Despite making revenue growth the top priority at Frontier Communications, the company still managed to lose 3% in year over year revenue as another 51,800 customers pulled the plug on their Frontier landline and slow DSL service.

Despite making revenue growth the top priority at Frontier Communications, the company still managed to lose 3% in year over year revenue as another 51,800 customers pulled the plug on their Frontier landline and slow DSL service.

Frontier’s latest quarterly earnings showed a net income rise to $67 million, a major improvement over $20.4 million earned during the same quarter last year. The earnings improvement comes from reduced operating expenses, down 12 percent to $977.3 million and rate increases for certain Frontier markets in less-competitive areas.

Frontier CEO Maggie Wilderotter told investors the company has been reviewing accounts obtained from Verizon Communications, scrutinizing for “unnecessary credits, adjustments, and discounts, ” and systematically eliminating them.

“We’ve got a number of [ex-Verizon] customers that have been with us at a very, very, very low price point; they’ve been on promotions,” said Donald Shassian, Frontier’s chief financial officer. “They’ve been in existence for years and never got curtailed. And once we converted [those customers] onto [Frontier’s billing system], we identified those.”

Frontier’s plan for future growth is a temporary transition away from expanding broadband service into unserved areas, instead focusing on speed upgrades and service improvements where Frontier already serves.

Frontier: Speed upgrades “help dispel the myth that DSL technology cannot keep up with customer demand.” Faster speeds support IPTV as well.

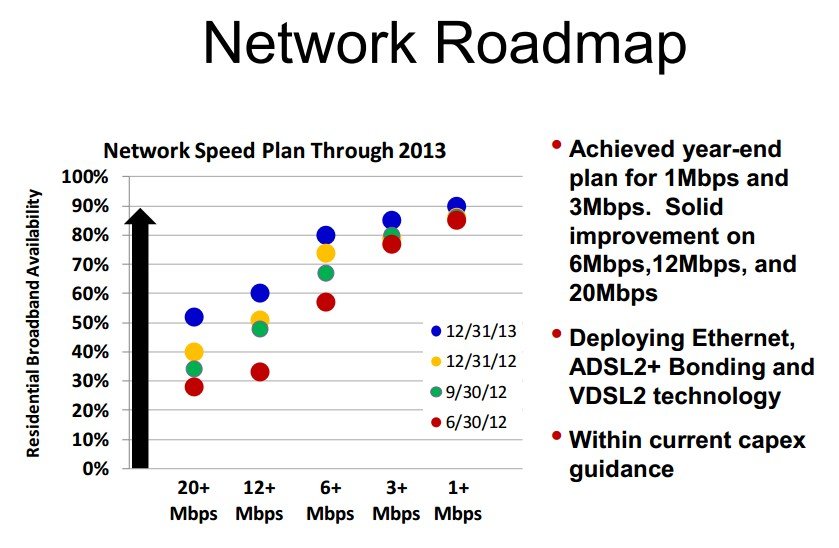

Frontier has targeted investment on improving speeds and network capacity for customers currently stuck with 1-3Mbps traditional DSL service. Frontier is using its fiber-based middle mile network and more advanced forms of DSL to dramatically increase broadband speeds. According to company officials, 64% of Frontier’s exchanges are now equipped with VDSL2, with speeds up to 40Mbps. At least 73% have equipment capable of bonded ADSL2+ with speeds up to 20Mbps. The target for Frontier’s fastest speeds are commercial customers. By the end of this year, 71% of Frontier’s exchanges will support carrier Ethernet service up to 1Gbps for business accounts.

Frontier has targeted investment on improving speeds and network capacity for customers currently stuck with 1-3Mbps traditional DSL service. Frontier is using its fiber-based middle mile network and more advanced forms of DSL to dramatically increase broadband speeds. According to company officials, 64% of Frontier’s exchanges are now equipped with VDSL2, with speeds up to 40Mbps. At least 73% have equipment capable of bonded ADSL2+ with speeds up to 20Mbps. The target for Frontier’s fastest speeds are commercial customers. By the end of this year, 71% of Frontier’s exchanges will support carrier Ethernet service up to 1Gbps for business accounts.

Most Frontier residential customers will see more modest speed improvements. During the third quarter, Frontier expanded its higher speed offerings with more to come:

- 20Mbps service is now for sale in 34% of its national service territory. By year end, 40% will have access and 52% by 2013;

- 12Mbps service is now available to 48% of its network footprint. By the end of the year, 51% of homes will have access and 60% in 2013;

- 6Mbps is now available to 67% of Frontier-served homes, with 74% expected by year end and 80% by 2013.

“We’re seeing 100Mbps delivery in vendor labs and that should be a reality in the next 12 months in our markets,” Wilderotter said. “This should help dispel the myth that DSL technology cannot keep up with customer demand.”

Wilderotter noted that the latest network upgrades might eventually support television service.

“We think we have the opportunity to offer an IPTV-type service in many of our markets, to many of our customers,” said Wilderotter. “In our labs, we’re doing some experimentation on the DSL platform with certain types of technologies that compress the data stream, so we could actually offer a very good video experience at 6Mbps or above. We’ll be doing some experimentation with that in 2013.”

New Products, More Simplified Pricing, Bigger Promotions

To better compete with cable, Frontier has simplified many of their broadband packages, eliminating the modem rental fee and other hidden surcharges for customers. Wilderotter noted the cable industry has recently started to “nickle and dime” customers with modem rental fees and surcharges, something Frontier has also charged customers in the past.

To better compete with cable, Frontier has simplified many of their broadband packages, eliminating the modem rental fee and other hidden surcharges for customers. Wilderotter noted the cable industry has recently started to “nickle and dime” customers with modem rental fees and surcharges, something Frontier has also charged customers in the past.

Frontier is now staking a position in simplified pricing.

“So when a customer gets a quote of $39.99 for broadband, it includes the modem, it includes surcharges, it includes everything,” Wilderotter explained. “So they’re not surprised when they get their bill. And we think that’s a huge value selling point for our product set.”

But simple pricing is not always lower pricing.

Increases in broadband service pricing, a hike in the Subscriber Line Charge, and other surcharges introduced for departing customers helped add to the company’s bottom line. But Frontier insists it adjusts rates only after considering the competitive environment.

“You don’t necessarily see us do price increases on broadband across the board,” explained Shassian. “We also believe that the price increases should be associated with increased value to the customer, too. So in some cases, it’s incremental speeds and capability.”

In an effort to upsell current customers, and even more importantly “win back” those who left, Frontier has introduced an aggressive new promotion that will reward subscribers with up to a $450 Apple gift card when committing to a new two-year contract. The value of the gift card ranges depending on how many services a customer chooses.

In an effort to upsell current customers, and even more importantly “win back” those who left, Frontier has introduced an aggressive new promotion that will reward subscribers with up to a $450 Apple gift card when committing to a new two-year contract. The value of the gift card ranges depending on how many services a customer chooses.

Stop the Cap! found Frontier pitching a triple play promotion in Tennessee for $87.99 a month with a $450 Apple gift card for new or returning Frontier customers. The bundle includes 6Mbps DSL, Frontier residential phone service with features and long distance service, and DISH Networks’ America’s Top 120 satellite service.

But there is fine print, including a two year service agreement with a $400 early termination fee for phone and broadband service, a DISH cancellation fee of $17.50 for each month remaining in a two year contract, at least $85 in “setup fees,” a $9.99 “broadband processing fee” if a customer disconnects service, and an online bonus credit a customer has to remember to request within 45 days of service activation.

Other Frontier Developments This Quarter

- Frontier began deploying the FCC Connect America Fund proceeds during the quarter to bring broadband to 92,877 new Frontier homes;

- A wireless partnership trial with AT&T began on October 8 in Washington and Minnesota. The discounted package bundle is only available to customers who also maintain Frontier broadband service;

- Over 203,000 Frontier customers signed up with legacy partner DirecTV saw their satellite service unbundled from their Frontier bills this quarter. Frontier chose DISH Networks as its satellite partner back in 2011, and the company has encouraged its old DirecTV customers to consider switching to DISH;

- Business customers constitute 52% of Frontier customer revenues. Frontier expects more than 66% of total customer revenue to come from broadband service;

- Frontier’s Simply Broadband, a broadband-only product, used to include a free landline. Not anymore;

- Frontier will begin accelerating promotions for its Apple Store gift card starting this week;

- Hughes Net Satellite service was integrated into Frontier’s systems and is pitched to customers as Frontier Satellite Broadband. It will be targeted to 750,000 households that cannot access wired broadband service from Frontier.

Subscribe

Subscribe