At a hearing Wednesday to question President Donald Trump’s nominees for the Federal Trade Commission, Democrats expressed concern about some signals from the three Republican and one Democratic nominees that they intend to enforce consumer protection laws as long as there is evidence they have the indisputable authority to act.

At a hearing Wednesday to question President Donald Trump’s nominees for the Federal Trade Commission, Democrats expressed concern about some signals from the three Republican and one Democratic nominees that they intend to enforce consumer protection laws as long as there is evidence they have the indisputable authority to act.

What happens when corporate interests and special interest groups insist the FTC’s regulatory powers are uncertain, limited by precedent, blocked by court opinions, or contrary to the wishes of Congress remained uncertain after the hearing.

The Senate Commerce Committee is facing some urgency to approve the nominations to fill a large number of vacancies at the FTC, which currently prevents the agency from taking votes on actions. If all four nominees are approved, the FTC will still have a single open commissioner’s seat on the Democratic side.

The nominated FTC commissioners are:

Simons

Joseph J. Simons, nominated for chairman for the FTC, is a Republican antitrust lawyer who has taken a few trips through Washington’s revolving door, serving as chief of the FTC’s Competition Bureau, investigating mergers and anticompetitive conduct from 2001 to 2003 under President George W. Bush. During his tenure, the FTC mostly pursued high-profile cases that brought clear evidence of antitrust harm. Under Simons, the FTC blocked Libbey, Inc. from acquiring its chief glassware rival Anchor Hocking. Vlasic Foods International and Claussen Pickle found an unreceptive FTC for their merger, eventually also blocked. Simons was noted for investigating pharmaceutical companies that applied for misleading drug patents designed to delay the entry of cheaper generic versions of brand name pharmaceutical products. After his tenure at the FTC, Simons accepted a lucrative $1.9 million partnership at the law firm Paul, Weiss, Rifkind, Wharton & Garrison LLP, which handles corporate mergers and acquisitions for corporate clients.

Wilson

Christine S. Wilson, a Delta Air Lines executive, is also a frequent flyer through D.C.’s revolving door. During the George W. Bush administration, she was chief of staff for then-FTC chairman Tim Muris. She also held three other significant corporate-public policy positions that advised companies and the U.S. government about antitrust matters. In 2011, Wilson accepted a high paying partnership at Kirkland and Ellis, a firm well-regarded for helping corporations successfully complete antitrust reviews of their mergers and acquisitions. Wilson’s latest employer was Delta Air Lines, which offered her an executive position in August 2016 as the company’s senior vice president for legal, regulatory, and international affairs. In addition to the $521,000 in distributions Wilson earned from her partnership at Kirkland and Ellis, Wilson accepted an undisclosed cash signing bonus, $136,000 in bonuses in 2017 from a management incentive plan, and a regular salary of $390,000. Wilson retains various amounts of unvested Delta stock and stock options that would normally be lost after leaving the company, but Delta apparently wanted to part with Wilson on the friendliest of terms, granting her pro rata compensation for the stock and waiving the usual requirement that an employee leaving so quickly after being hired should pay back 50% of their signing bonus.

Phillips

Noah Joshua Phillips served as chief counsel for Republican Sen. John Cornyn at the Senate Judiciary Committee. Before coming to Capitol Hill, Phillips was an associate at Steptoe & Johnson LLP in Washington and at Cravath, Swaine & Moore in New York. He focused on civil litigation.

Consumer Federation of America senior fellow Rohit Chopra is a Democrat and the only nominee with a long record of representing consumer interests and pushing for increased consumer protection and better oversight of financial services and products targeting consumers. Chopra was previously assistant director of the Consumer Financial Protection Bureau, where he oversaw the agency’s agenda on students and young consumers. He specialized in targeting the student loan industry for abusive practices and secured hundreds of millions of dollars in relief for student loan borrowers.

Chopra

Because of the unprecedented number of vacancies at the Commission, President Trump’s nominees could have an enormous impact on the direction of the FTC over the next several years. Traditionally, three of the commissioners belong to the current president’s political party and two belong to the other party.

Observers suggest the nominees are not atypical for a Republican president to nominate and some have served at the FTC before. None have attracted the kind of controversy that followed Makan Delrahim, Trump’s pick for head of the U.S. Department of Justice’s Antitrust Division. Most expect the Republican majority-led FTC will bend towards the interests of businesses unless there is clear and convincing evidence of significant consumer harm, especially in cases of mergers and acquisitions.

“Traditionally, Republican commissioners tend to be more lenient in merger enforcement on the marginal case, and we haven’t seen any evidence to indicate that [Simons] would depart from the traditional Republican posture,” said Mary Lehner, a partner with Freshfields and a former FTC attorney who also served as an adviser to two chairmen of the agency.

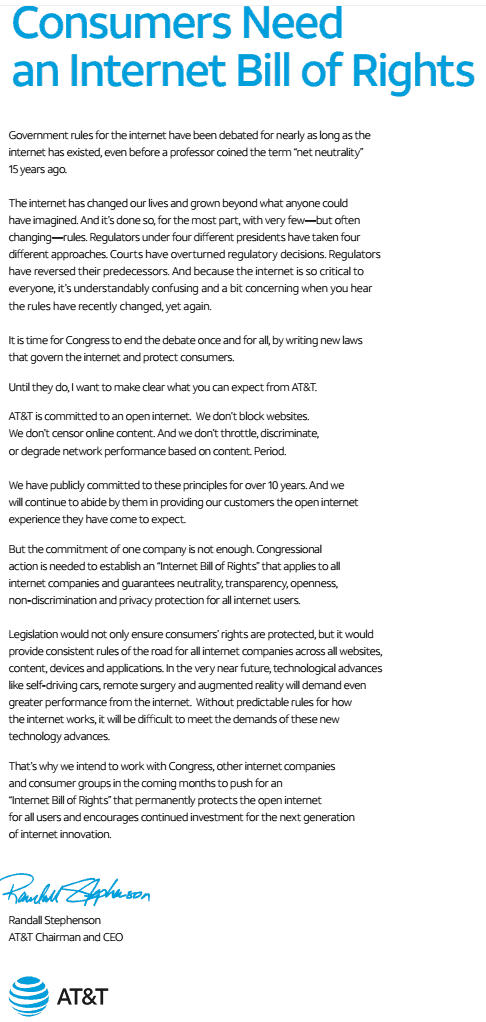

A major concern for some Democrats is that the FTC is now being tasked with protecting what remains of net neutrality, the open internet protocol that was swept away by the Republican majority at the Federal Communications Commission. The FCC reclassified internet service providers once again as “information services,” under Title 1 of the Communications Act. That transfers oversight back to the FTC — an agency not known for careful oversight of internet providers’ business practices.

A major concern for some Democrats is that the FTC is now being tasked with protecting what remains of net neutrality, the open internet protocol that was swept away by the Republican majority at the Federal Communications Commission. The FCC reclassified internet service providers once again as “information services,” under Title 1 of the Communications Act. That transfers oversight back to the FTC — an agency not known for careful oversight of internet providers’ business practices.

At the hearing, Simons equivocated on how the FTC will deal with allegations of ISP abuse and signaled his concern that a Ninth Circuit court ruling found that telecommunications companies that also serve as common carriers (ie. telephone companies) are completely exempt from FTC authority.

Some Democrats interpreted Simons’ remarks as suggesting he could adopt a “my hands are tied” approach to ISP oversight, claiming that the FTC lacks the authority to keep an eye out for industry abuses.

Sen. Ed Markey (D-Mass.) seized on such comments, asking Simons to confirm if he believes the FTC specifically “lacks rulemaking authority” on net neutrality while the FCC, directly responsible for transferring net neutrality enforcement away from itself, “does have rulemaking authority to prevent blocking, throttling and paid prioritization by ISPs.”

Simons prevaricated in his answer, telling Markey, “We both have rulemaking, and they’re different types of rulemaking.”

Markey

“I’d want to talk to the general counsel’s office before I gave a specific answer to that, but I’m not entirely clear,” Simons said in response to a followup question pressing the issue.

“We are going to take the [statutory] authority we have and use it as best we can,” Simons told senators at the Senate Commerce Committee hearing. “I don’t know exactly what types of anti-competitive or deceptive and unfair practices may come up. If something comes up that we can’t reach under our statute, then I would certainly talk to you about a federal legislative fix.”

But observers note such a fix could take years, and the FTC often takes a year or more to complete investigations of alleged wrongdoing before starting to act.

Chopra, the lone Democratic nominee, agreed with Democrats that he also feared the FTC’s authority to act is uncertain, and that lack of certainty is likely to delay any enforcement actions. Chopra comments suggested the telecom industry is likely to use the Ninth Circuit court ruling to their advantage.

“I share a lot of the skepticism and concerns,” Chopra told the committee. “The FTC may face an unlevel playing field where some major market participants are exempt from the commission’s authority while others are subject to it.”

Blumenthal

Sen. Richard Blumenthal (D-Conn.) said that single Ninth Circuit court ruling could provide the telecom industry with a ready-made loophole to escape the FTC’s jurisdiction altogether. An ISP could acquire “a minor side business” like a small rural telephone company subject to common carrier rules and win blanket corporate immunity from FTC oversight. Although Simons said he would support striking the common carrier exemption from the Federal Trade Commission Act which defines the FTC’s authority, such a change could take several years to get through Congress and a well-funded telecom industry lobbying effort.

Phillips seemed impatient about the net neutrality debate which occupied a significant part of the hearing, characterizing it as a side issue worth sidestepping to focus on broader issues.

“We can’t allow contentious issues to distract us from the bread and butter of the agency […] looking out for children, veterans, the elderly and Americans generally,” Phillips said.

Aside from the net neutrality debate, the Republican nominees signaled their interest in the possibility of investigating large tech companies like Google, Amazon, and Facebook for antitrust activities. Republicans have been especially critical of Google, and some conservatives believe Twitter and Facebook exhibit political bias against them. The president has also frequently attacked Amazon and its CEO Jeff Bezos. Bezos owns the Washington Post, one of the many news outlets Trump said has been unfair to him. Trump has also accused Amazon of stiffing the government on sales taxes.

“Oftentimes companies get big because they are successful with the consumer, they offer a good service at a low price,” Simons said. “And that’s a good thing, and we don’t want to interfere with that. On the other hand, companies that are already big and influential can sometimes use inappropriate means — anticompetitive means — to get big or to stay big. And if that’s the case then we should be vigorously enforcing the antitrust laws.”

Another issue the FTC nominees promised to prioritize: online security/data breaches which expose consumers’ private information.

Subscribe

Subscribe

BEIJING — A recent decision by the United States’ Federal Communications Commission to repeal net neutrality, which are rules designed to prevent the selective blocking or slowing of websites, has wide-ranging implications for China, which never believed in net neutrality and banned hundreds of foreign websites. The decision could result in a major trade war involving Chinese telecom and Internet companies, which are interested in accessing the U.S. market, analysts said.

BEIJING — A recent decision by the United States’ Federal Communications Commission to repeal net neutrality, which are rules designed to prevent the selective blocking or slowing of websites, has wide-ranging implications for China, which never believed in net neutrality and banned hundreds of foreign websites. The decision could result in a major trade war involving Chinese telecom and Internet companies, which are interested in accessing the U.S. market, analysts said. “I think it (FCC decision) has an impact potentially for Chinese technology companies that want to do business in the U.S.,” said Benjamin Cavender, a senior analyst at the Shanghai-based China Market Research Group (CMR). “You are asking about companies like Alibaba or Tencent, what this means for them in the U.S. markets– and I could very possibly see this being used as a trade war tool–and the U.S. government saying, ‘Look, we are going to restrict access to companies to our ISPs and force them to pay a lot of money.”

“I think it (FCC decision) has an impact potentially for Chinese technology companies that want to do business in the U.S.,” said Benjamin Cavender, a senior analyst at the Shanghai-based China Market Research Group (CMR). “You are asking about companies like Alibaba or Tencent, what this means for them in the U.S. markets– and I could very possibly see this being used as a trade war tool–and the U.S. government saying, ‘Look, we are going to restrict access to companies to our ISPs and force them to pay a lot of money.” The Obama administration lobbied and argued with China for nearly a decade to open up Internet access for American companies like YouTube, Twitter and Netflix. It was an important aspect of the annual strategic economic dialogue between the two countries.

The Obama administration lobbied and argued with China for nearly a decade to open up Internet access for American companies like YouTube, Twitter and Netflix. It was an important aspect of the annual strategic economic dialogue between the two countries.

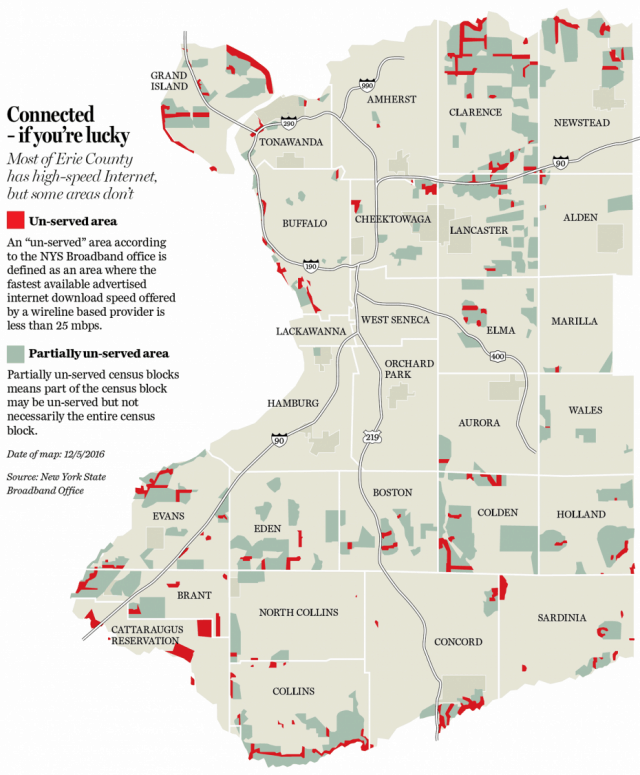

Rep. Chris Collins, a Clarence-area congressman with close ties to the Trump White House, defended FCC Chairman Ajit Pai’s recent decision to eliminate net neutrality. Pai was born in Buffalo.

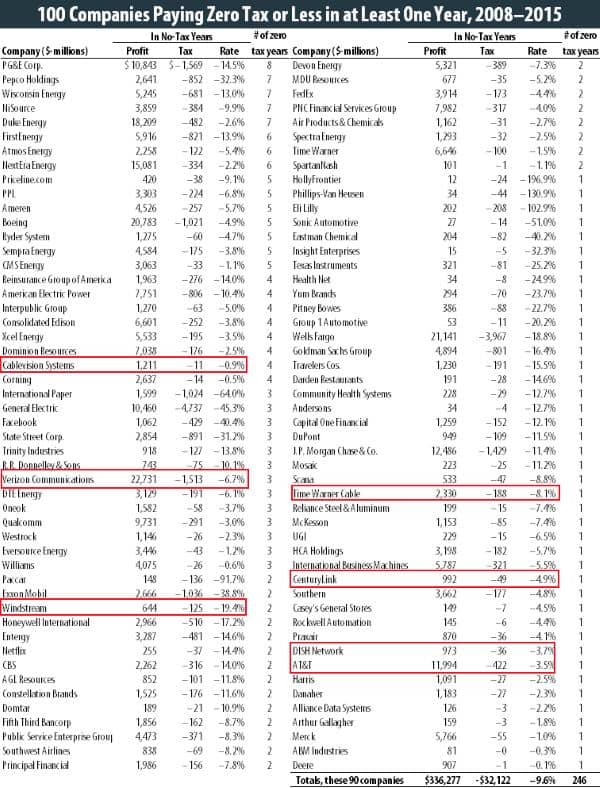

Rep. Chris Collins, a Clarence-area congressman with close ties to the Trump White House, defended FCC Chairman Ajit Pai’s recent decision to eliminate net neutrality. Pai was born in Buffalo. Some of America’s top telephone and cable companies will likely pay little, if any federal taxes as a result of the passage of a Republican-sponsored tax cut plan, while some may also receive generous “refunds” based on depreciation-related expenses and future investments the companies would have made with or without changes to the tax code.

Some of America’s top telephone and cable companies will likely pay little, if any federal taxes as a result of the passage of a Republican-sponsored tax cut plan, while some may also receive generous “refunds” based on depreciation-related expenses and future investments the companies would have made with or without changes to the tax code.