Locast, like Aereo and Ivi before it, has ceased streaming local, over the air television signals on a non-profit basis after a New York federal court judge ruled the service is violating U.S. copyright law by receiving more funding than it needs. But in developments this afternoon, there is word an appeal is planned.

Locast, like Aereo and Ivi before it, has ceased streaming local, over the air television signals on a non-profit basis after a New York federal court judge ruled the service is violating U.S. copyright law by receiving more funding than it needs. But in developments this afternoon, there is word an appeal is planned.

Since January 2018, Locast has attempted to provide its service legally by operating as an independent “translator service,” extending streams of over-the-air signals to viewers within the acknowledged viewing range of the stations. Locast used geofencing technology to block more distant viewers, and sought support for its service with a suggested contribution of $5 a month. Non-paying viewers were nagged with donation request messages that interrupted each stream every 15 minutes.

Despite its limited service areas, Locast amassed over 3 million regular users in its 36 served TV markets over the last three years. That growth represented a threat to lucrative retransmission fee revenue collected by TV station and network owners, who promptly sued Locast in federal court in 2019. A part of that lawsuit was decided Tuesday in favor of the broadcasters.

Judge Louis L. Stanton rejected Locast’s claim it was exempt from Section 111 (a) (5) of the U.S. Copyright Act, which allowed it to stream over the air signals without getting permission from those stations in advance. That section of the Copyright Act was designed to provide a loophole for independent non-profit translator stations, which in some rural areas pick up difficult to receive TV stations and rebroadcast them locally on other channels. Some of these translator operations existed before the days of cable and satellite television, and well before the internet as we know it ever existed. But many of these services were provided through low-power transmitters operated inside large apartment complexes or hotels for the enjoyment of tenants or guests. The Copyright Act allowed groups to retransmit TV signals as long as they lacked “direct or indirect commercial advantage” and did not charge viewers in excess of the “actual and reasonable costs of maintaining and operating the secondary transmission service.”

Judge Louis L. Stanton rejected Locast’s claim it was exempt from Section 111 (a) (5) of the U.S. Copyright Act, which allowed it to stream over the air signals without getting permission from those stations in advance. That section of the Copyright Act was designed to provide a loophole for independent non-profit translator stations, which in some rural areas pick up difficult to receive TV stations and rebroadcast them locally on other channels. Some of these translator operations existed before the days of cable and satellite television, and well before the internet as we know it ever existed. But many of these services were provided through low-power transmitters operated inside large apartment complexes or hotels for the enjoyment of tenants or guests. The Copyright Act allowed groups to retransmit TV signals as long as they lacked “direct or indirect commercial advantage” and did not charge viewers in excess of the “actual and reasonable costs of maintaining and operating the secondary transmission service.”

What got Locast in trouble with the judge is the fact the service nagged viewers to make $5 donations if they wanted the nagging messages to end, and those contributions delivered healthy revenue to Locast of $4.51 million in 2020, while the costs to provide the service were just $2.43 million that same year.

“On those undisputed facts, in 2020 Locast made far more money from user charges than was necessary to defray its costs of maintaining and operating its service,” Judge Stanton wrote. Stanton also rejected arguments that excess revenue was used to expand Locast into new markets, claiming the law was quite clear limiting charges only to the “actual and reasonable costs” incurred providing the service, not for expanding it. Stanton ruled Locast could not charge viewers to raise funds to expand into new markets. Had Judge Stanton accepted Locast’s argument that it was pouring excess revenue into expanding its service, not to make a profit, the broadcaster’s legal case could have been seriously weakened and Locast would have continued operating pending the final disposition of the lawsuit.

Instead, perhaps bowing to the court’s judgment that Locast’s contribution system was hampering its case, last evening Locast notified users it was suspending requests for contributions aired every 15 minutes, and hoped supporters would continue contributions anyway. But early this morning, Locast went further and announced the immediate suspension of its video streaming service.

In an e-mail to supporters, Locast announced:

We are suspending operations, effective immediately.

As a non-profit, Locast was designed from the very beginning to operate in accordance with the strict letter of the law, but in response to the court’s recent rulings, with which we respectfully disagree, we are hereby suspending operations, effective immediately.

Thank you.

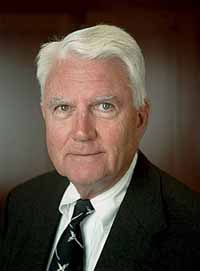

Judge Stanton

The Electronic Frontier Foundation (EFF), which has supported Locast with legal assistance in this case, criticized the judge’s ruling.

“We are disappointed that the court ruled against Locast on its copyright defense,” the EFF said in a statement. “The court interpreted the law in an artificially narrow way. Congress wrote copyright’s nonprofit retransmission exception to make sure that every American has access to their local broadcast stations, and expanding access is exactly what Locast does.”

The EFF said Judge Stanton’s ruling may not be the end of Locast, however.

“Locast has decided to suspend its operations. The case will continue, likely including an appeal, to resolve the remaining issues in the case. The problem remains: broadcasters keep using copyright law to control where and how people can access the local TV that they’re supposed to be getting for free,” a lawyer at the EFF said in a statement.

Theoretically, Locast could be restructured to spin off each of its markets into independent non-profit entities responsible for raising funds to maintain current operations and possibly be found “legal” under the U.S. Copyright Act provisions. New markets could be launched independently as well, starting with fundraisers to launch the service and then additional fundraising to maintain each operation.

Any legal appeal would likely be based on Stanton’s determination that “expansion” was disallowed under the Copyright Act, even though most non-profit entities raise funds to expand their operations all the time.

But for now, Locast will likely remain dark until the remaining legal issues are settled or determined.

Subscribe

Subscribe After months of testing, T-Mobile’s streaming TV service

After months of testing, T-Mobile’s streaming TV service

Quibi is

Quibi is  NBCUniversal’s Peacock streaming service app is now finally available on Roku devices and Roku-enabled televisions, almost 10 weeks after the new streaming service launched.

NBCUniversal’s Peacock streaming service app is now finally available on Roku devices and Roku-enabled televisions, almost 10 weeks after the new streaming service launched. Roku is also pleased whenever a significant content provider signs a deal with the company. Roku traditionally takes a 20% cut of all subscription revenue when a customer signs up for a service on the Roku platform. It receives at least 30% of the advertising time on free streaming services, allowing Roku to sell advertising and keep the money. NBCU appeared to be reluctant to accept those terms, and that is likely what caused the delay in debuting Peacock on Roku. Neither party would disclose the terms in the contract. Comcast is the parent company of NBCU.

Roku is also pleased whenever a significant content provider signs a deal with the company. Roku traditionally takes a 20% cut of all subscription revenue when a customer signs up for a service on the Roku platform. It receives at least 30% of the advertising time on free streaming services, allowing Roku to sell advertising and keep the money. NBCU appeared to be reluctant to accept those terms, and that is likely what caused the delay in debuting Peacock on Roku. Neither party would disclose the terms in the contract. Comcast is the parent company of NBCU.