CNN's Scare Stories on Wireless

As part of our ongoing coverage of the telecommunications industry, I talk with a variety of reporters in both Canada and the United States. We have educated local newspapers, national wire services, local TV news, and even big national consumer magazines about the problems consumers have with the North American telecommunications industry. Whether you are a wireless customer facing eroding usage caps and increasing prices, or a wired broadband customer now being slapped with Internet Overcharging schemes that monetize your usage, the truth about why your bill has gone up isn’t too hard to find, if you bother to look.

Unfortunately, CNN-Money just published a “week-long” series on the wireless mobile phone market that might as well have been written by the CTIA, the nation’s cell phone lobby.

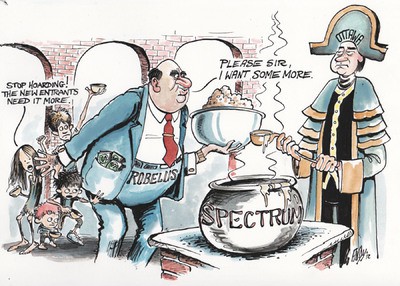

“The Spectrum Crunch” was supposed to be a sober and objective report about the state of congestion on America’s cell phone networks. Instead, the reporter decided industry press releases and lobbyist talking points were good enough to form the premise that America is deep in a cell phone crisis.

Sorry America, Your Airwaves Are Full

Part one of CNN’s special report is a laundry list of disaster predictions, explaining away rate increases and usage caps, and an industry-skewed view that the answer to the “crisis” is to give wireless carriers all the frequencies they want.

The spectrum crunch is not an inherently American problem, but its effects are magnified here, since the United States has an enormous population of connected users. This country serves more than twice as many customers per megahertz of spectrum as the next nearest spectrum-constrained nations, Japan and Mexico.

When spectrum runs short, service degrades sharply: calls get dropped and data speeds slow down.

That’s a nightmare scenario for the wireless carriers. To stave it off, they’re turning over rocks and searching the couch cushions for excess spectrum.

They have tried to limit customers’ data usage by putting caps in place, throttling speeds and raising prices. Carriers such as Verizon, AT&T, Sprint, T-Mobile, MetroPCS and Leap have been spending billions to make more efficient use of the spectrum they do hold and billions more to get their hands on new spectrum. And they have tried to merge with one another to consolidate resources.

The FCC has also been working to free up more spectrum for wireless operators. Congress reached a tentative deal last week, approving voluntary auctions that would let TV broadcasters’ spectrum licenses be repurposed for wireless broadband use.

[…] The bad news is that none of the fixes are quick, and all are expensive. For the situation to improve, carriers — and, therefore, their customers — will have to pay more.

The United States also covers more ground, with lots of wide open spaces where frequencies can be used and re-used without interference problems. As AT&T keeps illustrating, how you run your business has a lot to do with the quality of your service, spectrum crisis or not. AT&T customers in heavily-populated urban markets cope with dropped calls and slow data not because the company has run out of frequencies, but because AT&T has failed to appropriately invest in its own network. AT&T’s problems are generally not shared by customers of other carriers. Even T-Mobile, which has the least spectrum of all major carriers, does not share AT&T’s capacity issues.

CNN reporter David Goldman suggests mergers and consolidation have been a solution for ‘wireless shortages’ of the past. But are mergers about consolidating resources or leveraging profits?

The spectrum war’s winners and losers

AT&T’s failed $39 billion bid for T-Mobile was largely aimed at getting its rival’s spectrum. The Department of Justice and the Federal Communications Commission killed the deal, saying it would be too damaging to wireless competition.

That put the entire industry on notice: The carriers will have to solve their problems without any blockbuster takeovers.

The regulators’ main concern was that the deal would take the ranks of national carriers down from four to three. That’s why experts now expect the big players to focus instead on acquiring smaller, low-cost carriers like MetroPCS and Leap Wireless. Their spectrum could relieve capacity issues in large metro areas, which are the places most crippled by the crunch.

Industry analysts also think that Sprint and T-Mobile could gain approval to merge, though that’s a bit like two drowning victims clinging together. Sprint is losing piles of money every quarter, while T-Mobile is hemorrhaging customers with contracts.

Another possibility is that several carriers could partner in a spectrum-sharing joint venture.

But the most likely scenario is that the carriers continue fighting each other to snap up the last remaining large swaths of high-quality spectrum.

Stephenson

The claim that AT&T sought the purchase of T-Mobile USA for spectrum acquisition falls apart when you examine the record. For instance, during AT&T CEO Randall Stephenson’s presentation at the merger announcement, shareholders were told the buyout would deliver cost synergies and savings, would stabilize earnings from a more predictable mobile market (with T-Mobile’s ‘market disruptive’ pricing out of the way), and would allow the company to secure additional frequencies. However, as Stop the Cap! reported back in August, documents released by the FCC showed AT&T unprepared to specify what T-Mobile spectrum it expected to acquire, much less how the company intended to use it.

The “problem” AT&T sought to solve, in the eyes of both the Justice Department and the FCC, was pesky competition from T-Mobile and the reduced profits AT&T endured as T-Mobile forced competitors to deliver better service at lower prices.

Even Goldman admits T-Mobile had the smallest inventory of wireless spectrum among the major carriers — scant reason for AT&T to court a merger for spectrum purposes.

The spectrum winners continue to be AT&T and Verizon, who have the largest inventory of favorable frequencies, and both continue to warehouse spectrum they are not using for anything.

Your Cell Phone Bill is Going Up

Has your mobile phone bill jumped this past year?

Get used to it.

Demand for wireless data services is soaring, forcing carriers to invest massively to keep up. They have two main options: Upgrade their network technology or acquire more wireless spectrum to give them more bandwidth.

“Massively” is in the eye of the beholder. Verizon outspent AT&T on network upgrades and continues to enjoy enormous returns on that investment. Most major cell companies spend billions on network improvements, but also earn tens of billions from their customers. Yet in the midst of the “spectrum crisis,” AT&T CEO Randall Stephenson told investors revenue was up — way up:

“We’ll expand wireless and consolidated margins. We’ll achieve mid-single-digit EPS growth or better. Cash generation continues to look very strong again next year. And given the operational momentum we have in the business, all of this appears very achievable and probably at the conservative end of our expectations.”

AT&T’s chief financial officer John J. Stephens put a spotlight on it:

In 2011, 76% of our revenues came from wireless and wireline data and managed services. That’s up from 68% or more than $10 billion from just 2 years ago. And revenues from these areas grew about $7 billion last year or more than 7% for 2011. We’re confident this mix shift will continue. In fact, in 2012 we expect consolidated revenues to continue to grow, thanks to strength in these growth drivers with little expected lift from the economy.

[…] We also continue to bring more subscribers onto our network with tiered data plans, more than 22 million at the end of the quarter, with most choosing the higher-priced plan. As more of our base moves to tiered plans and as data use increases, we expect our compelling [average revenue per subscriber] growth story to continue.

That’s a story AT&T has avoided sharing with customers, because more than a few might take exception that the past year’s rate increases have more to do with the company’s “compelling growth story” than a spectrum shortage.

CNN could have reported this themselves, had they bothered to look beyond the press releases and talking points from the wireless industry. The reporter even conflated recent increases in early termination fees as part of the “spectrum shortage.”

Readers have to glean the real story by reading between the lines. Here is an example:

As Suraj Shetty, Cisco’s marketing chief, puts it: “Data caps are curbing the top 1% of users, but not the top 20%.”

For carriers, finding the sweet spot is a delicate balancing act. Heavy data consumption is costly for them. On the flip side, smartphone users, who are typically required to buy pricey monthly data plans, are their most lucrative customers.

The ideal customer is someone with a smartphone they use sparingly.

That reality could eventually be reflected in your monthly bill. All four of the major carriers declined to comment about their future pricing strategies, but analysts expect them to start experimenting with new “pay for what you consume” approaches.

The real agenda is finding customers who buy the most service and use it the least. Usage caps and throttles don’t even work, if one believes Mr. Shetty. Curbing one percent of your heaviest users does little to curtail congestion when the top 20% remain within plan limits and create an even greater strain on the network.

It’s another hallmark of Internet Overcharging — monetizing broadband usage while using “congestion” as an excuse. If a customer uses 10GB on an unlimited usage plan or 10GB on a limited use plan, the impact on the network is precisely the same. Only the profit-taking is different.

There Are Solutions

Only in the last part of the series does CNN’s reporter discover there are some practical solutions to the spectrum crunch. They include:

- Splitting cell phone traffic to reduce tower load. Adding additional towers is one solution, but not all have to be huge, unsightly monstrosities. In parts of Canada and Europe, new “micro-cells” on top of traditional power poles or buildings can reduce tower load, especially in urban areas. These units, which can fit in the palm of your hand, are especially good at serving fixed location users, such as those sitting at home, work, or in a shopping center. They don’t create eyesores, are relatively inexpensive, and are effective.

- Allocation of spectrum. The FCC is working on making additional wireless spectrum available. Some carriers are cooperating to alleviate capacity issues, share towers, and collaborate on new tower planning.

- Consider Wi-Fi. AT&T found offloading traffic to Wi-Fi and even home-based “femtocells” — mini in-home cell towers have effectively reduced demand on their wireless 3G/4G networks. There is still room to expand.

[flv width=”576″ height=”344″]http://www.phillipdampier.com/video/CNN Solutions to the spectrum crunch 2-2012.flv[/flv]

Alcatel-Lucent has a solution to the capacity crunch — a microcell cube that can be attached to a building or phone pole. (3 minutes)

A Wall Street analyst says Sprint has a 50/50 chance of being forced into bankruptcy, either pulling through a difficult upgrade to LTE 4G and stabilizing its partnership with Clearwire, or sinking under a load of debt incurred by Apple’s iPhone and network upgrade expenses.

A Wall Street analyst says Sprint has a 50/50 chance of being forced into bankruptcy, either pulling through a difficult upgrade to LTE 4G and stabilizing its partnership with Clearwire, or sinking under a load of debt incurred by Apple’s iPhone and network upgrade expenses. “The problem is 4G. Sprint doesn’t have enough free-and-clear spectrum on which to launch a competitive LTE network, and it doesn’t have the money to clear spectrum that’s already in use,” Moffett said. “We expect Sprint’s competitiveness to begin to backslide when LTE becomes the nation’s de facto standard.”

“The problem is 4G. Sprint doesn’t have enough free-and-clear spectrum on which to launch a competitive LTE network, and it doesn’t have the money to clear spectrum that’s already in use,” Moffett said. “We expect Sprint’s competitiveness to begin to backslide when LTE becomes the nation’s de facto standard.”

Subscribe

Subscribe