Qwest, born from a merger between US West and Qwest Communications is up for sale. Again. Actually, analysts are wondering exactly when Qwest wasn’t for sale over the last several years. Like that odd house on the corner of your street that nobody wants to buy, Qwest keeps lowering its asking price, hoping would-be suitors will stop driving past.

Qwest, born from a merger between US West and Qwest Communications is up for sale. Again. Actually, analysts are wondering exactly when Qwest wasn’t for sale over the last several years. Like that odd house on the corner of your street that nobody wants to buy, Qwest keeps lowering its asking price, hoping would-be suitors will stop driving past.

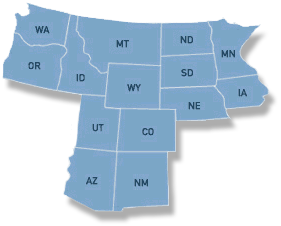

Qwest has a lot going against it. Unlike its bigger cousin Baby Bells, mostly absorbed into the AT&T or Verizon Continuum, Qwest is saddled with a service area that often spells r-u-r-a-l. The company got the short end of the stick when the Bell System was carved up in the mid-1980s, stuck with Arizona, Colorado, Idaho, Iowa, Minnesota, Montana, Nebraska, New Mexico, North Dakota, Oregon, South Dakota, Utah, Washington, and Wyoming. That’s a service territory shaped like a “T” which spells “trouble.” Outside of a few major cities like Phoenix, Denver, Minneapolis-St. Paul, Salt Lake City, and Seattle, the rest of Qwest Country is desert, ranch land, mountain ranges, farms, prairies, and some nice lakes and rivers.

While a great place to vacation, these spectacular landscapes are not what investors are looking for when considering what to do with a 100-year old copper wire telephone system. Qwest never even managed to launch its own cell phone service, instead relying on reselling Verizon Wireless to interested customers. Its foray into the cable TV business also flopped, and the company currently resells satellite TV service to customers.

The company was plagued with insider trading and other allegations of financial irregularities in the mid-2000s, and since 2005 has been rumored to be on the sales block.

The asking price keeps dropping, along with the company’s value. Originally worth $45 billion dollars ten years ago, Qwest can’t attract buyers even at half the price.

Customers aren’t very impressed either. In Lake County, Minnesota, the local newspaper printed a damning editorial Thursday accusing the company of being a villainous, untrustworthy liar after phone service went out for virtually the entire North Shore of Minnesota:

We’d like to have a villain in this story, but, so far, that character sketch is thin. Qwest is fitting the bill if you like obsequiousness on par with cigarette or multinational food companies.

Qwest touted the promise of high-tech 911 service, fast internet, a better connected North Shore. They’ve turned out to be good at promises but lousy on delivery when things go wrong.

Most people heard “All circuits are busy, please try your call again later” on their phones Tuesday. For more than a week, we’ve heard the same line from Qwest regarding what happened in Duluth and why there wasn’t a reroute up the Shore.

You can’t help becoming wary about how our technological infrastructure works after such failure Tuesday. Everyone was surprised to know that when fiber optic goes, so do cell phones. It was even more surprising to know that there was no detour for the line up the Shore. But that wasn’t technological indifference. That was a trust we put in Qwest.

[…]

It’s different when Qwest lies about why its line failed and we find out its assurance about a reroute was pure fantasy. There ends any trust or understanding to calmly wait out its line failures.

With Qwest, everything has been below the ground, literally and figuratively. It’s answer that repairing fiber optic is “difficult,” the empty promise of rerouting, and the lack of explanation of the real cause of the damage in Duluth, are all unacceptable.

It’s as if Qwest prefers a cloak of mystery about its technology and we should be happy to have it at all. That’s a poisoned relationship to have with fiber optic as it becomes ubiquitous in our lives.

Qwest, tell us what really happened under that street in Duluth, and, if it was the result of your own negligence, own up to it. Tell us why you told customers, including agencies responsible for public safety, you had a plan, a reroute in the case of a line break, but really didn’t.

And tell us why we should trust you again with this vital link to safety, health, and business along the North Shore.

While plots can be richer for their villains, we’d rather not have one in this story.

Ouch.

The Wall Street Mergers & Acquisition-vultures are circling over the company again, raising the stakes that Qwest is once again the common-sense choice for a takeover. But even they realize nobody may want the entire company, saddled with rural states’ phone customers over an aging network that will cost billions to upgrade. So the next best thing is to carve up the profitable bits and sell those to the highest bidder. Companies like AT&T, Verizon, and BellSouth could do well serving the major population centers in Qwest’s territory, leaving folks in states like Wyoming, Idaho, Montana and the Dakotas to their choice of likely “rural telco” suitors: CenturyLink, Frontier Communications, or Windstream. Qwest’s valued fiber optic network could fetch a billion or more on the open market. Their data centers could manage another cool billion if sold.

As Qwest’s revenue continues to decline, the company is likely going to continue cutting costs, keeping themselves as attractive as possible to would-be suitors.

“It gets harder and harder to keep cutting costs,” Donna Jaegers, an analyst with D.A. Davidson & Co. told the Denver Post. “As (former WorldCom chief executive) Bernie Ebbers used to say, ‘There’s no more lemon juice left in that lemon.’ ”

Just ask customers on the North Shore of Minnesota, as they sip Qwest’s bitter lemonade.

Subscribe

Subscribe