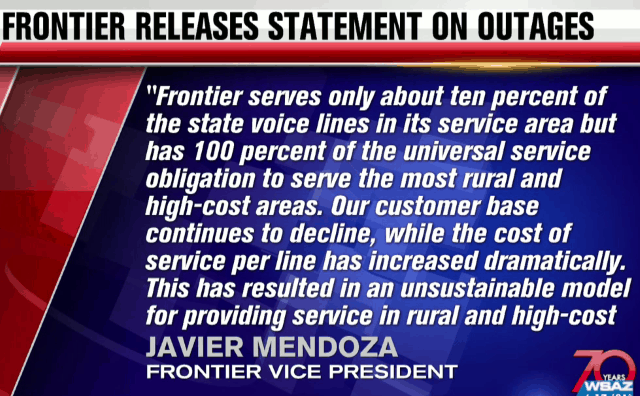

Frontier Communications has publicly admitted its residential telephone service in rural and “high-cost” service areas is “unsustainable,” resulting in an increasing number of lengthy service outages and unreliable service.

Frontier Communications has publicly admitted its residential telephone service in rural and “high-cost” service areas is “unsustainable,” resulting in an increasing number of lengthy service outages and unreliable service.

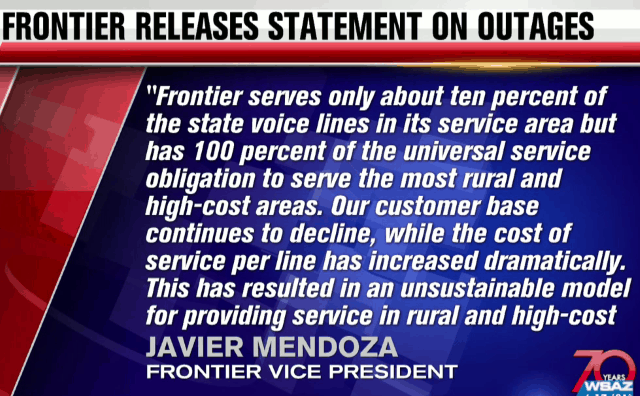

Javier Mendoza, vice president of Frontier Communications, made the admission in response to a growing chorus of complaints about rapidly deteriorating landline service in the state of West Virginia. Service has gotten so bad it prompted the senior senator from West Virginia to complain directly to Frontier CEO Dan McCarthy.

“In times of crisis, no one should ever have to think twice about whether he or she will be able to call for help,” Sen. Joe Manchin (D-W.V.) wrote in a letter directed to McCarthy. “Unfortunately, I have been alerted of several instances where my constituents who utilize Frontier’s landline service have not been able to complete calls due to service outages.”

The West Virginia Public Service Commission is currently auditing Frontier’s operations in the state after seeing “a large increase” in complaints about Frontier’s service. Frontier has been the state’s largest telecom company since 2010, when it acquired Verizon’s wireline network in West Virginia.

According to some customers, service has been going downhill ever since.

“I don’t always depend on it to work because I know it is probably not going to do that,” Frontier customer Lawrence Gray told WSAZ-TV. “So it used to be a real shock when you picked it up and it didn’t work. The other day when I picked it up and you couldn’t get a dial tone, I was like well here we are again. It is the way it is.”

Frontier is the dominant phone company in West Virginia.

Lawrence’s wife Patrecia notes they are both in their 70s and are anxious about being able to reach 911 in an emergency. Frontier has experienced several 911 outages in West Virginia as well.

“If we ever want to call 911 and it is not working, what do you do because we have no call phone service here,” Patrecia said.

The Gray family reports that it typically takes Frontier five to seven days to restore their phone service after an outage. That is unacceptable to Sen. Manchin.

“The safety of my constituents is my highest priority and the fact that so many of them are unable to do something as basic as calling 911 for assistance is unacceptable,” Manchin wrote Frontier. “Access to phone service is not a luxury; it is a critical lifeline that could mean the difference between life and death and I implore you to resolve this problem within your company immediately.”

Frontier’s response, through Mendoza, is to blame the situation on the unprofitability of Frontier’s landline network in rural West Virginia, after choosing to buy it nine years ago.

“Frontier serves only about ten percent of the state voice lines in its service area—and falling—but has 100 percent of the universal service obligation to serve the most rural and high-cost areas,” Mendoza said in a statement. “Our customer base continues to decline, while the cost of service per line has increased dramatically. This has resulted in an unsustainable model for providing service in rural and high-cost areas, manifesting in increased numbers of service complaints. We plan to reach out to the state’s leaders to collaboratively find solutions to this difficult challenge.”

Those challenges may be more difficult than imagined, considering the frequent complaints received by the Public Service Commission about the ongoing service problems experienced by customers.

Doug and Patricia Stowers represent a case in point. The Stowers family lives in Griffithsville, an unincorporated community in eastern Lincoln County. The nearest cell phone coverage in this part of West Virginia is a 14-mile drive into the town of West Hamlin. A landline is essential in Griffithsville and many other parts of West Virginia where cell service is spotty at best. The only choice of provider is often Frontier Communications.

This branch was left hanging on Frontier’s phone line… after a service call reporting branches on Frontier’s cable was finished. (Image courtesy of the Stowers family)

The Stowers family installed their landline in 2012. A single Frontier technician laid nearly one-quarter of a mile of phone cable, sections of which were laid on the ground next to the roadway.

“Since 2012, coverage has been sporadic. It took us a few service interruptions before we noticed a connection of when the county mowed [along the roadway] and the phone going out,” wrote Patricia Stowers. “When we found a long section of main line had been laid along the edge of the road, we walked the road, and made sure the line was thrown over edge out of the reach of the mowers.”

That is where Frontier’s phone cable stayed, for years. In areas where the phone cable was hung above ground, tree limbs and brush often cover the line, even after Frontier dispatches repair crews to address the latest service outage. At one point, the family discovered parts of their phone cable were now exposed to the core. A Frontier technician temporarily “patched” the cable and then placed it back on the ground, this time at the bottom of a dry creek bed.

When the family reports service outages to Frontier, having patience is a virtue.

“When we call for repairs, we are scheduled three to seven days out. To me this is unacceptable,” writes Patricia. “If we had a choice, trust me, we would not have phone service from Frontier, however, we are at their mercy.”

An attorney for Frontier Communications in Charleston disputed parts of the Stowers family complaint, noting that each time the family reported an outage, the company dispatched a technician to repair the trouble and the family was given credit on their bill.

The attorney also noted that the service address in question was a “weekend/vacation residence.” The cable lying in the creek bed was “not in service” and was “scheduled to be removed.” Further, despite the Stowers’ claims that branches were left laying on their phone line, the attorney claimed Frontier found only “a small branch lying on the 2-pair cable servicing the weekend/vacation residence” and it would be removed “with a pole saw.”

Frontier routinely responds to service complaints filed with the PSC with this declaration:

Pending final resolution and dismissal of this matter, Frontier respectfully reserves all defenses and objections, including without limitation the right to demand strict proof of each and every allegation of the Complaint not expressly admitted in this Answer.

WSAZ-TV in Huntington, W.V. reports Frontier’s landline service in the state is deteriorating, and Frontier admits its rural phone service is “unsustainable.“ (2:41)

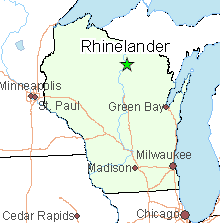

Frontier Communications customers across Rhinelander, Wis. were left without phone and internet service for a day after a construction crew cut fiber optic and copper cables that Frontier earlier promised to move, but never did.

Frontier Communications customers across Rhinelander, Wis. were left without phone and internet service for a day after a construction crew cut fiber optic and copper cables that Frontier earlier promised to move, but never did.

Subscribe

Subscribe Reuters reports AT&T is

Reuters reports AT&T is  The Utah Division of Public Utilities (DPU) has launched

The Utah Division of Public Utilities (DPU) has launched

Frontier Communications has publicly admitted its residential telephone service in rural and “high-cost” service areas is “

Frontier Communications has publicly admitted its residential telephone service in rural and “high-cost” service areas is “

Frontier Communications is

Frontier Communications is