New York Gov. Andrew Cuomo has set a goal that every resident of New York State should have access to at least 100Mbps broadband no later than 2018.

New York Gov. Andrew Cuomo has set a goal that every resident of New York State should have access to at least 100Mbps broadband no later than 2018.

The governor will kick off his latest broadband expansion effort with the launch of his $500 million broadband expansion program, dubbed the New New York Broadband Fund, a follow-up to the state’s $70 million public-private effort to expand broadband that began in 2012.

Much of the money awarded in the 2012 broadband expansion effort went to Wireless Internet Service Providers, institutional broadband networks, middle-mile fiber projects not accessible to the public, and emergency service network upgrades. Another $5.2 million was awarded to Time Warner Cable to expand broadband service to 4,114 households in the Capital, Central, Finger Lakes, Mid-Hudson, Mohawk Valley, NYC, North Country, Southern Tier and Western regions of New York State. In June, many of the top funding recipients also received honors from the governor’s office in the first annual New York State Broadband Champion Awards.

Gov. Cuomo

Despite the money, the 2012 effort did not make a significant dent in the pervasive problem of broadband availability in upstate New York.

While Gov. Cuomo is committed to a target speed of 100Mbps within the next four years, more than one million New York households still cannot access broadband that achieves the state minimum — 6.5Mbps. That includes 113,000 businesses.

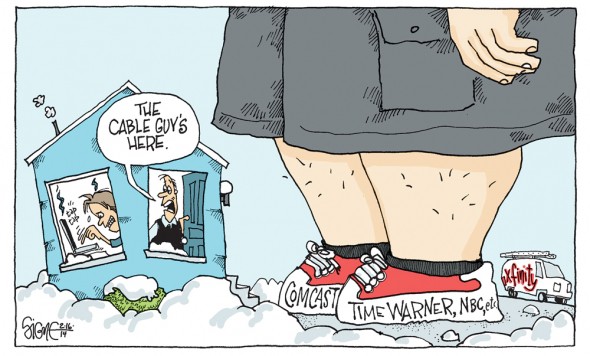

The governor’s solution is to subsidize private businesses with more tax dollars to resolve the broadband problem, with a significant part of the next round of funding likely to reach more institutional and public safety networks off-limits to the public, middle mile network expansion that can build state-of-the-art fiber rings that do not connect to end users, and an even bigger amount handed to Time Warner Cable (or Comcast if the state approves a merger with Time Warner Cable) and rural phone companies like Frontier Communications. Much of the money awarded to last mile providers like cable and phone companies will placate those that have stubbornly refused to expand further into rural areas unless taxpayers pick up some of the expense.

“In some of these areas, there’s just not a business case for these [service] providers to build out,” said David Salway, director of the New York State Broadband Program office. “The cost far exceeds what the revenue might be for that area.”

An unintended consequence of the broadband funding effort could be taxpayers subsidizing the establishment of for-profit monopolies in rural corners of the state. Although Salway told Capital NY he wanted to make sure New Yorkers had a choice, he clarified he was referring to a choice in technology, not service providers.

That must come as a relief for Verizon. The state’s largest phone company has petitioned state officials in the past for a gradual mothballing of New York’s rural landline network in favor of switching customers to wireless voice and broadband over Verizon’s cellular network. Theoretically, taxpayers could end up subsidizing the demise of rural New York landlines and DSL if Verizon seeks money from the rural broadband fund to expand its wireless tower network in rural New York. Time Warner Cable almost certainly will also seek more funding, probably in excess of the average $1,264 paid to the cable company for each of the 4,114 additional connections it agreed to complete during an earlier round of funding.

That must come as a relief for Verizon. The state’s largest phone company has petitioned state officials in the past for a gradual mothballing of New York’s rural landline network in favor of switching customers to wireless voice and broadband over Verizon’s cellular network. Theoretically, taxpayers could end up subsidizing the demise of rural New York landlines and DSL if Verizon seeks money from the rural broadband fund to expand its wireless tower network in rural New York. Time Warner Cable almost certainly will also seek more funding, probably in excess of the average $1,264 paid to the cable company for each of the 4,114 additional connections it agreed to complete during an earlier round of funding.

While rural broadband remains an important issue in New York, the merger of Comcast and Time Warner Cable is on the front burner and Salway, like the governor, had little to say. But Salway did offer that he did not believe the merger “would reduce [access] as much as further our goal” for expansion.

Guidelines for grant recipients are expected to become available just after the governor’s State of the State presentation in January, with ground-breaking on projects likely to start by mid-summer of 2015.

Subscribe

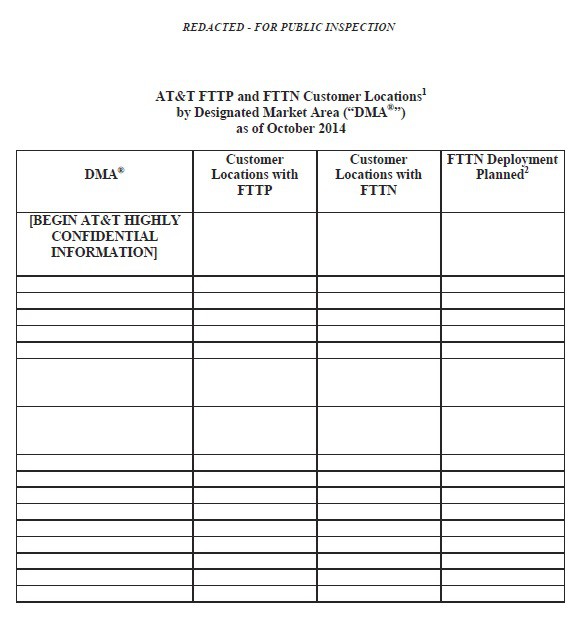

Subscribe AT&T CEO Randall Stephenson’s public hissy fit against the Obama Administration’s sudden backbone on Net Neutrality may complicate AT&T’s plans to win approval of its merger with DirecTV. forcing AT&T to retract threats to suspend fiber buildouts if the administration moves forward with its efforts to ban Internet fast lanes.

AT&T CEO Randall Stephenson’s public hissy fit against the Obama Administration’s sudden backbone on Net Neutrality may complicate AT&T’s plans to win approval of its merger with DirecTV. forcing AT&T to retract threats to suspend fiber buildouts if the administration moves forward with its efforts to ban Internet fast lanes.

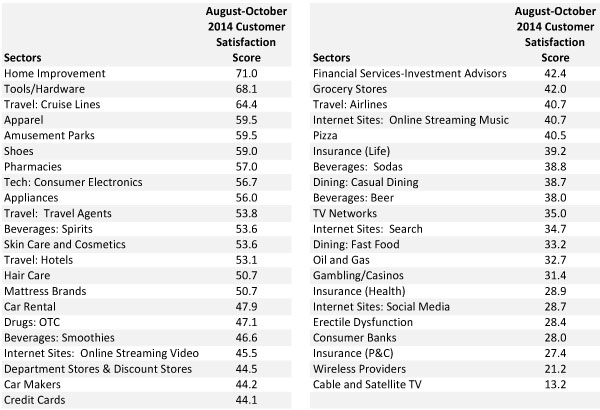

Americans would rather deal with unwanted telemarketing calls, fight their insurance company, or pay top dollar for oil and gas because almost anything is better than dealing with the cable company, if it happens to be named Comcast, Time Warner Cable, or Charter.

Americans would rather deal with unwanted telemarketing calls, fight their insurance company, or pay top dollar for oil and gas because almost anything is better than dealing with the cable company, if it happens to be named Comcast, Time Warner Cable, or Charter.

“That to me stands out as a major event over the last few months that has damaged the brand and category perception,” Fraenkel

“That to me stands out as a major event over the last few months that has damaged the brand and category perception,” Fraenkel