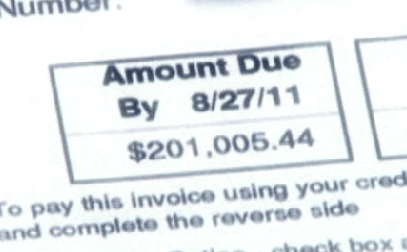

A Miami woman fell to pieces when T-Mobile sent her a cell phone bill that was higher than the purchase price of many nice suburban homes, after a two-week trip to Canada turned into a data roaming disaster.

A Miami woman fell to pieces when T-Mobile sent her a cell phone bill that was higher than the purchase price of many nice suburban homes, after a two-week trip to Canada turned into a data roaming disaster.

Celina Aarons is the latest victim of bill shock — when phone and cable companies send surprise bills that throw families into turmoil, begging for help from the provider that could either aggressively collect or save your sanity by reducing the bill.

Aarons appealed to WSVN Miami’s consumer reporter Patrick Fraser for help after the bill arrived.

“I was freaking out. I was shaking, crying, I couldn’t even talk that much on the phone,” Aarons said. “I was like my life is over!”

It turns out her deaf brother uses a phone on her account to communicate… a lot. He routinely sends thousands of text messages a month, in addition to relying heavily on the mobile smartphone’s Internet access. He had no idea a two-week trip to Canada would invoke an insanely high data roaming rate — $10 per megabyte. Text messages sent while roaming in Canada run $0.20 each, with or without a texting plan. Just running an online video at those rates will easily rack up charges well over $1,000. And they did.

Unfortunately for Celina, T-Mobile claims to have sent a handful of warning messages — to her brother’s phone, never to hers. He claims he never saw them. She’s ultimately responsible for the bill, and she’s upset T-Mobile didn’t notify the primary account holder — her — of the rapidly accumulating roaming charges. T-Mobile told her they don’t send such notifications for “privacy reasons.”

[flv width=”630″ height=”374″]http://www.phillipdampier.com/video/WSVN Miami Help Me Howard – High phone bill 10-17-11.mp4[/flv]

WSVN in Miami explains what happened when Celina Aarons received her 40+ page T-Mobile bill… for $201,000. (4 minutes)

That’s how parents end up receiving bill shock of their own, when children handed phones run up enormous charges mom and dad never learn about until the bill arrives in the mailbox. By then, it’s too late.

The Federal Communications Commission was supposed to take direct action to put an end to bill shock by demanding carriers send clear warnings when usage allowances are used up or when roaming charges begin to accrue. It was a priority for FCC Chairman Julius Genachowski, until wireless industry lobbyists convinced him to abandon the effort, choosing an industry-sponsored voluntary plan instead.

Genachowski quietly put the FCC’s own proposed bill shock regulations on hold, which also likely means an abdication of the agency’s responsibility to closely monitor the wireless industry’s adherence to its own voluntary guidelines.

The CTIA Wireless Association, the industry’s largest trade and lobbying group, will be coordinating the “early warning” program, but will take their time implementing it. The industry wants until October 2012 to implement the first phase of its program, which will send text messages for usage allowance depletion and excessive usage charges. It also wants even more time — April 2013 — before the industry is expected to adopt additional service alerts.

Genachowski: Abdicated his responsibility to protect consumers in favor of the interests of the wireless industry.

The wireless industry’s plan is based entirely on early warning text messages. It does not provide any of the top-requested protections consumers want to end the wallet-biting:

- The ability to shut off services once usage allowances are depleted until the next billing cycle;

- An opt-in provision which requires customers to authorize additional charges before they begin;

- The ability to shut off services and features on individual handsets on their account;

- The ability to easily opt-out of all roaming services, so sky high excess charges can never be charged to their accounts;

- Provisions to require providers to eat the bill if it is demonstrated that warning messages never arrived;

- Fines and other punishments for carriers who fail to meet the provisions of either a regulated or voluntary plan.

The CTIA’s plan won’t stop some of the horror stories Genachowski spoke about earlier this year, when he was still advocating immediate action by the Commission. Among them:

- Nilofer Merchant: Racked up $10,000 in international roaming and overlimit fees while visiting Toronto. AT&T waited until after she returned to the United States before notifying her of the charges. They “generously” agreed to reduce the bill to $2,000, which they ultimately pocketed.

- A woman who rushed to attend to her sister in Haiti after the 2010 earthquake found more tragedy when her provider billed her $34,000 in roaming charges;

- A man whose limited data plan ran out faced $18,000 in overlimit fees before the provider notified him his bill was going to be higher than normal that month.

The wireless industry’s chief lobbyist, CTIA president Steve Largent, declared total victory.

“Today’s initiative is a perfect example of how government agencies and industries they regulate can work together under President Obama’s recent executive order directing federal agencies to consider whether new rules are necessary or would unnecessarily burden businesses and the economy,” Largent said.

Consumer groups are less excited.

Joel Kelsey, a policy analyst at public interest group Free Press, said he was skeptical providers would be making their customers their first priority under the voluntary program.

“Asking the uncompetitive wireless industry to self-police itself is like asking an addict to self-medicate,” said Kelsey. “The FCC is charged by Congress to protect consumers, and they should use their authority to write a rule that puts an end to $16,000 monthly cellphone bills.”

“Wireless carriers are not charities — they will make the most revenue they can from their user base,” Kelsey said. “And since competition is weak in this industry, there aren’t natural incentives for companies to be on their best behavior.”

T-Mobile, which is in the process of trying to merge with AT&T, has agreed to discount Aarons’ bill to $2,500 and give her six months to pay. Stop the Cap! reader Earl, who shared the story with us, suspects that kind of charity won’t last long.

“This won’t happen again if AT&T merges with T-Mobile,” Earl suspects.

While $2,500 is a considerable discount over the original bill, customers who have suffered from bill shock would prefer an even better deal — no surprise charges at all.

That kind of deal is unlikely if the FCC continues to defer to the wireless industry, who have few incentives to provide it.

Consumers can reduce the chances of wireless bill shock by checking with their wireless provider to see if roaming services can be left turned off unless or until you activate them. Many companies also offer smartphone applications to track usage and billing, useful if you have a family plan and want to verify who is doing what with their phone. Avoid taking your cellphone on international trips, and that includes Canada. If you need a cell phone abroad, we recommend purchasing a throwaway prepaid phone when you arrive and rely on that while abroad. Such phones can be had for as little as $10, and per-minute rates are usually substantially lower than the roaming charges imposed by providers back home.

If you must travel with your phone, carefully consider roaming rates before you go. Some carriers may offer international usage plans that discount usage fees. You can use Wi-Fi to manage data sessions, but it’s best to avoid high bandwidth applications while abroad altogether. One movie can cost a thousand dollars or more in international roaming charges.

While T-Mobile could have provided warnings to Aarons’ own phone as her bill began to skyrocket, T-Mobile’s bill was ultimately correct. Wireless phone users must take personal responsibility for the use of phones on their account. Aarons’ brother ignored the handful of warnings T-Mobile claims to have provided, and the agony of the resulting bill no doubt created tension inside that family. Don’t let a wireless phone bill tear your family apart. Take steps to protect yourself, because it’s apparent the FCC won’t anytime soon.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/PBS NewsHour New Alerts to Stop Bill Shock 10-17-11.flv[/flv]

PBS NewsHour interviews FCC Chairman Julius Genachowski about the pervasive problem of “bill shock,” and why the Commission elected to defer to the wireless industry to voluntarily alert consumers when their bills explode. (7 minutes)

Subscribe

Subscribe