All of these media and content companies may be up for grabs.

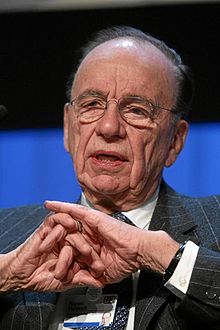

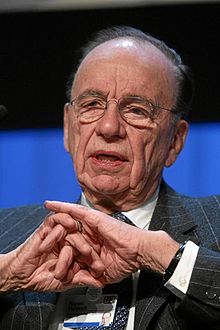

Could Rupert Murdoch become the next owner of CNN? Will Verizon consider buying out the owner of more than a dozen cable networks, or the Walt Disney Company, owner of ABC?

Since 1983, media moguls have assembled annually in posh Sun Valley, Idaho to talk business. But never have they met while several huge consolidation and merger deals are on the table among their colleagues. Comcast acquiring Time Warner Cable and AT&T buying out DirecTV are both seen as game-changers among Wall Street bankers and the media elite, leaving many self-consciously pondering whether they are no longer big enough to stay competitive in a consolidated media world.

The Wall Street Journal and the Atlanta Journal-Constitution both report that at least one huge merger deal could emerge as a result of this week’s conference. Among the most likely buyers is FOX CEO Rupert Murdoch, who is reportedly looking to buy a major content company.

The most likely target is Time Warner (Entertainment), former owner of Time Warner Cable. After spinning off its money-losing magazine unit, TW has become much more focused on content and distribution – exactly what Murdoch is looking for. Time Warner owns New Line Cinema, HBO, Turner Broadcasting System, The CW Television Network, Warner Bros., Kids’ WB, Cartoon Network, Boomerang, Adult Swim, CNN, DC Comics, Warner Bros. Animation, Cartoon Network Studios, Hanna-Barbera, MLB Network and Castle Rock Entertainment. In fact, altogether the company owns or controls dozens of television channels which could all soon fall into the hands of Murdoch.

A Murdoch acquisition would be the last death-blow for Ted Turner’s Turner Broadcasting System, which launched CNN, TBS, and TNT and is now a division within Time Warner. Murdoch’s Fox News Channel was launched as a conservative alternative to CNN’s perceived left-leaning reporting. A Murdoch buyout would either deliver bipartisan profits to the media mogul or allow him to shut down the network or relaunch it under the Fox News brand.

Such an acquisition would not be cheap. Time Warner is worth as estimated $62 billion.

A Murdoch buyout would be especially troublesome for those already upset with corporate media consolidation. Murdoch would end up controlling three major U.S. networks – FOX, CW, and MyNetworkTV, multiple cable news channels, dozens of local television stations in major media markets, and more cable networks than most people can count. In fact, the assembled list of Murdoch-owned media properties is enormous:

Murdoch: The next owner of CNN?

Adult Swim, Boomerang, Cartoon Network, CNN Worldwide, HLN, Inside CNN Tour & Store, TBS, TCM, TheSmokingGun.com, TNT, truTV, Turner Sports, Fox Business Network, Fox News, Star India, YES Network, Twentieth Century Fox, Fox 2000 Pictures, Fox Searchlight Pictures, Fox International Productions, Twentieth Century Fox Television, Fox Home Entertainment, Shine Group, Twentieth Century Fox Animation, The Sun, The Times, The Sunday Times, Times Literary Supplement, The Wall Street Journal, The New York Post, The Australian, The Daily Telegraph (Australia), The Sunday Telegraph (Australia), The Herald Sun, The Sunday Herald Sun, The Courier Mail, The Sunday Mail, The Advertiser, NT News, The Sunday Territorian, The Sunday Times (Australia), The Sunday Tasmanian, Mercury, Warner Bros. Pictures, Warner Bros. Pictures International, New Line Cinema, Warner Home Video, Warner Bros. Advanced Digital Services, Warner Bros. Interactive Entertainment, Warner Bros. Technical Operations, Warner Bros. Anti-Piracy Operations, Warner Bros. Television Group, Warner Bros. Television, Telepictures Productions, Warner Horizon Television, Warner Bros. Animation, Warner Bros. Domestic Television Distribution, Warner Bros. International Television Distribution, Warner Bros. International Television Production, Warner Bros. International Branded Services, Studio 2.0, The CW Television Network, DC Entertainment, Warner Bros. Theatre Ventures, HarperCollins General Books Group, HarperCollins Children’s Books Group, HarperCollins Christian Publishers, HarperCollins UK, HarperCollins Canada, HarperCollins Australia/New Zealand, HarperCollins India, FX, FXX, FXM, National Geographic Channel, Nat Geo WILD, Nat Geo Mundo, FSN, FOX Sports 1, FOX Sports 2, FOX Soccer Plus, FOX College Sports, FOX Deportes, FOX Life, Baby TV, Fox Broadcasting Company, Sky 1, Sky Atlantic, Sky Living, Sky Arts, Sky Sports, Sky Movies, Sky News, Sky Deutschland, Sky Italia, MyNetworkTV, MundoFox, FOX International Channels, Fox Sports Enterprises, HBO, HBO On Demand, HBO GO, Cinemax, Cinemax on Demand, MAX GO, HBO2, HBO Signature, HBO Family, HBO Comedy, HBO Zone, HBO Latino, More Max, Action Max, Thriller Max, 5 Star Max, Max Latino, Outer Max, Movie Max, Barron’s, MarketWatch, Factiva, Dow Jones Risk & Compliance, Dow Jones VentureSource, All Things Digital, Amplify, News America Marketing, and Storyful.

Murdoch has already shown a willingness to spend big. He has recently taken an ownership interest in the up and coming Vice Media, popular with the under 30-viewing crowd. He also spent $415 million to buy romance novel publisher Harlequin Enterprises.

But Murdoch may not be the only one shopping for a deal. The Wall Street Journal offered a shopping list:

- Small cable network owners: Nobody just owns three or four cable networks these days. Content conglomerates like CBS, Disney, Time Warner and Comcast own 15, 30, or even 40 different channels. Smaller players are ripe for the picking. Chief among them include Scripps Networks Interactive (Food Network, HGTV), AMC Networks (AMC, IFC, Sundance), and Crown Media (Hallmark).

- Small studios: Owning a small Hollywood studio is quaint, but Wall Street investment bankers think the time is long past to sell out to larger corporate entities who can better leverage distribution of their releases, easy enough if you own your own theater chain, pay cable network, broadcast stations, and basic cable outlets.

Both phone companies are attending Sun Valley for the first time.

In addition to buyout offers from the largest networks around, Discovery Networks is also in the mood to grow larger at the urging of its board of directors, which includes Dr. John Malone, CEO of Liberty Global. Malone is behind much of the cheerleading to consolidate the cable industry and helped spark the Comcast-Time Warner Cable deal when his partly owned Charter Communications sought a takeover of Time Warner Cable itself.

Wall Street bankers love even better the idea of selling Discovery to a new owner – Disney.

For the first time, phone companies AT&T and Verizon are also in attendance at Sun Valley, and analysts don’t believe the CEOs are there for summer vacation.

Jimmy Schaeffler, chairman of media and telecom consulting firm Carmel Group, says Verizon has been most lacking in the content ownership department and “needs something else right now” as rivals bulk up. AT&T’s acquisition of DirecTV only underlines that sentiment among many Wall Street analysts who think Time Warner (Entertainment) could be an option if Verizon isn’t outbid by Murdoch.

All of this shopping has caused alarm for some, including CNN’s media reporter Brian Stelter who declared, “I will eat my remote control … in fact, I will eat my copy of the New York Post … if Murdoch becomes the owner of CNN.”

[flv]http://www.phillipdampier.com/video/WSJ Digits Media Consolidation 7-7-14.flv[/flv]

The Wall Street Journal’s ‘Digits’ explores the ongoing consolidation of media creators and distributors. This year’s media conference in Sun Valley could spark more merger deals. (5:02)

Subscribe

Subscribe Independent television in Great Britain

Independent television in Great Britain  John Malone’s Liberty Global is seen as a leading contender, already owning a 6.4% stake in ITV acquired from BSkyB for $824 million. Liberty Global and Discovery Networks have maintained close association and jointly bid $930 million to acquire All3Media, the production arm of reality shows like “Undercover Boss.”

John Malone’s Liberty Global is seen as a leading contender, already owning a 6.4% stake in ITV acquired from BSkyB for $824 million. Liberty Global and Discovery Networks have maintained close association and jointly bid $930 million to acquire All3Media, the production arm of reality shows like “Undercover Boss.” Although Charter Communications did not succeed in its bid to assume control of Time Warner Cable, it isn’t crying about its loss to Comcast either.

Although Charter Communications did not succeed in its bid to assume control of Time Warner Cable, it isn’t crying about its loss to Comcast either.