The mouthpiece of Big Telecom.

The Information Technology and Innovation Foundation has looked and looked, and just does not see America’s broadband problems aptly described by industry critics including Susan Crawford, David Cay Johnston and Tim Wu. As far as the ITIF is concerned Americans have little to complain about with respect to broadband availability, speeds or pricing.

That finding is part of a new research paper, “The Whole Picture: Where America’s Broadband Networks Really Stand,” authored by Richard Bennett, Luke Stewart, and Robert Atkinson.

The report sniffs at critics complaining about uncompetitive, high-priced service, dismissing them as misguided “holders of a particular ideology or economic doctrine, which is Neo-Keynesian, populist economic thinking in this instance.”

Bennett, Stewart, and Atkinson, who have all penned pro-industry reports for years, prove another economic doctrine: the free market for industry bought-and-paid-for-“research” is alive and well.

The summary finding of the report:

Taking the whole picture into account, this report finds that the United States has made rapid progress in broadband deployment, performance, and price, as well as adoption when measured as computer-owning households who subscribe to broadband. Considering the high cost of operating and upgrading broadband networks in a largely suburban nation, the prices Americans pay for broadband services are reasonable and the performance of our networks is better than in all but a handful of nations that have densely populated urban areas and have used government subsidies to leap-frog several generations of technology ahead of where the market would go on its own in response to changing consumer demands.

Although the report is extensively footnoted to bestow credibility, once a reader begins to check out those footnotes, trouble looms:

- Some footnotes lead the reader to business or Wall Street media reports, which can favor an industry point of view or extensively quote from executives and insiders;

- Several certain critical assertions include footnotes that link only to the home page of the source, making it impossible to find the exact source material used;

- Many footnotes come from earlier articles, position papers, and statements from the authors or others affiliated with the ITIF — hardly independent sources of information.

Bought and paid for research.

ITIF’s report is riddled with customized benchmarks the ITIF appears to have invented itself. Ars Technica caught one in the executive summary and questioned the relevance of measuring broadband adoption among “computer-owning households” at a time when an increasing number of Americans use broadband for video streaming on televisions, use smartphones, or rely on tablets for access.

We also noted the authors making several assertions without facts in evidence to support them. Among them is the unsupported notion that “the high cost of operating and upgrading broadband networks in a largely suburban nation” makes today’s broadband pricing understandable and fair.

In fact, the most significant costs borne by cable operators came during the early years of their initial construction — one, even two decades before broadband over cable was envisioned. When cable Internet service was introduced, it was praised for its relatively inexpensive start-up costs and its ability to deliver ancillary, unregulated revenue for cable operators. Those cable networks over which broadband is delivered have been paid off for years.

The authors avoid the actual financial reports of the largest phone and cable companies in their study, because as public shareholder-owned companies, they are obligated to disclose reality. Those financial reports show a consistent drop in capital expenses and infrastructure investment and a major increase in revenue and profits from broadband service. Cable industry executives have repeatedly asserted the reason they raise broadband prices is not because the costs to run their networks are very high, but rather because “they can.”

From there, Bennett, Stewart, and Atkinson play endless rounds of Statistics Scrabble.

Claim: America enjoys robust competition for broadband.

Phone Company

Fact: The cable industry has declared itself the victor for delivering high-speed broadband in the United States. DSL has long since given up competing on speed, and even AT&T’s hybrid fiber-copper U-verse platform is rapidly losing ground in the broadband speed race. Wireless and satellite plans are almost all slower and routinely cap usage, often to levels of just a few gigabytes per month.

The cable industry also won the right to keep its network to itself, not allowing third-party wholesalers on-demand access to resell broadband over those networks. Phone companies have been able to charge discriminatory wholesale pricing to access their networks, and only for certain types of connections.

Abroad, most networks are open to third parties on non-discriminatory terms. In places like the United Kingdom, customers have their choice of ISPs available over a traditional BT DSL line. In Asia, public subsidies and incentives helped push providers to construct fiber to the premises networks, but those networks are open access, helping spur competition and lower prices.

Domestically Time Warner Cable permits competitors like Earthlink on its network on a voluntary basis, but unsurprisingly Earthlink charges the same or higher prices for service that Time Warner charges once a six month promotion ends. That represents “competition” in name-only.

Claim: Most speed-test-based research rankings on broadband speeds around the world are wrong.

Cable Company

Fact: ITIF at one point makes the unfounded assertion that since many people only test their broadband speed when something seems wrong with their connection, most speed-test-sourced “actual speed” data is not very useful because there often is something wrong with a broadband connection when testing it, resulting in flawed data. This ‘picked out of the sky’ claim is one of the primary arguments ITIF makes about why broadband rankings (produced by those other than themselves) are irrelevant.

ITIF’s press release about its report makes the completely unsubstantiated assertion that “the average network rate of all broadband connections in the United States was 29.6Mbps in the third quarter of 2012; in the same period, we ranked seventh in the world and sixth in the OECD in the percentage of users with performance faster than 10Mbps.”

DSL customers may find a statistic rating America’s broadband speeds as better than one might expect to be less than useful when it only counts broadband connections faster than the average DSL user can buy themselves.

This cherry-picking may help the ITIF’s arguments look more credible, but it does nothing to improve your broadband speeds at home or at work.

Claim: Broadband provider profits average less than 2% annually.

Fact: Another clever statistic (poorly sourced as ‘from the home page of Bloomberg.com’ — check back with us when you find the original article yourself) that fails to tell the whole story.

We aren’t THAT profitable, really.

First, ITIF defines net profits specifically as “simply the difference between revenue and expenses.” But that definition may not account for a range of corporate accounting activities which can diminish net profits but still let the company walk away with high fives from Wall Street. Share buybacks or dividend payouts, acquisitions, costs and expenses from other divisions not related to broadband, etc., can all affect the bottom line and mask the enormous earnings and profit potential of American broadband.

Take Time Warner Cable, which has a 95 percent gross margin selling broadband. Broadband service is just one of three primary services sold by the cable operator. Broadband does not suffer from landline losses in the phone business or from escalating TV programming expenses. Broadband is clearly the most profitable service in Time Warner’s product arsenal because it occupies only a small part of the company’s wired infrastructure. Supplying broadband service also costs Time Warner relatively little money as a percentage of their earnings and has helped offset revenue loss from the television side of the business. Bandwidth costs have also declined year after year. Infrastructure upgrades are more than covered by pricing that has begun to creep up over the last few years. In effect, broadband earnings are covering for other products that are not selling as well.

ITIF’s claim that supplying broadband is costly and that current rates are justified just isn’t true.

Claim: Europe is behind the United States in broadband.

Fact: The one legacy network that both Europeans and Americans share in common is the copper wire basic telephone service. From there, telecommunications service diverged.

North Americans embraced cable television while much of western Europe (especially the UK) preferred direct-to-home satellite service. That difference set the stage for some significant broadband disparity. Cable broadband technology has proved more robust and reliable than DSL service. Phone companies that rely on basic DSL are falling behind in broadband speeds. Investment to bring fiber online is the only way these phone companies can stay competitive with cable broadband. Some countries with particularly decrepit telephone networks, especially those left over from the Communist era in eastern Europe, are being scrapped in favor of fiber to the home service. Many western European countries are incrementally introducing fiber to the cabinet or neighborhood service, which leaves the last mile copper phone wire connection in place.

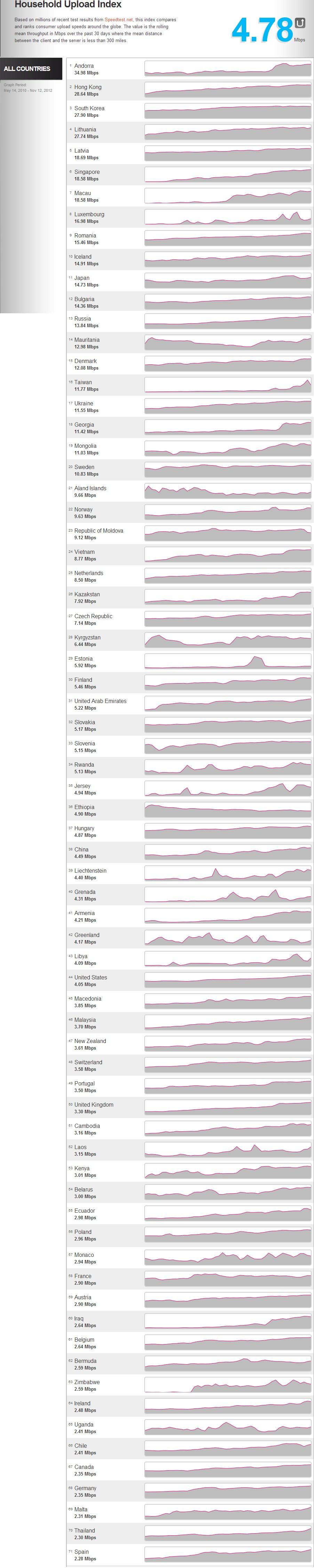

This is why speeds in many eastern European countries and the Baltic states with full fiber networks are so high. Advanced forms of DSL are more common further west, using technologies like VDSL2+. But DOCSIS 3 cable upgrades (and those to follow) continue to leapfrog over telephone company DSL advancements. Speed disparity is often the result of fewer cable systems in Europe as well as the amount of fiber optics replacing basic telephone service infrastructure.

Despite that, many Europeans pay less, particularly for faster service, than we do. Plus, fiber optic upgrades are within the foreseeable future in many European countries. In the United States, fiber deployments are now crawling or stalled in areas served by AT&T and Verizon. Neither company shows much interest in spending money on further wired upgrades and no competitive pressure is forcing them to, especially as both phone companies increasingly turn attention to their wireless divisions for most of their earnings.

The kind of research produced by the ITIF is tainted as long as they don’t reveal who is paying for these research reports. As Stop the Cap! readers have learned well, following corporate money usually helps expose the real agenda of these so-called “think tanks,” which are created to distort reality and quietly echo the agenda of their paymasters with a veneer of independence and credibility.

![[Image: The Verge]](https://stopthecap.com/wp-content/uploads/2013/07/t-mobile-jump.jpg)

Subscribe

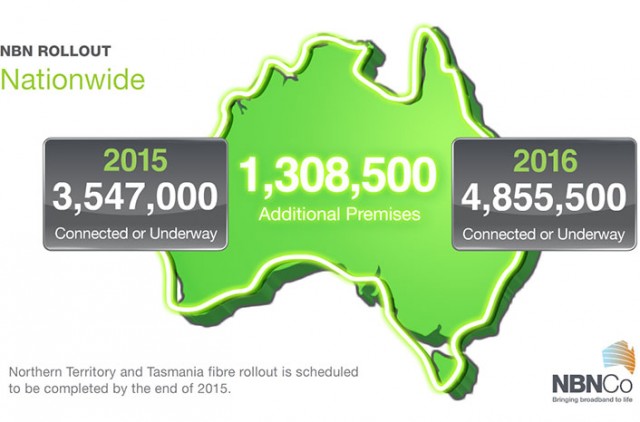

Subscribe Attention broadband planners: Although broadband deployment strategies differ around the world, a new report decisively concludes there is only one network technology proven to meet the demands of broadband users both today and tomorrow: a national fiber optic network.

Attention broadband planners: Although broadband deployment strategies differ around the world, a new report decisively concludes there is only one network technology proven to meet the demands of broadband users both today and tomorrow: a national fiber optic network.