Netflix stock lost over 11% of its value late today after the company reported second quarter results that underwhelmed Wall Street, including a surprising loss of 130,000 U.S. customers that left the streaming service during the last three months.

Netflix stock lost over 11% of its value late today after the company reported second quarter results that underwhelmed Wall Street, including a surprising loss of 130,000 U.S. customers that left the streaming service during the last three months.

Netflix added 2.7 million customers in the second quarter, a much smaller number than the 6 million it added during the same period last year. As of the end of June, Netflix now has 151.6 million customers worldwide. Wall Street expected between 153-156 million by that time. The $2/month U.S. rate increase during the first quarter for Netflix’s popular two-concurrent stream plan (was $10.99, now $12.99 in the U.S.) helped keep company revenue up 26%, to $4.92 billion for the quarter. But analysts expected $4.93 billion. Profits also declined to $270 million, compared with $384 million a year ago during the same quarter.

The company blamed the lackluster results on the lack of compelling content during the second quarter. In a letter to shareholders, Netflix claimed the recent price increase slowed growth, but the real problem was overheated growth during the first quarter and not a lot of blockbuster movies and shows to watch.

“We think [the second quarter’s] content slate drove less growth in paid net adds than we anticipated,” Netflix executives said.

The company also noted it is raising prices in several European countries including the United Kingdom, Spain, Ireland, France and Germany.

Netflix does not believe competition with other streaming services had a material impact on its subscriber numbers during the quarter, but analysts suggest Netflix should be concerned about forthcoming streaming competition from AT&T/WarnerMedia (HBO Max) and Walt Disney (Disney+). As more services become available, consumers are likely to take a hard look at the streaming services they are watching and ditch those they are not.

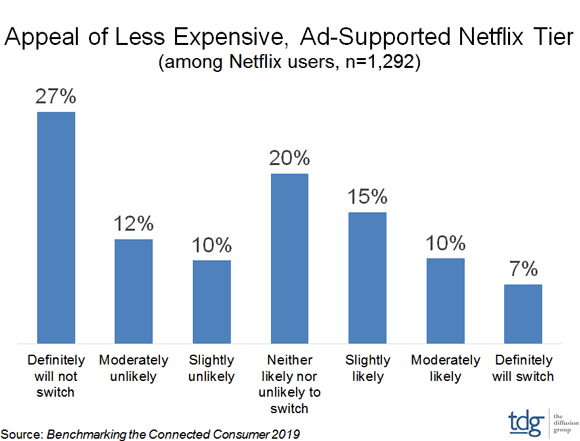

Netflix also declared it will not introduce a cheaper, ad-supported version, despite increasing speculation it would.

“We believe we will have a more valuable business in the long term by staying out of competing for ad revenue and instead entirely focusing on competing for viewer satisfaction.” Netflix told shareholders.

The Wall Street Journal reviews the many challenges to Netflix from forthcoming contenders in the streaming wars. (4:36)

Subscribe

Subscribe While net neutrality in the United States has been neutered by the Republican-controlled FCC, the concept of an online level playing field is alive and well in Germany, and T-Mobile’s parent company Deutsche Telekom (DT) just got called out for a foul ball.

While net neutrality in the United States has been neutered by the Republican-controlled FCC, the concept of an online level playing field is alive and well in Germany, and T-Mobile’s parent company Deutsche Telekom (DT) just got called out for a foul ball.

AT&T/WarnerMedia’s new streaming service due to debut in Spring 2020 will be called HBO Max and bundle original and classic content from AT&T-owned networks and studios, including Warner Bros., New Line, DC Entertainment, CNN, TNT, TBS, truTV, CW, Turner Classic Movies, Cartoon Network, Adult Swim, Crunchyroll, Rooster Teeth, and Looney Tunes.

AT&T/WarnerMedia’s new streaming service due to debut in Spring 2020 will be called HBO Max and bundle original and classic content from AT&T-owned networks and studios, including Warner Bros., New Line, DC Entertainment, CNN, TNT, TBS, truTV, CW, Turner Classic Movies, Cartoon Network, Adult Swim, Crunchyroll, Rooster Teeth, and Looney Tunes. AT&T today

AT&T today