Clearwire users seeking alternatives after the wireless ISP shuts down its WiMAX network this fall are surprised to hear some Clear customer service representatives recommending Comcast as their best option.

Clearwire users seeking alternatives after the wireless ISP shuts down its WiMAX network this fall are surprised to hear some Clear customer service representatives recommending Comcast as their best option.

Stop the Cap! reader Randall Page has been looking for a new ISP after receiving a notification from Clearwire its network is ceasing operations before the end of this year and he needs to find a different provider:

Dear Valued CLEAR/Clearwire Customer,

You are receiving this notice because our records show you are subscribed to services on the CLEAR 4G (WiMAX) Network or Clearwire Expedience network. Sprint is in the process of implementing major enhancements to the Sprint 4G LTE Network, including the deployment of Sprint Spark, an enhanced LTE network capability, by repurposing the CLEAR 4G (WiMAX) Network and Clearwire Expedience Network. As a valued customer, we are providing you formal notice that Sprint will cease operating the CLEAR 4G (WiMAX) Network and Clearwire Expedience Network on November 6, 2015 at 12:01AM EST.

What this means to you:

- Sprint will no longer support CLEAR 4G WiMAX and Clearwire Expedience devices or services.

- Your CLEAR 4G WiMAX and Clearwire Expedience devices and services will no longer work, including your ability to contact 9-1-1.

- You should not return your device(s).

To discuss your options or learn more, please call 1-888-888-3113.

Thank you for your business.

Sincerely,

CLEAR/Clearwire Wireless

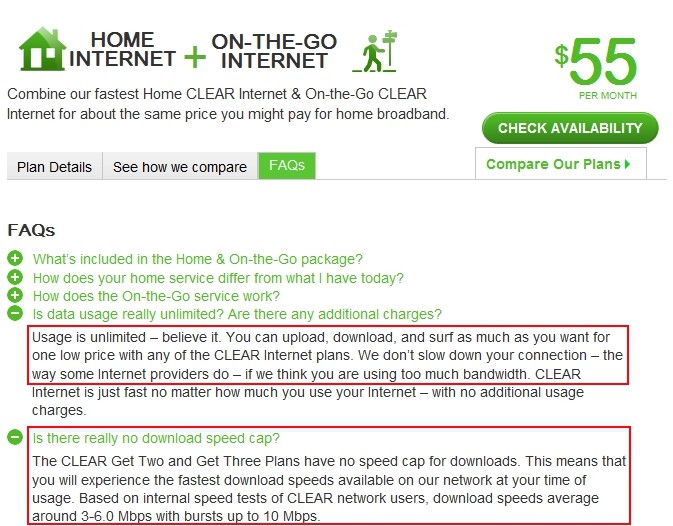

The Page family has used Clearwire for years to get Internet service in their rural home near Lynden, Wash. The service was affordable and more than adequate for the occasional web browsing and e-mail Page’s parents rely on. After learning the service was being discontinued, Page called Clearwire customer service to learn what other options were available.

“They claim they will essentially match your current level of Clearwire service on the Sprint network,” Page told Stop the Cap! “Although Clearwire originally advertised unlimited service, the representative was not willing to match that through Sprint. Instead, they built a recommended usage plan based on reviewing actual use over the last several months.”

Clear/Clearwire’s modems and routers were designed to work with their WiMAX network, which is being decommissioned. This equipment will be obsolete and cannot be reused with a new provider.

Page was offered a 30GB plan adequate for his parents, but the quoted price of $110 a month was more than twice the price of Clearwire. The family also had to pay $200 for a replacement modem compatible with Sprint’s LTE network to replace the Clearwire WiMAX modem that isn’t.

“No consideration for Clearwire customers, no special promotions, no loyalty discounts, nothing for customers like us who have been with Clearwire for almost five years,” Page complained. “When Alltel was sold off and their network was changed, customers were given a free replacement phone as a courtesy, but Sprint seems to care less about us.”

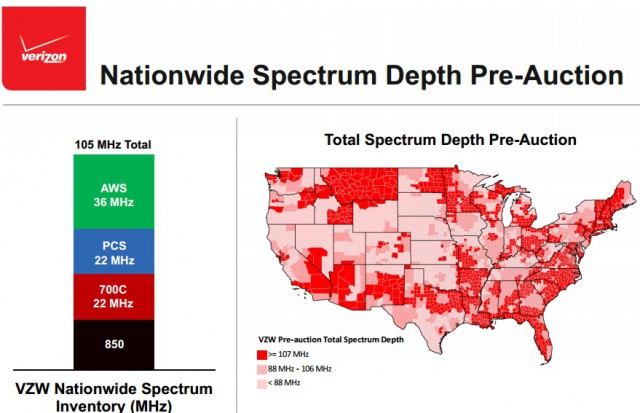

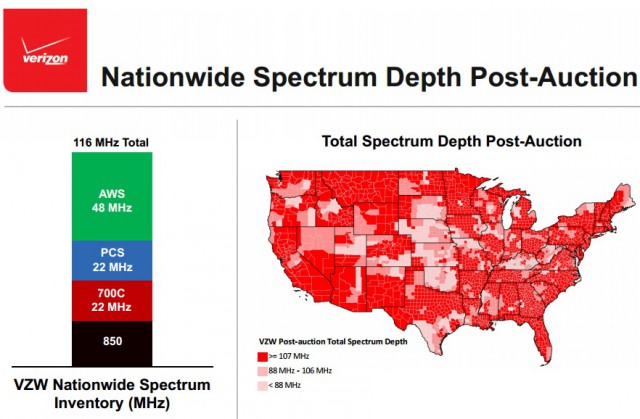

Sprint acquired Clearwire in 2013 mostly for its massive spectrum holdings in the 2.5GHz band. After the deal closed, Sprint fired 75% of Clearwire’s workforce and began planning the end of Clearwire’s legacy WiMAX network, also familiar to first generation 4G Sprint customers who used it before the launch of LTE service.

Clearwire’s higher frequency spectrum never penetrated buildings well and did not reach as far as wireless signals on lower frequencies, which meant Clearwire was required to build a large cellular network to deliver reasonable service. Sprint inherited 17,000 Clearwire-enabled cell sites in the deal, many deemed redundant. A Sprint filing with the Securities & Exchange Commission indicated Sprint was shutting down no fewer than 6,000 of those sites by the end of this year, with the remaining transitioned to TD-LTE service as part of the Sprint Spark project.

The change will allow Sprint to better monetize its 2.5GHz spectrum by selling usage-based plans and more expensive home wireless broadband service. It’s the second major wireless technology shutdown organized by Sprint. In 2013, Sprint shut off the last 800MHz iDEN Nextel cell site inherited from its acquisition of Nextel. Sprint now provides LTE 4G service over the frequencies formerly used by Nextel.

Page was not happy with Clearwire’s alternative through Sprint, and remarkably the representative then suggested his family should sign up for Comcast service instead.

“I was floored to hear a representative working on behalf of Sprint recommend Comcast,” Page said.

It isn’t the first time Clearwire has done this:

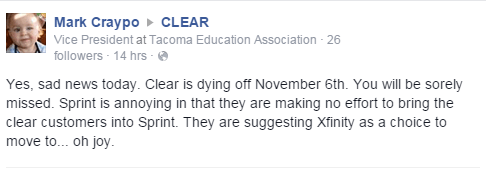

Clearwire’s own Facebook page was abandoned in 2013, presumably right after its sale to Sprint was complete. Stranded customers are complaining about the impending loss of service and the lack of alternative options and information.

Clearwire’s own Facebook page was abandoned in 2013, presumably right after its sale to Sprint was complete. Stranded customers are complaining about the impending loss of service and the lack of alternative options and information.

Wireless ‘n WiFi’s high usage data plan has gotten good reviews from Stop the Cap! readers, although it is expensive and relies on Sprint’s less-than-great network.

Unfortunately, the Page home is not serviced by Comcast and DSL from CenturyLink is not an option either. Page and his immediate neighbors are instead joining a group “family plan” on a wireless carrier and will share a Wi-Fi hotspot that can reach three homes. It technically violates the terms and conditions of most family plans to share a connection in this way but it is the only affordable choice the families have for now.

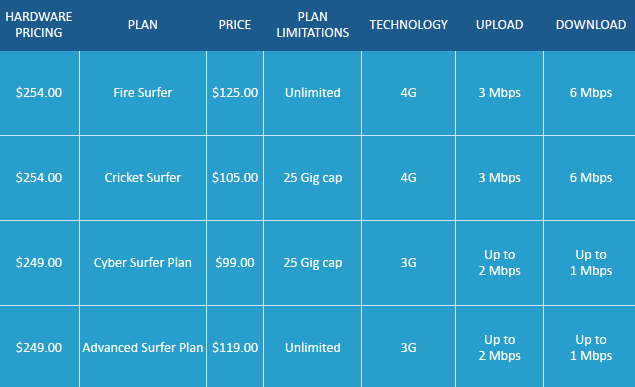

Those rural Clearwire customers who cannot subscribe to cable or DSL broadband might also explore some options from Wireless ‘n WiFi, which sells high limit 3G/4G LTE plans that work on Sprint’s 3G and 4G networks.

Their current plan offers up to 60GB of usage per month, up to 30GB of which can come from using Sprint’s 3G network. The service costs a still steep $109.99 a month (including all taxes and fees) and comes with additional startup costs:

- Rental of NetGear 341u USB modem and MBR1200B Cradlepoint Wi-Fi Router ($100 equipment deposit required, refunded when equipment returned)

- $49.99 Activation Fee

- $8.95 Priority Mail Shipping (for Equipment)

- $268.93 total startup cost includes all charges referenced above (not including monthly service fee)

Service is month-to-month, no term contract. Overlimit fee is $5/GB.

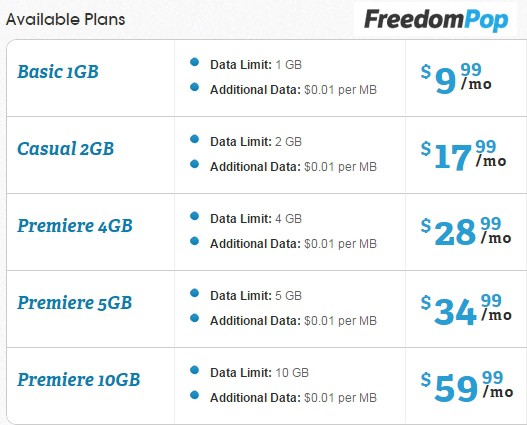

Some lighter users report reasonably priced service is available from FreedomPop, as long as you are careful to avoid over 10GB of usage per month ($59.99) and you turn off revenue generators like automatic top-off and other various extras they pitch (including data rollover if you find you use up most of your monthly allowance anyway).

Subscribe

Subscribe

Since 2002, New York Tax Law has required mobile phone companies to collect and pay sales taxes on the full amount of the monthly access charges for their calling plans. For example, when a customer pays Sprint a fixed monthly charge of $39.99 for 450 minutes of mobile calling time, the law requires Sprint to collect and pay sales taxes on the entire $39.99. According to the Attorney General’s complaint, starting in 2005, Sprint illegally failed to collect and pay New York sales taxes on an arbitrarily set portion of its revenue from these fixed monthly access charges.

Since 2002, New York Tax Law has required mobile phone companies to collect and pay sales taxes on the full amount of the monthly access charges for their calling plans. For example, when a customer pays Sprint a fixed monthly charge of $39.99 for 450 minutes of mobile calling time, the law requires Sprint to collect and pay sales taxes on the entire $39.99. According to the Attorney General’s complaint, starting in 2005, Sprint illegally failed to collect and pay New York sales taxes on an arbitrarily set portion of its revenue from these fixed monthly access charges. Millenicom customers have had their ups and downs over the last two weeks coping with e-mail notifications they would lose, keep, and once again lose their unlimited wireless data plan.

Millenicom customers have had their ups and downs over the last two weeks coping with e-mail notifications they would lose, keep, and once again lose their unlimited wireless data plan. Blue Mountain Internet (BMI) offers an “unlimited plan” that isn’t along with several usage allowance plans. BMI strongly recommends the use of their Mobile Broadband Optimizer software that compresses web traffic, dramatically improving speeds and reducing consumption:

Blue Mountain Internet (BMI) offers an “unlimited plan” that isn’t along with several usage allowance plans. BMI strongly recommends the use of their Mobile Broadband Optimizer software that compresses web traffic, dramatically improving speeds and reducing consumption: There is a $100 maximum on overlimit fees, but BMI reserves the right to suspend accounts after running 3-5GB over a plan’s allowance to limit exposure to the penalty rate. The compression software is for Windows only and does not work with MIFI devices or with video/audio streaming. BMI warns its wireless service is not intended for video streaming. Customers are not allowed to host computer applications including continuous streaming video and webcam posts that broadcast more than 24 hours; automatic data feeds; automated continuous streaming machine-to-machine connections; or peer-to-peer (P2P) file-sharing.

There is a $100 maximum on overlimit fees, but BMI reserves the right to suspend accounts after running 3-5GB over a plan’s allowance to limit exposure to the penalty rate. The compression software is for Windows only and does not work with MIFI devices or with video/audio streaming. BMI warns its wireless service is not intended for video streaming. Customers are not allowed to host computer applications including continuous streaming video and webcam posts that broadcast more than 24 hours; automatic data feeds; automated continuous streaming machine-to-machine connections; or peer-to-peer (P2P) file-sharing.

Wireless ‘n Wifi

Wireless ‘n Wifi