The Sydney Morning Herald ran a piece Friday morning that had absolutely nothing nice to say about the former leadership of Telstra, Australia’s “Private Telecom Monopoly.”

Sol Trujillo was the George W. Bush of telecommunications. For both, the American way was the only way. Being the biggest meant you did not have to do diplomacy, and both were better at starting wars than finishing them. Both used patronage and punishment to ensure a like-minded leadership group that made worse decisions more harmoniously.

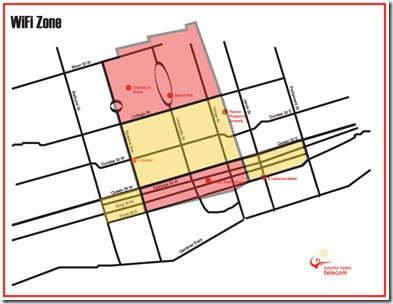

Australians remain unimpressed with the tumbleweeds that routinely blow across the Land Down Under’s broadband superhighway — the result of a combination of failed government leadership, special-interest dominated public policies which put the interests of private companies ahead of their own citizens, and the predictable emergence of greedy telecommunications providers delivering the least possible service at the highest possible price for millions of Australians.

Rodney Tiffen, professor of government at the University of Sydney, calls out a succession of Australian governments which have repeatedly dropped the broadband ball, and have left the country with comparatively overpriced service with ludicrous Internet Overcharging schemes that punish citizens with usage caps, outrageous reductions in their broadband speeds or, worse, overlimit fees and penalties:

Australian consumers suffered particularly from the stringent caps placed on downloads and the high expense of exceeding the cap. While in nine of the countries no explicit caps were placed on broadband subscriptions, Australia was one of only four countries (with New Zealand, Canada and Belgium) where all survey offers included caps, and among these four was by far the most expensive when the caps were exceeded – an average of 11 cents per megabyte compared with 1 cent for the others.

Tiffen rejects the argument that Australians have to pay more because Australia has low population density.

“It should also be remembered Australia has a higher percentage of people living in large cities (defined as those with more than three-quarters of a million people) than any of the other countries (measured by the Organization for Economic Co-operation and Development),” Tiffen writes.

The key policy issue Tiffen identifies is: what is a natural monopoly and when does competition produce more dynamism and responsiveness to consumers? Since telecommunications reform came on to the public agenda about two decades ago, there had been a bipartisan failure to address this central question.

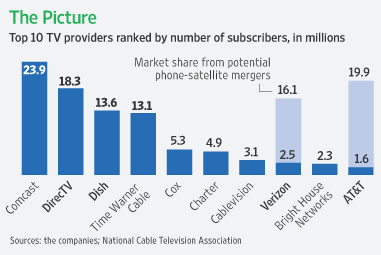

Tiffen wants Australia to recognize the mistakes America made dealing with its cable television industry — “replete with cases where a company controlling the delivery platform has favoured its own company’s channels over its competitors.”

“Indeed a private monopoly at a key gate-keeping point often leads to less competition in services than there would be with a publicly owned or regulated infrastructure,” Tiffen argues.

Subscribe

Subscribe