Dr. John Malone’s Liberty Media will buy a 27.3 percent interest in Charter Communications with a $2.62 billion investment in America’s fourth largest cable operator.

Dr. John Malone’s Liberty Media will buy a 27.3 percent interest in Charter Communications with a $2.62 billion investment in America’s fourth largest cable operator.

Liberty will buy the stake from investment firms Apollo Management, Crestview Partners, and Oaktree Capital Management.

“We are pleased with Charter’s market position and growth opportunities and believe that the company’s investments in its high-capacity digital network which provides digital HD and on demand television, high-speed data and voice, will benefit its customers and shareholders alike,” Malone said in a statement.

Malone is no stranger to the cable industry, having been at the helm of Tele-Communications, Inc. (TCI), the largest cable operator in the country in the 1980s and 1990s. TCI systems were sold to AT&T in 1999, which eventually spun them off to Comcast and Charter Communications, which still run them today.

Dr. John Malone

Since Malone’s exit at TCI, he has been in charge of Liberty Global, which owns cable systems overseas and controls several U.S. cable programming interests through his Liberty Media operation. The investment in Charter represents Malone’s return to an American cable industry he helped pioneer.

The agreement requires Liberty to acquire no more than 35 percent of Charter until January 2016, at which point Liberty’s maximum allowable controlling interest rises to 39.99 percent. Liberty also wins four seats on Charter’s board of directors. But many industry analysts predict Malone will not be satisfied with anything less than eventual full control.

Malone often takes an initial minority interest in the companies he later intends to acquire outright. Macquarie analyst Amy Yong told Reuters he employed a similar tactic to gain control of SiriusXM, the satellite radio company.

“He’s probably going to have a pretty big say in the company’s future over the next few years. This will accelerate capital returns and take advantage of Charter’s tax assets to consolidate the cable industry some more,” Yong said.

Malone is attracted to investment opportunities in companies with high marketplace leverage opportunities and exploiting potential revenue from captive customers in the rural, less-competitive markets Charter has traditionally favored.

Here today, gone tomorrow: Bresnan Communications that was Optimum is now Charter Cable.

Malone also has a strong philosophy towards marketplace consolidation, something ongoing in the cable industry, particularly among smaller cable operators serving less-populated areas.

Under the leadership of ex-Cablevision executive Thomas Rutledge, Charter Communications recently acquired the interests of Cablevision West — former Bresnan Cable systems in the mountain west. Malone sees considerable opportunities expanding operations in smaller communities that have either received substandard cable service, or none at all.

Malone has recently been stockpiling available cash for investments, spinning off his former cable programming properties Starz, a premium cable channel, Discovery Communications, which runs the Discovery Networks, and Liberty Interactive, which owns the lucrative home shopping channel QVC.

Charter Communications has had a difficult history. Microsoft co-founder Paul Allen bought a controlling interest in the cable operator in the late 1990s, primarily because he saw cable broadband as a natural fit for his vision of a future wired America. Allen’s weighty investment was used to jump into a cable industry consolidation frenzy still underway more than a decade ago. Cable operators claimed consolidation was necessary to increase efficiency by building up regional clusters of cable systems. Before consolidation, it was not unusual for two or three different cable operators to serve customers in separate parts of a metropolitan area. Often one operator would serve the city with one or two other cable companies offering service in suburban and exurban communities nearby.

In 1999 alone, under Allen’s leadership, Charter Cable acquired 10 cable companies.

By 2005, Charter Cable had amassed millions of new subscribers, but not as many as company executives claimed when they artificially inflated subscriber numbers to protect the value of the company’s stock. Four executives were indicted that year for criminal accounting fraud. By 2009, with $22 billion in debt, the company declared bankruptcy, eventually wiping out shareholders.

By 2005, Charter Cable had amassed millions of new subscribers, but not as many as company executives claimed when they artificially inflated subscriber numbers to protect the value of the company’s stock. Four executives were indicted that year for criminal accounting fraud. By 2009, with $22 billion in debt, the company declared bankruptcy, eventually wiping out shareholders.

The court’s decision to forgive 40 percent of the company’s debt angered creditors but opened an opportunity for private equity firm Apollo Capital Management to gain control by ending up with the majority of shares in the restructured company.

For years, the company has continued to receive some of the worst customer satisfaction ratings in the industry, usually ranking at or near the bottom. But many Charter customers stay because there is little competition from other players, especially telephone companies. AT&T’s U-verse is the most likely triple-play competitor, but AT&T has avoided introducing U-verse in many of Charter’s service areas because they are deemed too small.

Malone sees Charter’s future revenue potential grow as a broadband provider, considered both a money-maker and must-have service. Analysts say that Charter is well-positioned to poach more customers from phone companies, which typically only offer slow DSL service in much of Charter’s rural footprint.

Gore: Malone is the Darth Vader of cable.

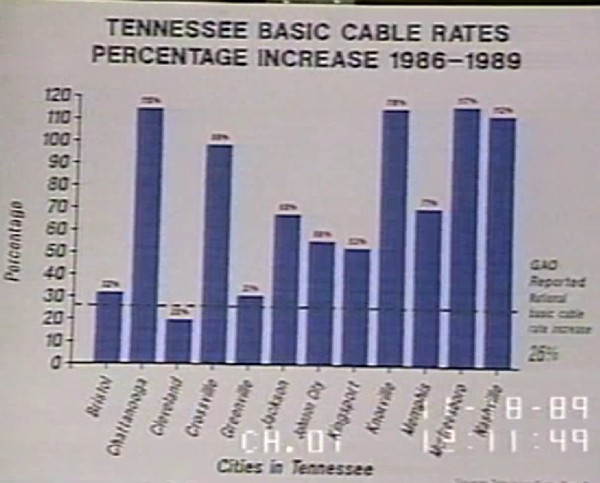

But customers may find with Malone’s involvement, that service may come at a price. Malone was criticized heavily in the 1980s and 1990s for leading the charge for customer rate increases. TCI’s captive customers in Tennessee found their cable bills increased between 71-116 percent in just three years during the 1980s.

Former Sen. Al Gore, Jr., at the time called Malone the head of a “Cable Cosa Nostra” and the Darth Vader of big cable. The cable executive was a frequent target of lawmakers flooded with constituent complaints about poor cable service and accelerating prices.

In 1999, The Guardian noted Malone was an admirer of telecom oligopolies:

He is scathing about regulatory attempts to prevent monopolies and mergers. Governments, he says, are “antediluvian” in their approach to the emerging new world economic order. Instead of trying to prevent mergers and collusion between media and communications companies, Malone says governments should actually promote the creation of “super-corporations” (such as his own) with enough capital to exploit the potential of new technology.

That attitude may soon be back in play with the cable industry’s increasing focus on expanding broadband service as their new primary revenue generator.

As Dr. John Malone positions his pieces on the cable industry’s chess board to win back the title of King of Big Cable, it is important to consider history.

As Dr. John Malone positions his pieces on the cable industry’s chess board to win back the title of King of Big Cable, it is important to consider history.

Subscribe

Subscribe One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets. Dr. John Malone’s Liberty Media will buy a 27.3 percent interest in Charter Communications with a $2.62 billion investment in America’s fourth largest cable operator.

Dr. John Malone’s Liberty Media will buy a 27.3 percent interest in Charter Communications with a $2.62 billion investment in America’s fourth largest cable operator.

By 2005, Charter Cable had amassed millions of new subscribers, but not as many as company executives claimed when they artificially inflated subscriber numbers to protect the value of the company’s stock. Four executives were indicted that year for criminal accounting fraud. By 2009, with $22 billion in debt, the company declared bankruptcy, eventually wiping out shareholders.

By 2005, Charter Cable had amassed millions of new subscribers, but not as many as company executives claimed when they artificially inflated subscriber numbers to protect the value of the company’s stock. Four executives were indicted that year for criminal accounting fraud. By 2009, with $22 billion in debt, the company declared bankruptcy, eventually wiping out shareholders.