The worst enemy of some advocacy groups writing guest editorial hit pieces against municipal broadband is: facts.

The worst enemy of some advocacy groups writing guest editorial hit pieces against municipal broadband is: facts.

Raul Lopez is the founder and executive director for Latinos for Tennessee, a 501C advocacy group that reported $0 in assets, $0 in income, and is not required to file a Form 990 with the Internal Revenue Service as of 2014. Lopez claims the group is dedicated to providing “Latinos in Tennessee with information and resources grounded on faith, family and freedom.”

But his views on telecom issues are grounded in AT&T and Comcast’s tiresome and false talking points about publicly owned broadband. His “opinion piece” in the Knoxville News Sentinel was almost entirely fact-free:

It is not the role of the government to use taxpayer resources to compete with private industry. Government is highly inefficient — usually creating an inferior product at a higher price — and is always slower to respond to market changes. Do we really want government providing our Internet service? Government-run health care hasn’t worked so well, so why would we promote government-run Internet?

Phillip Dampier: Corporate talking point nonsense regurgitated by Mr. Lopez isn’t for the good of anyone.

Lopez’s claim that only private providers are good at identifying what customers want falls to pieces when we’re talking about AT&T and Comcast. Public utility EPB was the first to deliver gigabit fiber to the home service in Chattanooga, first to deliver honest everyday pricing, still offers unlimited service without data caps and usage billing that customers despise, and has a customer approval and reliability rating Comcast and AT&T can only dream about.

Do the people of Chattanooga want “the government” (EPB is actually a public utility) to provide Internet service? Apparently so. Last fall, EPB achieved the status of being the #1 telecom provider in Chattanooga, with nearly half of all households EPB serves signed up for at least one EPB service — TV, broadband, or phone service. Comcast used to be #1 until real competition arrived. That “paragon of virtue’s” biggest private sector innovation of late? Rolling out its 300GB usage cap (with overlimit fees) in Chattanooga. That’s the same cap that inspired more than 13,000 Americans to file written complaints with the FCC about Comcast’s broadband pricing practices. EPB advertises no such data caps and has delivered the service residents actually want. Lopez calls that “hurting competition in our state and putting vital services at risk.”

Remarkably, other so-called “small government” advocates (usually well-funded by the telecom industry) immediately began beating a drum for Big Government protectionism to stop EPB by pushing for a state law to ban or restrict publicly owned networks.

Lopez appears to be on board:

Our Legislature considered a bill this session that would repeal a state municipal broadband law that prohibits government-owned networks from expanding across their municipal borders. Thankfully, it failed in the House Business and Utilities Subcommittee, but it will undoubtedly be back again in future legislative sessions. The legislation is troubling because it will harm taxpayers and stifle private-sector competition and innovation.

Or more accurately, it will make sure Comcast and AT&T can ram usage caps and higher prices for worse service down the throats of Tennessee customers.

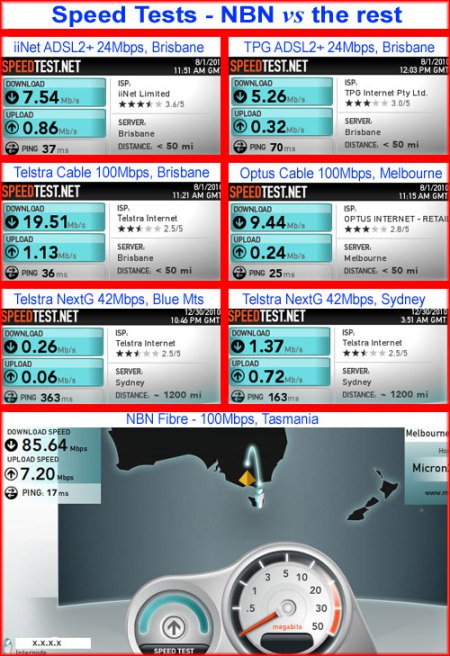

EPB’s broadband pricing. Higher discounts possible with bundling.

Lopez also plays fast and loose with the truth suggesting the Obama Administration handed EPB a $111.7 million federal grant to compete with Comcast and AT&T. In reality, that grant was for EPB to build a smart grid for its electricity network. That fiber-based grid is estimated to have avoided 124.7 million customer minutes of interruptions by better detection of power faults and better methods of rerouting power to restore service more quickly than in the past.

EPB provides municipal power, broadband, television, and telephone service for residents in Chattanooga, Tennessee

Public utilities can run smart grids and not sell television, broadband, and phone service, leaving that fiber network underutilized. EPB decided it could put that network to good use, and a recent study by University of Tennessee economist Bento Lobo found EPB’s fiber services helped generate between 2,800 and 5,200 new jobs and added $865.3 million to $1.3 billion to the local economy. That translates into $2,832-$3,762 per Hamilton County resident. That’s quite a return on a $111.7 million investment that was originally intended just to help keep the lights on.

So EPB’s presence in Chattanooga has not harmed taxpayers and has not driven either of its two largest competitors out of the city.

Lopez then wanders into an equally ridiculous premise – that minority communities want mobile Internet access, not the fiber to the home service EPB offers:

Not all consumers access the Internet the same way. According to the Pew Research Center, Hispanics and African-Americans are more likely to rely on mobile broadband than traditional wire-line service. Indeed, minority communities are even more likely than the population as a whole to use their smartphones to apply for jobs online.

[…] Additionally, just like people are getting rid of basic at-home telephone service, Americans, especially minorities, are getting rid of at-home broadband. In 2013, 70 percent of Americans had broadband at home. Just two years later, only 67 percent did. The decline was true across almost the entire demographic board, regardless of race, income category, education level or location. Indeed, in 2013, 16 percent of Hispanics said they relied only on their smartphones for Internet access, and by 2015 that figure was up to 23 percent.

That drop in at-home broadband isn’t because fewer Americans have access to wireless broadband, it’s because more are moving to a wireless-only model. The bureaucracy of government has trouble adapting to changes like these, which is why government-owned broadband systems are often technologically out of date before they’re finished.

But Lopez ignores a key finding of Pew’s research:

In some form, cost is the chief reason that non-adopters cite when permitted to identify more than one reason they do not have a home high-speed subscription. Overall, 66% of non-adopters point toward either the monthly service fee or the cost of the computer as a barrier to adoption.

So it isn’t that customers want to exclusively access Internet services over a smartphone, they don’t have much of a choice at the prices providers like Comcast and AT&T charge. Wireless-only broadband is also typically usage capped and so expensive that average families with both wired broadband and a smartphone still do most of their data-intensive usage from home or over Wi-Fi to protect their usage allowance.

EPB runs a true fiber to the home network, Comcast runs a hybrid fiber-coax network, and AT&T mostly relies on a hybrid fiber-copper phone wire network. Comcast and AT&T are technically out of date, not EPB.

Not one of Lopez’s arguments has withstood the scrutiny of checking his claims against the facts, and here is another fact-finding failure on his part:

Top EPB officials argue that residents in Bradley County are clambering for EPB-offered Internet service, but the truth is Bradley County is already served by multiple private Internet service providers. Indeed, statewide only 215,000 Tennesseans, or approximately 4 percent, don’t have broadband access. We must find ways to address the needs of those residents, but that’s not what this bill would do. This bill would promote government providers over private providers, harming taxpayers and consumers along the way.

Outlined section shows Bradley County, Tenn., east of Chattanooga.

The Chattanoogan reported it far differently, talking with residents and local elected officials on the ground in the broadband-challenged county:

The legislation would remove territorial restrictions and provide the clearest path possible for EPB to serve customers and for customers to receive high-speed internet.

State Rep. Dan Howell, the former executive assistant to the county mayor of Bradley County, was in attendance and called broadband a “necessity” as he offered his full support to helping EPB, as did Tennessee State Senator Todd Gardenhire.

“We can finally get something done,” Senator Gardenhire said. “The major carriers, Charter, Comcast and AT&T, have an exclusive right to the area and they haven’t done anything about it.”

So while EPB’s proposed expansion threatened Comcast and AT&T sufficiently to bring out their lobbyists demanding a ban on such expansions in the state legislature, neither company has specific plans to offer service to unserved locations in the area. Only EPB has shown interest in expansion, and without taxpayer funds.

The facts just don’t tell the same story Lopez, AT&T, and Comcast tell and would like you to believe. EPB has demonstrated it is the best provider in Chattanooga, provides service customers want at a fair price, and represents the interests of the community, not Wall Street and investors Comcast and AT&T listen to almost exclusively. Lopez would do a better job for his group’s membership by telling the truth and not redistributing stale, disproven Big Telecom talking points.

Subscribe

Subscribe

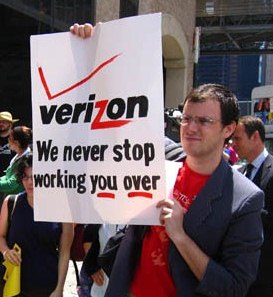

Big Telecom companies like Verizon and AT&T use phony numbers and perpetuate myths about broadband traffic and network investments that have conned investors

Big Telecom companies like Verizon and AT&T use phony numbers and perpetuate myths about broadband traffic and network investments that have conned investors  “We just have to try harder to match those growth rates and catch up with WorldCom,” AT&T executives told Odlyzko and his colleagues, believing the problem was simply ineffective sales, not real broadband demand. When sales couldn’t generate those traffic numbers and Wall Street analysts began asking why, companies like Global Crossing and Qwest resorted to “hollow swaps” and other dubious tricks to fool analysts, prop up the stock price and executive bonuses, and invent sales.

“We just have to try harder to match those growth rates and catch up with WorldCom,” AT&T executives told Odlyzko and his colleagues, believing the problem was simply ineffective sales, not real broadband demand. When sales couldn’t generate those traffic numbers and Wall Street analysts began asking why, companies like Global Crossing and Qwest resorted to “hollow swaps” and other dubious tricks to fool analysts, prop up the stock price and executive bonuses, and invent sales. That isn’t a problem for wireless carriers because texting is where the real money is made. Odlyzko notes that wireless carriers profit an average of $1,000 per megabyte for text messages, usually charged per-message or through subscription plan add ons or as part of a bundle. Cellular voice calling is much less profitable, earning about $1 per megabyte of digitized traffic.

That isn’t a problem for wireless carriers because texting is where the real money is made. Odlyzko notes that wireless carriers profit an average of $1,000 per megabyte for text messages, usually charged per-message or through subscription plan add ons or as part of a bundle. Cellular voice calling is much less profitable, earning about $1 per megabyte of digitized traffic.