Many of the same civil rights groups that regularly advocate their support of giant corporate telecom mergers are back once again to show their support for the controversial T-Mobile/Sprint merger. But that support does not come for free.

Many of the same civil rights groups that regularly advocate their support of giant corporate telecom mergers are back once again to show their support for the controversial T-Mobile/Sprint merger. But that support does not come for free.

A “Memorandum of Understanding” (MOU) that includes “philanthropy and community investment” that does not exclude direct financial contributions from the two wireless companies to these civil rights groups is a major part of a new “understanding” announced today between several organizations founded to represent minority interests and T-Mobile and Sprint that the wireless companies hope will deliver an imprimatur for the troubled merger deal with regulators and politicians.

The key items in the MOU:

- Standing up a national diversity and inclusion council comprised of non-employees from diverse groups, including each of the multicultural leadership organizations that are party to the MOU, and other highly esteemed community leaders to facilitate open communication over the development, monitoring, and evaluation of diversity initiatives and to provide advice to the New T-Mobile senior executives.

-

With the help and input of the council, developing and implementing a Diversity Strategic Plan addressing each of the key elements of the MOU and reflecting best practices in the industry.

-

Increasing the diversity of its leadership and workforce at all levels including its Board governance, to reflect the diversity of the communities in which it operates.

-

Making a targeted effort to increase partnerships, business, and procurement activities with diverse business enterprises in a range of categories such as financial and banking services, advertising, legal services and asset sales. New T-Mobile aims to become a member of the Billion Dollar Roundtable by 2025.

-

Expanding wireless offerings to low-income citizens, underserved minority populations and insular and rural areas, and to organizations serving these underserved communities [including] a significant philanthropic investment for institutions serving disadvantaged or underrepresented communities to support tech entrepreneurship and to bridge the gap in literacy.

The groups, most familiar to Stop the Cap! readers that have followed civil rights groups engaged in pay for play advocacy, include:

- National Urban League: A notorious friend of big cable and phone companies, the Urban League is a regular supporter of telecom mergers and opposes net neutrality.

- The League of United Latin American Citizens (LULAC): Brazenly photographs its executive leadership accepting big checks from AT&T and other telecom companies.

- National Action Network: Rev. Al Sharpton’s group loves to support telecom mergers and acquisitions and lobbies to block consumer protection regulation.

- UnidosUS: Receives most of its funding from corporate interests.

- Asian Americans Advancing Justice | AAJC

- OCA – Asian Pacific American Advocates: One of Comcast’s special friends, OCA advocated against new consumer privacy rules two years ago claiming poor people want more intrusive ads.

In a joint statement, the groups urged the FCC to approve the T-Mobile/Sprint merger “so the combined New T-Mobile can definitively launch these enhanced diversity efforts and expansion of service to all communities included in the MOU.”

In a joint statement, the groups urged the FCC to approve the T-Mobile/Sprint merger “so the combined New T-Mobile can definitively launch these enhanced diversity efforts and expansion of service to all communities included in the MOU.”

“T-Mobile is honored to partner with these visionary organizations to create an action plan of this magnitude that includes commitments to diversity and inclusion that are bolder than ever before,” John Legere, CEO of T-Mobile and CEO of New T-Mobile, said in a statement. “With this MOU, we have doubled down on ensuring we represent the communities we serve today and will serve as the New T-Mobile in the future. We are excited for the New T-Mobile to become a reality so we can get to work on delivering these commitments.”

Except in most cases, these kinds of arrangements serve mostly as window dressing, gussying up otherwise nakedly anti-consumer merger deals under the guise of serving minority or disadvantaged interests. Money often quietly flows between the corporate and the non-profit side, usually in the form of donations. Some groups may also offer token advisory board positions to executives, which usually cements an ongoing advocacy relationship.

Members of these civil rights organizations have a right to be puzzled why such groups are spending significant time and resources engaged in corporate advocacy. The interests of two major corporations cementing a multi-billion dollar merger deal and civil rights groups trying to fight discrimination and improve the lives of their constituents are often tangential, if not in direct opposition to each other. Apparently the money that usually comes with these arrangements matters much more.

Subscribe

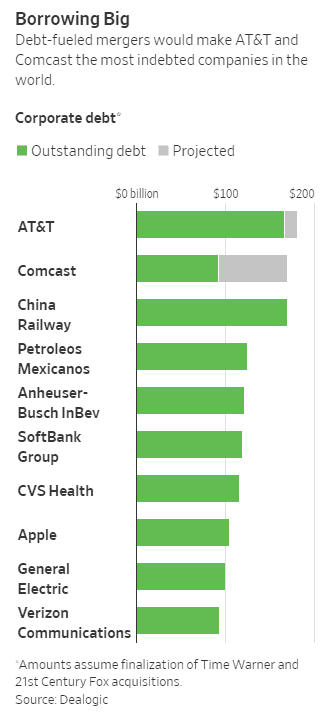

Subscribe If Comcast’s $65 billion all-cash offer for 21st Century Fox is accepted, America’s largest cable operator will also be among the world’s largest corporate debtors, owing $170 billion in all.

If Comcast’s $65 billion all-cash offer for 21st Century Fox is accepted, America’s largest cable operator will also be among the world’s largest corporate debtors, owing $170 billion in all. AT&T and Comcast officials told the Journal any fears are unwarranted; they are different from most companies because their respective debts are expected to be repaid quickly with higher levels of cash generated by their businesses. AT&T claims it could apply the $8-10 billion of its anticipated free cash flow from the merger with Time Warner to reduce debts, although that could threaten shareholder perks like dividend payouts and share buybacks, as well as customer-focused network upgrades.

AT&T and Comcast officials told the Journal any fears are unwarranted; they are different from most companies because their respective debts are expected to be repaid quickly with higher levels of cash generated by their businesses. AT&T claims it could apply the $8-10 billion of its anticipated free cash flow from the merger with Time Warner to reduce debts, although that could threaten shareholder perks like dividend payouts and share buybacks, as well as customer-focused network upgrades. AT&T has won its $85 billion bid to acquire Time Warner, Inc., overturning Justice Department opposition in a court case and completely rejecting allegations the merger was anti-consumer and would raise prices by suppressing competition. The favorable decision is expected to signal the business community the time is right for several more multi-billion dollar media mergers.

AT&T has won its $85 billion bid to acquire Time Warner, Inc., overturning Justice Department opposition in a court case and completely rejecting allegations the merger was anti-consumer and would raise prices by suppressing competition. The favorable decision is expected to signal the business community the time is right for several more multi-billion dollar media mergers.

While giant cable company mergers unexpectedly took a breather in 2017, Fierce Cable predicts this year isn’t likely to be a repeat of last year.

While giant cable company mergers unexpectedly took a breather in 2017, Fierce Cable predicts this year isn’t likely to be a repeat of last year.