Is this the future of satellite TV?

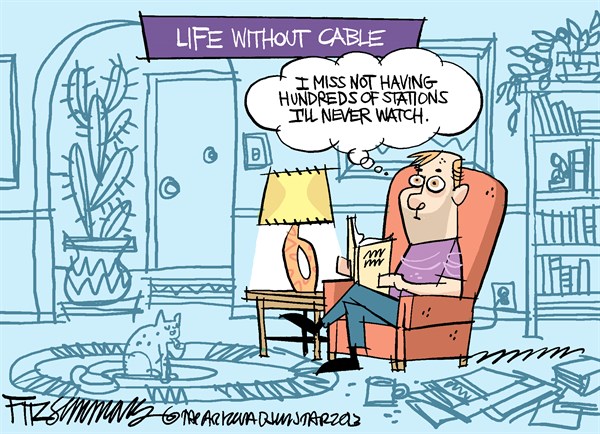

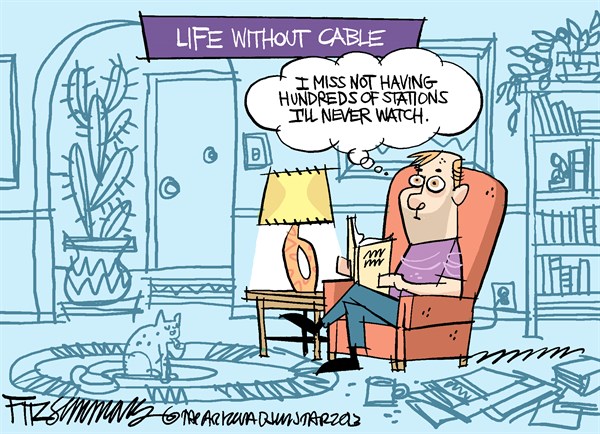

Ten years ago, large programmers like NBC-Universal, Fox, Viacom, and Time Warner started bundling new niche channels into their programming packages, forcing pay television providers to add networks few wanted just to get a contract renewal agreement in place for the networks they did want. Now, in the era of cord-cutting, those programming conglomerates are preparing to slim down.

One of the largest — Comcast/NBCUniversal — is the first to admit “there are just too many networks,” to quote NBCUniversal CEO Steve Burke.

Burke warned investors back in July that axing networks like Style and G4 was just the beginning.

“You’ll see us and others trimming channels,” Burke said during Comcast’s second-quarter earnings call. “We will continue to invest what we need to invest into our bigger channels, and we’ll continue to trim the smaller ones.”

Cable operators hope that day arrives sooner rather than later as cord-cutting continues to have an impact on cable-TV subscriptions.

For every popular cable network like USA and Bravo, cable operators get stuck carrying ratings-dogs like CNBC World, Centric, Cloo, VH1 Classic, Fox Business Network, and Fuse — all of which attract fewer than 100,000 viewers nationwide at any one time. Fuse barely attracted 51,000 viewers in 2015. But just about every cable TV customer pays for these channels, and many more.

Many cable channels wouldn’t survive without subscription fees because advertisers consider them too small to warrant much attention.

While Burke’s prediction has yet to slash the cable dial by more than a few networks so far, it has slowed down the rate of new network launches considerably. One millennial-targeted network, Pivot, will never sign on because it failed to attract enough cable distribution and advertisers, despite a $200 million investment from a Canadian billionaire. Time, Inc.’s attempts to launch three new networks around its print magazines Sports Illustrated, InStyle and People have gone the Over The Top (OTT) video route, direct to consumers who can stream their videos from the magazines’ respective websites.

While Burke’s prediction has yet to slash the cable dial by more than a few networks so far, it has slowed down the rate of new network launches considerably. One millennial-targeted network, Pivot, will never sign on because it failed to attract enough cable distribution and advertisers, despite a $200 million investment from a Canadian billionaire. Time, Inc.’s attempts to launch three new networks around its print magazines Sports Illustrated, InStyle and People have gone the Over The Top (OTT) video route, direct to consumers who can stream their videos from the magazines’ respective websites.

Fierce Cable this week opined that forthcoming cord cutter-targeted TV packages streamed over the internet from players including DirecTV/AT&T and Hulu, among others, will likely start a war of cable network attrition, which may make the concept of a-la-carte cable a thing of the past. Editor Daniel Frankel believes the future will be a finite number of cable networks delivered primarily over IP networks, which are expected to dramatically pare down the traditional cable TV bundle into fewer than 100 channels. Only the most popular networks will be included in a traditional cable TV lineup, and some of these providers expect to deliver a bundle of fewer than 50 channels, including local stations. Those booted out of the bundle may still find life from viewers going OTT, if those networks can attract enough people to watch.

AT&T is hoping for the best of both worlds as it prepares to launch an internet-based package of networks under its DirecTV brand called DirecTV Now. Sources told Bloomberg News AT&T is hoping DirecTV Now will attract more subscribers by 2020 than its satellite service. At some point in the future, it may even replace DirecTV’s satellite television service.

DirecTV Now is expected by the end of this year and will likely offer a 100 channel package of programming priced at between $40-55 a month, viewable on up to two screens simultaneously. The app-based service will be available for video streaming to televisions and portable devices like tablets and phones. No truck rolls for installation, no service calls, and no equipment to buy or rent are all attractive propositions for AT&T, hoping to cut costs.

DirecTV Now is expected by the end of this year and will likely offer a 100 channel package of programming priced at between $40-55 a month, viewable on up to two screens simultaneously. The app-based service will be available for video streaming to televisions and portable devices like tablets and phones. No truck rolls for installation, no service calls, and no equipment to buy or rent are all attractive propositions for AT&T, hoping to cut costs.

Since AT&T has taken over DirecTV, it has lost over 100,000 satellite customers. The threat to AT&T U-verse TV is also significant as customers increasingly look for alternatives to cable TV’s bloated and expensive programming packages. AT&T no doubt noticed the impending arrival of Hulu’s cable TV streaming platform next year and other services like Sling TV. Deploying their own streaming alternative with AT&T’s volume discounts from the combined subscribers of DirecTV and U-verse means AT&T can sell its streaming service at a substantial discount.

If consumers find the offerings from DirecTV Now and Hulu a credible alternative to traditional cable television, cord cutting could dramatically accelerate, provoking a response from cable operators likely to offer their own slimmed-down packages. So being among the 100 or so networks carried on DirecTV Now, or among the 50 or so networks Hulu is planning to offer, could be crucial to the future survival of any cable network. Those stranded in the 500-channel Universe of today’s cable television packages could be forced off the air or to an alternative means of reaching an audience such as OTT.

The lesson learned by the cable television industry is that customers are tapped out and unwilling to pay ever-rising cable TV bills for dozens of networks they’ve never watched and don’t intend to. The longer term lesson may be even more scary for some networks. Live, linear television as a concept may have seen its time come and go, at least for entertainment programming. While viewers are always going to seek live television for sports and breaking news, alternative on-demand viewing of everything else, preferably commercial-free, is a growing priority for many, especially if the price is right.

As a result of the current coronavirus (COVID-19) crisis, NBCUniversal is now offering free access to MSNBC, NBC News Now, and CNBC on cable lineups and to authenticated video subscribers of various cable, satellite, and telco TV services. Customers need not have current subscriptions to any or all of these services to get access. If streaming online, enter the account credentials of your current provider when prompted.

As a result of the current coronavirus (COVID-19) crisis, NBCUniversal is now offering free access to MSNBC, NBC News Now, and CNBC on cable lineups and to authenticated video subscribers of various cable, satellite, and telco TV services. Customers need not have current subscriptions to any or all of these services to get access. If streaming online, enter the account credentials of your current provider when prompted.

Subscribe

Subscribe Effective today, Hulu is

Effective today, Hulu is

While Burke’s prediction has yet to slash the cable dial by more than a few networks so far, it has slowed down the rate of new network launches considerably. One millennial-targeted network, Pivot, will never sign on because it failed to attract enough cable distribution and advertisers, despite a $200 million investment from a Canadian billionaire. Time, Inc.’s attempts to launch three new networks around its print magazines Sports Illustrated, InStyle and People have gone the Over The Top (OTT) video route, direct to consumers who can stream their videos from the magazines’ respective websites.

While Burke’s prediction has yet to slash the cable dial by more than a few networks so far, it has slowed down the rate of new network launches considerably. One millennial-targeted network, Pivot, will never sign on because it failed to attract enough cable distribution and advertisers, despite a $200 million investment from a Canadian billionaire. Time, Inc.’s attempts to launch three new networks around its print magazines Sports Illustrated, InStyle and People have gone the Over The Top (OTT) video route, direct to consumers who can stream their videos from the magazines’ respective websites. DirecTV Now is expected by the end of this year and will likely offer a 100 channel package of programming priced at between $40-55 a month, viewable on up to two screens simultaneously. The app-based service will be available for video streaming to televisions and portable devices like tablets and phones. No truck rolls for installation, no service calls, and no equipment to buy or rent are all attractive propositions for AT&T, hoping to cut costs.

DirecTV Now is expected by the end of this year and will likely offer a 100 channel package of programming priced at between $40-55 a month, viewable on up to two screens simultaneously. The app-based service will be available for video streaming to televisions and portable devices like tablets and phones. No truck rolls for installation, no service calls, and no equipment to buy or rent are all attractive propositions for AT&T, hoping to cut costs. NEW YORK (Reuters) – Comcast Corp, the largest U.S. cable operator, posted in-line second-quarter results, as its high-speed Internet and NBC Universal businesses grew amid a drop in pay-TV subscriber departures.

NEW YORK (Reuters) – Comcast Corp, the largest U.S. cable operator, posted in-line second-quarter results, as its high-speed Internet and NBC Universal businesses grew amid a drop in pay-TV subscriber departures. Wall Street keeps a close watch on the number of new video subscribers as pay TV operators fight to keep customers amidst intense competition from streaming video services such as Dish Corp’s Sling TV.

Wall Street keeps a close watch on the number of new video subscribers as pay TV operators fight to keep customers amidst intense competition from streaming video services such as Dish Corp’s Sling TV.