Fox Television’s over the air signal may be scrambled and available “only by subscription” if the courts do not reverse their decision to allow an upstart television streaming service to continue operations while a broadcaster-backed lawsuit works through the legal system.

Fox Television’s over the air signal may be scrambled and available “only by subscription” if the courts do not reverse their decision to allow an upstart television streaming service to continue operations while a broadcaster-backed lawsuit works through the legal system.

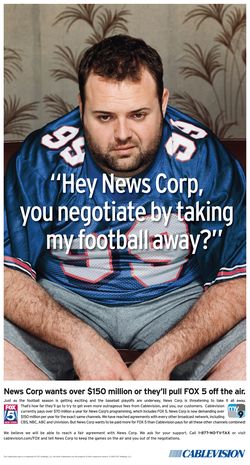

Aereo has been streaming New York City local stations to area residents that lease a tiny dime-sized antenna and receive the stations via the Internet. Broadcasters consider Aereo an end run around copyright law and retransmission consent fees paid by cable, satellite, and telco-TV operators. With millions in licensing fees at stake, several networks immediately filed suit to force the service to suspend operations.

But the 2nd Circuit Court of Appeals ruled in a 2-1 decision last month that Aereo’s streaming service did not represent a “public performance,” meaning the company was not infringing on the copyrights of broadcasters. Until a final court ruling is made, Aereo can continue operating, the judges ruled.

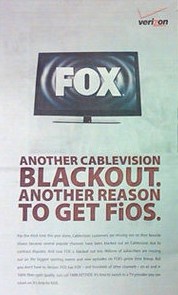

That decision prompted a hissy fit by News Corporation’s president and chief operating officer, who declared he is considering turning the Fox television network into a subscription-only service, potentially meaning the service would be scrambled and unavailable for free over-the-air in the future.

“Aereo is stealing our signal,” Chase Carey said at the opening of the National Association of Broadcasters’ convention is Las Vegas last night. “If we can’t have our rights properly protected through legal and governmental solutions, we will pursue business solution. One solution would be to take the network and make it a subscription service. We’re not going to sit idly by and let people steal our content.”

[flv width=”640″ height=”380”]http://www.phillipdampier.com/video/Bloomberg News Corp to Take Fox Off Air If Courts Back Aereo 4-8-13.flv[/flv]

Bloomberg Television explores Fox’s “nuclear option” of scrambling its broadcast outlets and forcing all Americans to pay for its content. (2 minutes)

[flv width=”384″ height=”236″]http://www.phillipdampier.com/video/CNN Money Aereo TV 3-13.flv[/flv]

CNN Money explains Aereo and its threat to the traditional broadcast retransmission consent fee system that has made over-the-air networks highly profitable with subscriber fees paid by your cable, satellite, or telco-TV provider and passed on to you in the form of higher cable or satellite bills. (2 minutes)

Subscribe

Subscribe Cable, satellite, and telco-TV subscribers face paying an extra $12 a year for two new sports channels that are certain to be added to the lineup by this summer.

Cable, satellite, and telco-TV subscribers face paying an extra $12 a year for two new sports channels that are certain to be added to the lineup by this summer.