The Federal Communications Commission today raised the hurdle for AT&T when it told the wireless company it would consider its proposed acquisition of wireless spectrum from Qualcomm in concert with its application to acquire T-Mobile USA.

The Federal Communications Commission today raised the hurdle for AT&T when it told the wireless company it would consider its proposed acquisition of wireless spectrum from Qualcomm in concert with its application to acquire T-Mobile USA.

The FCC wrote both AT&T and Qualcomm regarding the ongoing review of both transactions:

“The Commission’s ongoing review has confirmed that the proposed transactions raise a number of related issues, including, but not limited to, questions regarding AT&T’s aggregation of spectrum throughout the nation, particularly in overlapping areas. As a result, we have concluded that the best way to determine whether either or both of the proposed transactions serve the public interest is to consider them in a coordinated manner at this time.”

AT&T Donates $9,000 to the United Way of Northwest Florida, which promptly returns the favor with a nice letter to the FCC supporting the telecom company's agenda.

At issue is whether AT&T is warehousing wireless spectrum it actually has little intention to use and whether or not AT&T is being honest when it suggests it needs to acquire T-Mobile USA to expand the number of frequencies open for its growing wireless network.

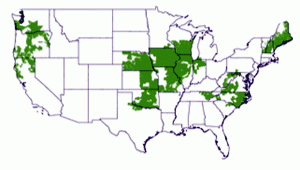

Critics of the merger claim AT&T has plenty of unused spectrum available to deliver service, particularly in the rural areas AT&T claims T-Mobile can help it serve. T-Mobile is not well-known for its service in smaller communities and rural areas, preferring to rely on roaming agreements to achieve national coverage. With its proposed acquisition of valuable spectrum in the 700MHz range from Qualcomm, excellent for penetrating buildings and delivering reliable service, the FCC may be wondering if the proposed merger with T-Mobile is necessary at all.

Gigi Sohn from Public Knowledge doesn’t think so.

“We are pleased that the Commission has decided to consider AT&T’s purchase of Qualcomm spectrum in the context of AT&T’s takeover of T-Mobile. It doesn’t matter whether both transactions are in the same docket; the fact that the Bureau will consider them together in any manner is a strong statement,” Sohn said.

“This April, several public interest groups, Consumers Union, Free Press, the Media Access Project, Public Knowledge, and the New America Foundation, asked for the Commission to take that action because we said that both deals together would ‘further empower an already dominant wireless carrier to leverage its control over devices, backhaul, and consumers in ways that stifle competition,” Sohn added. “We look forward to working with the Commission on these issues which are so vital to the economy of this country.”

Companies that have acquired wireless spectrum at government auctions have not always put those frequencies to use. At least one firm warehoused spectrum as an investment tool, earning proceeds reselling it to other providers. Others have simply squatted on their spectrum, sometimes to keep it away from would-be competitors.

Of course, considering AT&T is a master of dollar-a-holler astroturf operations and lobbying, it’s only a matter of time before a renewed blizzard of company-ghost-written letters start arriving at the Commission telling them AT&T needs both the Qualcomm spectrum -and- the merger with T-Mobile.

Groups like the NAACP, United Way of Northwest Florida, the National Puerto Rican Coalition, and the U.S. Cattlemen’s Association ought to know, right?

Thanks to Stop the Cap! reader Bones for alerting us.

Subscribe

Subscribe