WASHINGTON (Reuters) – T-Mobile US Inc’s $26 billion acquisition of rival Sprint Corp won the support of the head of the Federal Communications Commission on Monday, in a big step toward the deal’s approval.

WASHINGTON (Reuters) – T-Mobile US Inc’s $26 billion acquisition of rival Sprint Corp won the support of the head of the Federal Communications Commission on Monday, in a big step toward the deal’s approval.

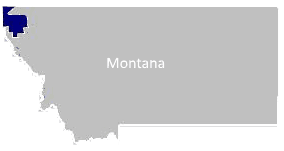

FCC Chairman Ajit Pai, a Republican, came out in favor of the combination after the companies offered concessions including selling Sprint’s Boost Mobile prepaid cell service.

Sprint shares surged 23.2% while T-Mobile shares rose 5.1%. If okayed by the FCC, the deal would still need approval from the U.S. Justice Department’s antitrust division.

If the deal is completed, the number of U.S. wireless carriers would drop to three from four, with Verizon Communications Inc and AT&T Inc leading the pack.

Some telecommunications experts have predicted that prices for cell phone service would rise as a result, and U.S. Senator Richard Blumenthal agreed.

“The FCC’s seeming abdication makes it even more important for the Department of Justice to step up to the plate to block this merger,” the Democratic senator said in a statement.

Pai will recommend that the other four FCC commissioners vote to approve the merger. Commissioner Brendan Carr, a Republican, said on Monday he will vote in favor.

The third Republican, Mike O’Rielly, did not reply to a request for comment. The Commission is made up of three Republicans and two Democrats.

Pai

FCC Commissioner Jessica Rosenworcel, a Democrat, tweeted her disapproval.

“We’ve seen this kind of consolidation in airlines and with drug companies,” she said. “It hasn’t worked out well for consumers. But now the @FCC wants to bless the same kind of consolidation for wireless carriers. I have serious doubts.”

The FCC will not formally vote on the merger on Monday but will first draft an order, two people briefed on the matter said.

The FCC move boded well for the Justice Department to also approve the deal, Citi analysts said in a note.

“While the two federal agencies have different standards of review that could lead to different outcomes, we believe the likelihood for some coordination between the agencies is encouraging for the approval prospects by the (Justice Department),” the note said.

Reviews by state attorneys general and public utility commissions could push full approval back to the third quarter of this year, the Citi note said.

CONCESSIONS

In a filing with the FCC on Monday, the companies pledged to sell prepaid wireless provider Boost Mobile.

The sale will include the brand name, any active accounts and dedicated Boost assets and staff but no wireless spectrum. The new Boost could buy network access from T-Mobile for at least six years.

One critic of the deal called the concession weak.

“I don’t understand how the mere spinning off of one of three prepaid services would satisfy (Pai), given all the evidence in the record that post-paid (wireless) prices will go up,” said Gigi Sohn, who held a senior FCC position during the Obama administration. “I just think this is very weak tea.”

The Boost sale is aimed at resolving concerns that the deal would give the combined company 54% of the prepaid market, which generally includes those with poor credit who cannot pay with a credit card.

T-Mobile, which is about 63 percent owned by Deutsche Telekom AG, also promised the new company would build a “world-leading” 5G network, which is supposed to be the next generation of wireless service. It promises to give rural Americans robust 5G broadband and enhance home broadband.

The FCC and Justice Department had been expected to make a decision in early June. They have been weighing potential a loss of competition and higher prices for consumers against the prospect of a more powerful No. 3 wireless carrier that can build a faster, better 5G network.

T-Mobile has about 80 million customers and Sprint has about 55 million customers.

Reporting by David Shepardson and Diane Bartz, additional reporting by Douglas Busvine in Frankfurt; Editing by Susan Heavey, Paul Simao and Jeffrey Benkoe

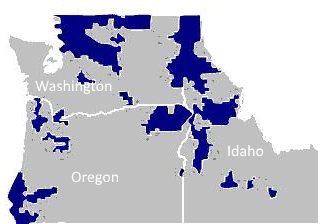

Telecom companies that receive Connect America Fund (CAF) dollars to deploy rural broadband service will not have to prove suitable internet speed and performance until early next year, after the FCC’s Wireline Bureau today announced it is delaying mandatory testing because of telecom industry objections.

Telecom companies that receive Connect America Fund (CAF) dollars to deploy rural broadband service will not have to prove suitable internet speed and performance until early next year, after the FCC’s Wireline Bureau today announced it is delaying mandatory testing because of telecom industry objections.

Subscribe

Subscribe Frontier Communications is

Frontier Communications is

T-Sprint’s argument is that this transaction will accelerate the deployment of 5G technology in a war for 5G supremacy with China. But exactly what technology is deployed, on what spectrum, using small cells or macro cell towers, makes a lot of difference. China’s wireless companies are owned and controlled by the Chinese government, which is also underwriting some of the costs. America’s networks are financed with private capital (and customer bills). T-Sprint’s 5G plans are also far less ambitious than those from AT&T and Verizon, and the cost to long-term competition is too high. The FCC should know that.

T-Sprint’s argument is that this transaction will accelerate the deployment of 5G technology in a war for 5G supremacy with China. But exactly what technology is deployed, on what spectrum, using small cells or macro cell towers, makes a lot of difference. China’s wireless companies are owned and controlled by the Chinese government, which is also underwriting some of the costs. America’s networks are financed with private capital (and customer bills). T-Sprint’s 5G plans are also far less ambitious than those from AT&T and Verizon, and the cost to long-term competition is too high. The FCC should know that. WASHINGTON (Reuters) – T-Mobile US Inc’s $26 billion acquisition of rival Sprint Corp won the support of the head of the Federal Communications Commission on Monday, in a big step toward the deal’s approval.

WASHINGTON (Reuters) – T-Mobile US Inc’s $26 billion acquisition of rival Sprint Corp won the support of the head of the Federal Communications Commission on Monday, in a big step toward the deal’s approval.

Frontier Communications

Frontier Communications