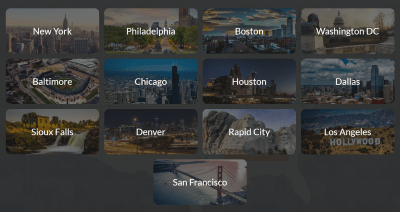

Locast, the not-for-profit cooperative that has successfully streamed local, over the air stations without running afoul of copyright law and attorneys, has announced a big expansion into the cities of Los Angeles, San Francisco, Sioux Falls and Rapid City (South Dakota).

Locast, the not-for-profit cooperative that has successfully streamed local, over the air stations without running afoul of copyright law and attorneys, has announced a big expansion into the cities of Los Angeles, San Francisco, Sioux Falls and Rapid City (South Dakota). Before 1976, under two Supreme Court decisions, any company or organization could receive an over-the-air broadcast signal and retransmit it to households in that broadcaster’s market without receiving permission (a copyright license) from the broadcaster. Then, in 1976, Congress passed a law overturning the Supreme Court decisions and making it a copyright violation to retransmit a local broadcast signal without a copyright license. This is why cable and satellite operators, when retransmitting a broadcast signal, either must operate under a statutory “compulsory” copyright license, or receive permission from the broadcaster.

Before 1976, under two Supreme Court decisions, any company or organization could receive an over-the-air broadcast signal and retransmit it to households in that broadcaster’s market without receiving permission (a copyright license) from the broadcaster. Then, in 1976, Congress passed a law overturning the Supreme Court decisions and making it a copyright violation to retransmit a local broadcast signal without a copyright license. This is why cable and satellite operators, when retransmitting a broadcast signal, either must operate under a statutory “compulsory” copyright license, or receive permission from the broadcaster.