Gerald Levin, the former CEO of Time Warner, who presided over the company’s disastrous merger with the AOL online service confessed “I presided over the worst deal of the century, apparently.”

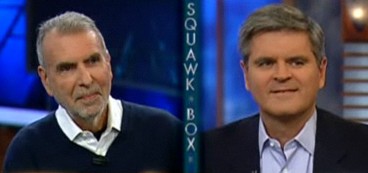

Appearing Monday on CNBC with Steve Case, former head of AOL, the two lamented the blockbuster wealth destruction vehicle on its 10th anniversary.

“I’m really very sorry about the pain and suffering and loss that was caused. I take responsibility,” Levin said. “It wasn’t the board. It wasn’t my colleagues at Time Warner. It wasn’t the bankers and lawyers.”

“It’s a little hard to exercise compassion, connection, and love when the market is very unforgiving,” Levin added.

The striking admission that a corporate master of the universe exercised flawed judgment was rare enough, but to apologize for it is near unprecedented.

The Times-Online called it “a tad late,” coming a decade after the deal, noting the deal was only made possible because of the Dot.com Boom launching AOL stock value into the stratosphere.

“In the US, there have been no apologies from the chief executives who steered Wall Street banks on to the rocks, notably Dick Fuld of Lehman Brothers. Given he is likely to spend the rest of his life defending legal actions, that is hardly surprising,” the newspaper adds.

The Financial Times notes corporate apologies come with some rules of etiquette:

There are – rightly – limits on what responsibility a business can accept until it has talked to its lawyers. Executives whose contrite words turn out to contain too great an admission of liability may soon end up apologising all over again.

But there are a few straightforward rules for an effective corporate apology, and the first one is to keep it simple. Expressions of penitence that come with explanations of how the event was not a total catastrophe or was partly someone else’s fault lose their impact. Equally, a statement that equivocates on the extent of remorse will fail to convince. The apology must also be clearly directed at those adversely affected by what has happened, rather than aimed at making those responsible feel better about it.

Mr Levin mixed his belated apology with a call for today’s corporate leaders to accept responsibility for the financial crisis. Though some bank executives have apologised, expressing regret for this crisis is a harder task than it sounds. People can take responsibility only for their own misdeeds, but explaining this may sound weaselly. At the same time, if an angry public favours ritual sacrifice, then other acts to make amends might seem inadequate. So those executives who pull off an effective apology for the crisis deserve our respect – as long as they do not leave it until 2018.

Amusingly, post colossal failure, the two executives have found remarkably similar career paths divorced from the high tech telecommunications market.

Levin runs the California-based new-agey Moonview ‘addiction-rehab-for-the-rich’ Sanctuary, which markets itself as “a place to revel in the wonder of you.” New York Magazine said Levin was pitching “brain painting, equine therapy and soul communion with the dead.”

Moonview’s “comprehensive multi-modal mind, body and spirit assessment creates a customized plan of psychological, spiritual, physical healing and optimal performance.”

It had better. They don’t take health insurance and charge $2,500 for a one-half day and from $5,000 for a full day. Minimum is $15,000. That makes me depressed.

Steve Case founded Revolution, which claims to: “drive transformative change by shifting power to consumers and building significant, category-defining companies in the process. Focusing on multiple market sectors, including Health, Financial Services, Resorts, Living and Digital, Revolution’s mission is to give people better choices, more control and more convenience in the important aspects of their lives.”

Looking through their collection of companies, the middle class need not apply. I especially enjoyed Case’s vision of a getaway with his “Exclusive Resorts” company:

We believe that your Exclusive Resorts membership plan should be designed around your lifestyle, not the other way around.

With Membership Fees starting at $160,000 (75% refundable) and Annual Dues of just under $1,000 per day on all plans, our memberships are designed to be tailored to your individual needs. A wide range of plans from 10 to 60 days of vacation per year and optional features such as priority holiday access ensure that you will find the unique combination that is right for you.

My last vacation getaway was in Calgary and Kananaskis Country in Alberta in 2007. The private chef “at your beck and call” at Exclusive Resorts for them was a trip to Tim Horton’s for me.

But then I didn’t preside over the worst deal of the century, requiring a mind, body and spirit assessment and a getaway to the French Alps.

[flv]http://www.phillipdampier.com/video/CNBC 10 Years After AOL-Time Warner, Gerald Levin Says He’s Sorry 1-4-10.flv[/flv]

Gerald Levin and Steve Case revel in the wonder of their failure 10 years ago merging Time Warner with AOL. (22 minutes)

Subscribe

Subscribe

AOL was the worst. I had a free trial 1 time back in the dial-up days and I couldn’t use another browser without having to leave their browser open because if I closed their browser, it logged me off the Internet. Also, they threw a ton of advertisements at me that I didn’t want to see. Needless to say, I canceled the same day I got the free trail. AOL, good riddance!!

I remember having AOL back in the days when they were still good. They began going down hill a year or two before I first got DSL hooked up.