Studies find few surprises for cable and phone companies that pay for them.

Internet plans with term contracts, usage limits, and other pricing tricks are good for consumers and save them money over comparable unlimited usage plans.

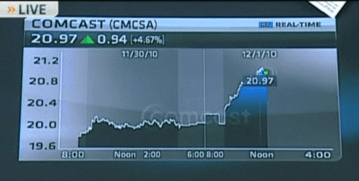

That is the conclusion of a new study from the Technology Policy Institute, an industry front group funded by AT&T, Comcast, the National Cable & Telecommunications Association, Qwest, Time Warner Cable, T-Mobile, and Verizon.

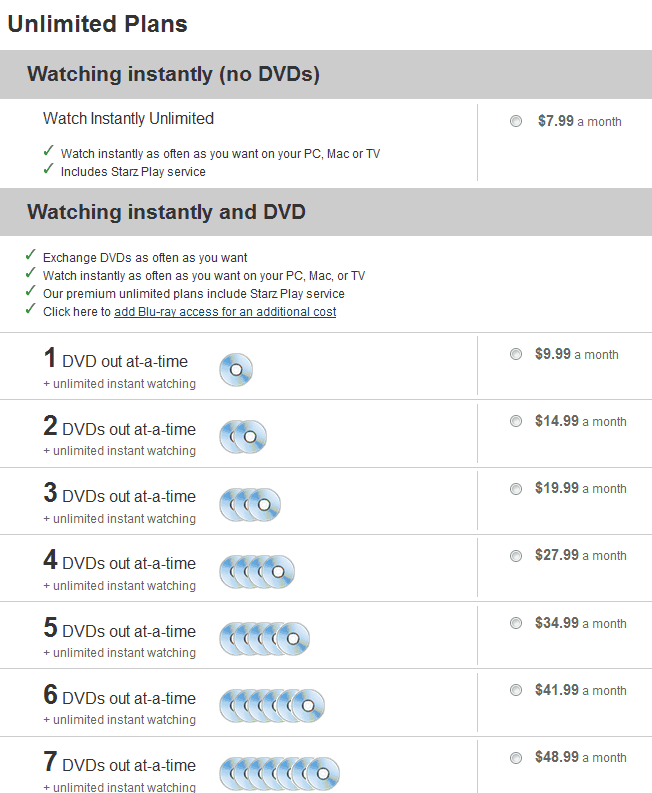

Scott Wallsten and James Riso’s “study,”Residential and Business Broadband Prices, Part 1: An Empirical Analysis of Metering and Other Price Determinants,” claims to have taken a comprehensive look at 25,000 plans offered across North America, Europe and the Pacific to make their case that a residential service plan with a 10GB monthly usage cap would save consumers 27 percent over the price of a comparable unlimited plan, as long as data use stays below the cap. They also suggest additional savings can be had if consumers lock themselves into term contracts with service providers (most of which carry hefty fees to exit early.)

These results suggest that the unlimited data plans typically offered by most U.S. wireline broadband providers may not be optimal for many consumers. The details of capped plans matter, and how an individual user is affected depends on the base price, allowed data usage, and consequences for exceeding the cap. Nevertheless, because capped plans are—all else equal—cheaper than unlimited plans, many consumers, particularly the low-volume users, are likely to pay less for broadband with data caps than they would for plans offering unlimited data transfer.

Wallsten and Riso make much of AT&T’s recent decision to end unlimited usage for wireless broadband, suggesting that consumers are saving money with new, low-use plans over the company’s old unlimited pricing. The authors claim close to 70 percent of iPhone users consume less than 200 MB per month, which is the cap for AT&T’s cheaper data plan.

But the authors concede that usage is growing — rapidly in the case of online video, which sets the stage for consumers saving money today, but facing serious overlimit charges on their bills tomorrow:

Some analysts, however, remain concerned that these plans make video streaming impractical given the bandwidth it consumes, could eventually cost consumers more as they use their wireless devices more intensively, and generally make it less likely for wireless to become a viable substitute for wireline broadband. To be sure, while Figure 3 shows that the vast majority of users consume small amounts of data today, it also shows per user mobile data consumption growing quickly, so the number of people who exceed the caps could increase significantly in a relatively short period of time.

Major U.S. wireline providers have not yet introduced metered pricing successfully, though, as shown above, it is common in other countries. An experimental metered pricing plan by Time Warner Cable garnered strong reaction, prompting one group to demand that Congress ―investigate ongoing metered pricing practices to determine the impact on consumers. Some in Congress did, in fact, hold hearings on the plans. In response to this backlash, Time Warner Cable canceled its experiment.

Despite the political reaction, all consumers are not inherently worse off or better off with metered pricing. Low-volume users are likely to be better off under metered plans and high volume users worse off. The net effect on any given consumer depends on his data use, the base price, how much data the base price allows, the price of data when exceeding the cap, and how much he would have paid for an unlimited plan.

Wallsten and Riso also admit several parts of their study are “incomplete,” and “lack data.” We would also include the facts they ignored whether consumers prefer unlimited plans, how customers would feel about a bill with overlimit fees attached, or whether the usage cap levels the authors note in their study are adequate. They also completely ignore the critical issue of bandwidth cost trends and their relationship to consumer pricing.

Wallsten and Riso also admit several parts of their study are “incomplete,” and “lack data.” We would also include the facts they ignored whether consumers prefer unlimited plans, how customers would feel about a bill with overlimit fees attached, or whether the usage cap levels the authors note in their study are adequate. They also completely ignore the critical issue of bandwidth cost trends and their relationship to consumer pricing.

But of course they would, considering the same providers who want these pricing schemes are paying the costs for the study.

Welcome to the world of Hired Gun Research.

Wallsten, in particular, has been singing the same cap-happy tune for several years now, churning out the same industry-financed conclusions about broadband. Back in 2007, he delivered a piece trumpeted by the Progress & Freedom Foundation and the Heartland Institute — two groups notorious for parroting corporate-friendly talking points. Back then it was about Internet overloads and supporting Internet toll booths for “congestion pricing” after Comcast got caught secretly throttling broadband customer speeds.

Dave Burstein of DSL Prime notes most consumers don’t like caps, lock-in contracts, or speed throttles.

“Policymakers should normally assume that imposing caps generally results in negative consumer welfare. The small efficiency gains don’t come close to making up for a second rate Internet,” Burstein writes. “Everyone is better off with a robust, unthrottled Internet. It allows for an important form of video competition and market access for innovative new net offerings. It’s a better experience for the user and hence more people will be connected, a good thing.”

In this latest study, the two authors completely ignore some very important facts:

- Who sets the pricing for unlimited and usage-capped broadband? Providers. Do consumers save money from usage limited plans because of decreased provider costs passed along to consumers or pricing schemes that artificially inflate unlimited broadband pricing to drive customers to “money-saving” limited plans that teach usage restraint or expose consumers to dramatic overlimit fees?

- What are the trends for wholesale bandwidth costs and how does that trend comport with industry pricing schemes that have increased broadband pricing in the United States? An honest study would reflect these costs are dropping… dramatically, and would introduce the very real question of whether unlimited broadband is a problem in search of a revenue-generating solution that would come from further monetizing broadband with so-called “consumption pricing.”

- What is the consumer perception of usage-limited broadband? An important part of this equation is whether consumers want unlimited broadband service to be discontinued. Every study to date not paid for by the providers themselves shows consumers are willing to pay today’s prices for the peace of mind they receive in not being exposed to limits or overlimit fees. Wallsten and Riso touched on the consumer backlash, to a considerable part coordinated by Stop the Cap!, over Time Warner’s pricing scheme which would have tripled broadband pricing for an equivalent level of service. But the authors charge on with their pro-cap conclusions regardless.

- Wallsten and Riso’s study only casually mentions the dramatically different paradigms of wireless and wireline broadband. The former is delivered using technology that is recognized to have limitations that can only be seriously addressed with additional spectrum allocation that could take years to address. The latter is already being mitigated by cable broadband technology upgrades, fiber optics, and improved backbone connections that often deliver much better access at a fraction of the price providers paid just a few years earlier. Drawing comparisons between AT&T’s wireless broadband pricing and wireline broadband is dubious at best, especially since two companies largely control pricing and service for the majority of wireless customers in the United States.

- To prove its contention limited broadband service is “common in other countries,” the authors cite a Frequently Asked Questions article by Comcast trying to justify that company’s own usage cap to its customers. So because Comcast’s PR department says it, it must be true. In fact, in countries where usage capped broadband has been a traditional problem, consumer demand and public policy efforts have moved providers towards offering unlimited service plans to meet popular demand. In fact, in countries like Australia, New Zealand, and South Africa, governments have cited usage caps as a serious disadvantage to growth of the digital economy. Consumers certainly agree.

Dave Burstein, DSL Prime

Burstein adds:

Caps or other throttling measures are almost never imposed because of actual congestion problems (on large, wired networks.) The caps would be at far higher levels if they were, like Comcast’s 250 gigabytes. The usual explanation is bogus. The typical consumer advocate believes the caps are about preventing competition to the carriers’ own video package. That’s certainly common, but so is price discrimination to yield increased potential revenues. As Scott notes, price discrimination in a strongly competitive market can work out well for all concerned. With strong competition, the benefits flow through to consumers. Since competition in broadband is typically weak, I believe it far more often has little consumer benefit but is good for company profits.

The authors conclude that despite limitations on data available, “The policy implications, however, are clear. Policymakers should not immediately conclude that data caps and other pricing schemes that differ from traditional unlimited plans are necessarily bad.” Instead, the authors suggest pricing trends should be evaluated over time to identify the effects on prices, investment and usage.

Although that’s a point Burstein agrees with, we feel there is substantial evidence this debate is based not on experimental pricing to find new customers, but rather a defensive position to respond to an inevitable public backlash against Internet Overcharging schemes. Providers are desperately looking for excuses to further monetize broadband, cut costs, and deliver an effective impediment to online video competitors using broadband networks to deliver alternative, less expensive services to consumers.

Policymakers should listen to their constituents, who are more than comfortable with today’s unlimited broadband experience. Nobody objects to experimental low usage plans with discount pricing, but not at the expense of ending or repricing existing unlimited service into the stratosphere. Today’s broadband industry earns billions in annual profits, even as their costs decline. Providers have done considerable profit-taking in the last few years from their broadband divisions, slashing upgrades and other investments to keep pace with traffic demands.

Subscribe

Subscribe