Charter Communications has petitioned the FCC for permission to impose DATA CAPS on customers at least two years before the FCC’s prohibition on caps — a key condition imposed on the cable company in return for approval of its 2016 merger with Time Warner Cable and Bright House Networks — is scheduled to expire.

Charter Communications has petitioned the FCC for permission to impose DATA CAPS on customers at least two years before the FCC’s prohibition on caps — a key condition imposed on the cable company in return for approval of its 2016 merger with Time Warner Cable and Bright House Networks — is scheduled to expire.

In 2016, the FCC told Spectrum its merger was NOT in the public interest without requiring some changes and conditions that would benefit you as a Spectrum customer. Because the FCC recognized that competition was uncommon in the cable industry, it knew there would be a temptation after a merger to slap data caps on internet customers for no good reason, other than the fact the company could. In fact, data caps have long been discussed as a deterrent to keep customers from dropping cable TV subscriptions in favor of streaming video. Why? Because if you stream TV programming from Netflix, Hulu, YouTube TV, Sling, and others, that data usage would quickly eat up any data allowances Spectrum would include with its data cap. Most companies with data caps make sure you pay dearly if you go over your allowance. The de facto standard overlimit fee is $10 for each 50 GB of usage, up to a maximum ranging between $100-200 a month! That kind of bill shock would likely push you back to cable TV.

The FCC hoped that a seven-year ban on Spectrum imposing data caps would give competition a chance to develop, and not just with streaming video. In fact, the FCC argued newly arriving cable operators, fiber to the home providers, and 5G services could probably create so much competition, data caps would likely disappear. Unfortunately, consumers have seen little competition emerge in the last four years. In fact, many still have only one choice — a cable monopoly — for internet service that meets the FCC’s minimum speed (25 Mbps) to qualify as broadband. DSL from the phone company rarely provides the speed available from your local cable operator. Fiber to the home competition is growing in some areas, but many homes still lack access. Although there has been much hype in the media about 5G, robust and fast wireless home internet will only be available in a fraction of homes for years to come.

The FCC hoped that a seven-year ban on Spectrum imposing data caps would give competition a chance to develop, and not just with streaming video. In fact, the FCC argued newly arriving cable operators, fiber to the home providers, and 5G services could probably create so much competition, data caps would likely disappear. Unfortunately, consumers have seen little competition emerge in the last four years. In fact, many still have only one choice — a cable monopoly — for internet service that meets the FCC’s minimum speed (25 Mbps) to qualify as broadband. DSL from the phone company rarely provides the speed available from your local cable operator. Fiber to the home competition is growing in some areas, but many homes still lack access. Although there has been much hype in the media about 5G, robust and fast wireless home internet will only be available in a fraction of homes for years to come.

Despite this reality, Charter is asking the FCC to let the ban on data caps expire two years early, which means they could slap data caps on customers just like you by next spring. Charter argues there are lots of streaming services now competing for your business, so there is no evidence Spectrum is hurting the marketplace for streaming television. Therefore, there is no need to protect consumers from data caps.

We argue several points in response:

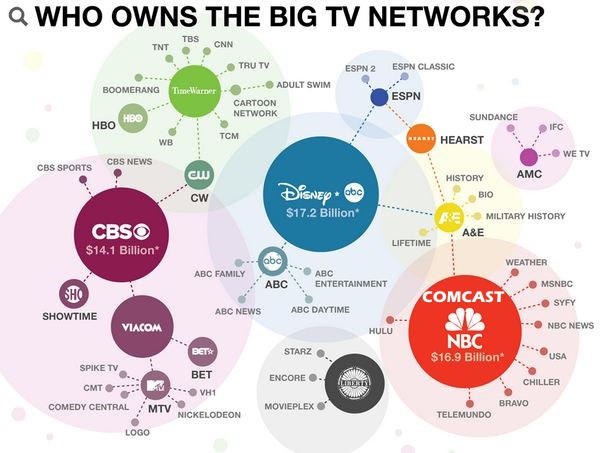

Since this graphic was created, Time Warner was sold to AT&T and CBS and Viacom have merged.

Most large streaming video providers are owned by giant satellite, cable and telephone companies (Comcast’s Peacock, AT&T’s TV/TV Now and HBO Max, Dish Network’s Sling TV), giant TV conglomerates (ABC-Disney’s Hulu/Disney +, CBS-Viacom’s All Access), or tech companies (Apple TV, YouTube TV). Netflix has raised prices for its service, in part because it has been pushed to pay cable companies like Comcast “interconnection fees” to guarantee Comcast customers will get suitable service. Most streaming services not affiliated with telecom companies have opposed data caps all along, understanding they can be anticompetitive and hurt subscriber numbers.

What competition? Charter Spectrum customers likely still have the same competitive options they had in 2016, if any, which is not enough. Imposing data caps on home broadband service illustrates that lack of competition in action. Comcast has avoided imposing data caps on its customers in the more competitive northeast and mid-Atlantic regions, where it faces Verizon’s FiOS service, which does not have data caps.

Charter asked for and was granted approval of a merger consumers did not need or want. Charter voluntarily agreed to the FCC’s conditions to close the deal. A deal is a deal, but Charter now wants to walk away. The company is spending thousands on its attorneys to free itself from the FCC’s data cap ban while claiming they have no plans to implement data caps. Do you honestly believe them?

Consumers hate data caps. In fact, just having data caps on internet service can undermine a provider’s marketing and ad campaigns and make signing up new customers difficult. Companies with data caps lose more customers than those that don’t because customers switch if a new cap-free competitor comes to town. Just dealing with implementing complicated usage meters and upset customers complaining about their accuracy costs more than any revenue companies earn from overlimit fees. Remarkably, those are not just the views of Stop the Cap! Charter itself told the FCC those were just some reasons there was a strong business case against implementing data caps. Now it is asking the FCC for permission to impose data caps despite all that!

Monroe County Legislator Rachel Barnhart has teamed up with Stop the Cap! to fight Charter’s request to allow it to data cap customers.

Data caps do not protect broadband networks from congestion, and they are not about equitably sharing internet capacity. The ongoing pandemic just proved that big cable and phone companies have existing broadband networks more than capable of handling a large spike in network traffic. Reasonable, cost-effective upgrades will continue that success story for years to come with no need for arbitrary data caps. Make no mistake. Data caps are just another way telecom companies can monetize your usage to increase their already fat profits.

What can you do?

Until July 22, 2020, you can send a comment directly to the FCC urging them NOT to allow Charter’s request to sunset merger deal conditions early. Monroe County (N.Y.) legislator Rachel Barnhart and Stop the Cap! have teamed up to push this message through to Spectrum customers everywhere. We need to put the FCC on notice it must leave well enough alone and allow the deal conditions to remain in place. We also want to send a clear message to executives at Charter that customers do not want data caps… ever. It’s a message Stop the Cap! successfully delivered in 2009 to the top leadership of Time Warner Cable, and they listened. It’s now time to send another message to the folks at Charter. We sincerely hope they will listen too.

Here is a sample letter, which we urge you to adjust to reflect your own views and circumstances before submitting:

To Whom It May Concern:

Please reject Charter’s request to sunset the deal conditions it agreed to as part of its merger with Time Warner Cable and Bright House Networks.

A deal is a deal, and Charter agreed not to impose data caps on its customers for at least seven years. It now wants that prohibition lifted two years early, arguing competition has flourished over the last four years. In fact, little has changed for us. Competition has not flourished. We still do not have choices for broadband service and although there are more streaming video providers, most are owned by large cable, satellite, and phone companies or giant media conglomerates. Data caps will make me reconsider using these services because I cannot afford an even higher internet bill.

Competition is supposed to bring pricing down in a healthy marketplace. But my bill is only going up. What kind of company would ask for permission to slap usage limits on customers in the middle of a pandemic, after telling everyone their networks were more than robust enough to handle increased stay-at-home usage? The answer is a company that faces little competition and has no fear a competitor will use this request against them. Internet affordability is already an enormous problem, and data caps just make internet service even more expensive. We already pay among the highest prices in the world for service.

My family did not ask for this merger, and the FCC in 2016 determined it was not in the public interest to approve it without imposing a handful of conditions to allow consumers to benefit from the transaction. The FCC should insist Charter be true to its word and not impose data caps. Charter told the FCC in 2016 it had an “aversion to data caps, stating that instead of enforcing usage limits it chooses to market the absence of data caps as a competitive advantage” and that “there is a strong business case for not implementing caps” and that caps “undermined” its marketing messaging. Was Charter being honest with the FCC in 2016? Their current request for permission to lift data caps seems to ignore the positions Charter itself took with the FCC just a few years ago.

We urge you to deny Charter’s petition, which will allow Charter to continue making plenty of money from the sale of unlimited internet access and continue honoring its advertising commitments to sell internet service “with no data caps” as it does now.

To submit your comments on this issue:

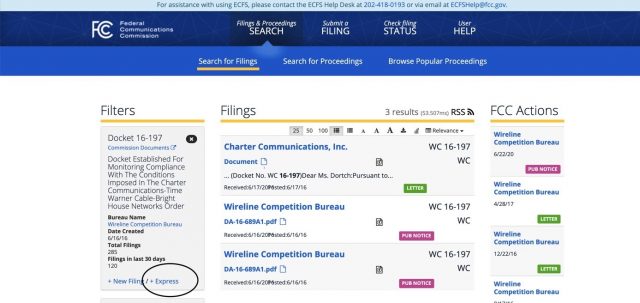

First, click this link to be taken to the FCC website.

Second, click the link on the left sidebar marked “+Express” as circled below:

Third, fill out the form as completely as possible, and leave your comments in the “brief comments” box at the bottom.

You can also mail your written comments:

Mail TWO COPIES of your written comments, which should open with the greeting “Dear Secretary Dortch,” and close with your signature to this address:

Ms. Marlene H. Dortch

Office of the Secretary

Federal Communications Commission

445 12th Street SW

Washington, DC 20554

Subscribe

Subscribe Several Spectrum employees have contacted Stop the Cap! to let us know a rate increase is planned for Spectrum services that will raise rates for cable television customers beginning as early as next month.

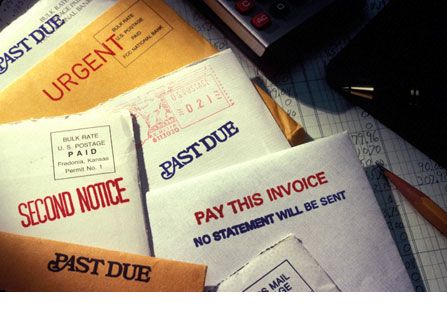

Several Spectrum employees have contacted Stop the Cap! to let us know a rate increase is planned for Spectrum services that will raise rates for cable television customers beginning as early as next month. Internet providers are preparing to cut off late-paying and non-paying customers as early as June 30, as the Federal Communications Commission’s “Keep America Connected” pledge expires next week.

Internet providers are preparing to cut off late-paying and non-paying customers as early as June 30, as the Federal Communications Commission’s “Keep America Connected” pledge expires next week. Those customers that lose service for non-payment may forfeit future participation in low-cost internet programs for those on public assistance, and cannot restart service without coming to terms on past due balances. That could leave desperate customers at risk of losing access to job-seeking information, education, and news about the ongoing pandemic.

Those customers that lose service for non-payment may forfeit future participation in low-cost internet programs for those on public assistance, and cannot restart service without coming to terms on past due balances. That could leave desperate customers at risk of losing access to job-seeking information, education, and news about the ongoing pandemic. Charter/Spectrum: The company has announced it will forgive a portion of past due balances and not require full repayment, if the customer or his/her job was directly impacted by the coronavirus. Spectrum’s offer of 60 days of free internet service introduced in March was accepted by at least 400,000 customers. But for most, the offer has since expired. Spectrum has worked to convert those at the end of the free offer into paid customers, but won’t disclose how much success they have had.

Charter/Spectrum: The company has announced it will forgive a portion of past due balances and not require full repayment, if the customer or his/her job was directly impacted by the coronavirus. Spectrum’s offer of 60 days of free internet service introduced in March was accepted by at least 400,000 customers. But for most, the offer has since expired. Spectrum has worked to convert those at the end of the free offer into paid customers, but won’t disclose how much success they have had. Comcast: Customers enrolled in the Xfinity Assistance Program are being given the option of repaying past due amounts in up to 12 equal monthly installments. After a repayment arrangement is made, some customers are persuaded to downgrade service to more affordable plans until past due amounts are repaid. Comcast’s offer of 60 days of free internet service has ended for most customers that enrolled shortly after it was introduced. Comcast has not announced a date when its 1,000 GB usage cap is scheduled to return in most service areas.

Comcast: Customers enrolled in the Xfinity Assistance Program are being given the option of repaying past due amounts in up to 12 equal monthly installments. After a repayment arrangement is made, some customers are persuaded to downgrade service to more affordable plans until past due amounts are repaid. Comcast’s offer of 60 days of free internet service has ended for most customers that enrolled shortly after it was introduced. Comcast has not announced a date when its 1,000 GB usage cap is scheduled to return in most service areas. Verizon: Verizon will continue service for “hundreds of thousands of customers” that enrolled in the Keep America Connected pledge program, as long as they agree to make regular payments as part of a special repayment plan that will be introduced for these customers in July. Customers will be billed a portion of their past due amounts along with current service charges until repayment has been made in full.

Verizon: Verizon will continue service for “hundreds of thousands of customers” that enrolled in the Keep America Connected pledge program, as long as they agree to make regular payments as part of a special repayment plan that will be introduced for these customers in July. Customers will be billed a portion of their past due amounts along with current service charges until repayment has been made in full. Charter Communications is petitioning the Federal Communications Commission for permission to usage cap its internet customers two years before the FCC’s ban on the company imposing data caps runs out.

Charter Communications is petitioning the Federal Communications Commission for permission to usage cap its internet customers two years before the FCC’s ban on the company imposing data caps runs out. The FCC’s 2016 order approving the merger between Charter Communications, Time Warner Cable, and Bright House Networks, with a 7-year prohibition on data caps, was not unanimous. Separate statements from Republican Commissioners Ajit Pai and Michael O’Rielly were highly critical of most of the deal conditions the then-Democratic majority favored. Four years later, Pai now presides as chairman over a Republican-majority FCC that could take a favorable view of Charter’s request to end deal conditions early.

The FCC’s 2016 order approving the merger between Charter Communications, Time Warner Cable, and Bright House Networks, with a 7-year prohibition on data caps, was not unanimous. Separate statements from Republican Commissioners Ajit Pai and Michael O’Rielly were highly critical of most of the deal conditions the then-Democratic majority favored. Four years later, Pai now presides as chairman over a Republican-majority FCC that could take a favorable view of Charter’s request to end deal conditions early. But the FCC remained unconvinced by Charter’s statements. In a review of confidential internal company documents, the FCC found multiple instances where Time Warner Cable had not completely abandoned the idea of data caps, despite multiple high-profile consumer backlashes against the idea.

But the FCC remained unconvinced by Charter’s statements. In a review of confidential internal company documents, the FCC found multiple instances where Time Warner Cable had not completely abandoned the idea of data caps, despite multiple high-profile consumer backlashes against the idea. With record-breaking unemployment and an economy in tatters, consumers are abandoning high-priced mobile plans and switching to lower priced cable operator mobile plans.

With record-breaking unemployment and an economy in tatters, consumers are abandoning high-priced mobile plans and switching to lower priced cable operator mobile plans. “Given the levels of economic hardship that have accompanied the lockdowns, one can reasonably imagine that these kinds of hyper-aggressive pricing plans won’t have much trouble breaking through to capture market share,” Moffett said in a research note.

“Given the levels of economic hardship that have accompanied the lockdowns, one can reasonably imagine that these kinds of hyper-aggressive pricing plans won’t have much trouble breaking through to capture market share,” Moffett said in a research note.