A Florida utility company has told federal regulators it is certain Verizon has a plan to exit its landline and wired broadband businesses within the next ten years to become an all-wireless service provider.

A Florida utility company has told federal regulators it is certain Verizon has a plan to exit its landline and wired broadband businesses within the next ten years to become an all-wireless service provider.

Florida Power & Light argued in a regulatory filing with the Federal Communications Commission it was clear Verizon had plans to exit its wireline business after the phone company suddenly informed regulated utilities like FP&L it no longer seemed interested in fighting over pole attachment fees and pole ownership and use issues. FP&L suggests that is a radical change of heart for a company that has fought tooth and nail over issues like pole attachment fees for years.

“Verizon has made it clear it intends to be out of the wireline business within the next ten years, conveying this clear intent to regulated utilities in negotiations over joint use issues and explaining that Verizon no longer wants to be a pole owner,” FP&L wrote to federal regulators. “Indeed, the current proposed [$10.54 billion sale of Verizon facilities in Florida, Texas and California] proves this point.”

Verizon has fought repeatedly with the Florida power company over the fees it pays FP&L to attach copper and fiber cables to the power company’s poles. Verizon Florida has repeatedly accused FP&L of charging unjust fees and at one point withheld payments to the utility worth millions.

In February, the FCC dismissed Verizon’s complaint for lack of evidence in the first-ever decision in a pole attachment complaint case involving an incumbent telephone company under a joint use agreement with an electric utility. The power company accused Verizon of lying when it promised concrete benefits to consumers if the FCC reduced joint use pole attachment rates. Suddenly, Verizon no longer seems to be interested in the issue.

“Verizon has not increased its efforts to deploy wireline broadband in the last three years; and there is no evidence that Verizon has used the capital saved on joint use rates for the expansion of wireline broadband,” FP&L officials write. “Indeed, all of the evidence shows that Verizon is abandoning its efforts to build out wireline broadband.”

“Verizon has not increased its efforts to deploy wireline broadband in the last three years; and there is no evidence that Verizon has used the capital saved on joint use rates for the expansion of wireline broadband,” FP&L officials write. “Indeed, all of the evidence shows that Verizon is abandoning its efforts to build out wireline broadband.”

The power company is not about to just wave goodbye to Verizon. It filed remarks opposing the sale, claiming the benefits will end up in the pockets of executives and shareholders while customers get little or nothing. FP&L wants the FCC to enforce concrete conditions that guarantee Frontier will invest in upgrades to Verizon’s network, especially in non-FiOS service areas.

FP&L added it supports forward technological progress for the benefit of consumers, but the price of that progress should not be the abandonment of wireline customers, contractual obligations, and past promises to the FCC. The utility wrote it is not opposed to Verizon becoming a fully wireless company, but it should only be allowed to do so after it ensures that “its wireline house is in order.”

As things stand today, the utility argues Verizon is looking to abdicate on its obligation to deliver universal service and is no longer interested in maintaining its wired networks. FP&L points to Verizon’s efforts in 2013 to discard damaged wired facilities in favor of Voice Link, Verizon’s wireless landline replacement, in states including New York, New Jersey, and Florida.

“There should be no doubt that Verizon’s strategy to abandon wireline service in favor of wireless service extends beyond New York and Florida and beyond storm damaged and rural areas,” argues FP&L.

The utility points to Verizon’s successful effort to relieve itself of obligations to build a statewide fiber network in New Jersey that was supposed to be complete by 2010.

“Verizon, quite simply, has failed to build out wireline broadband in New Jersey because Verizon has no interest in doing so,” said FP&L. “As the sale of wireline facilities in Florida, Texas, and California […] clearly demonstrates, Verizon obviously is no longer interested in the wireline broadband business and sees its financial future in the wireless industry.”

Subscribe

Subscribe The two largest telecom companies in Zimbabwe believe broadband access isn’t just an essential utility —

The two largest telecom companies in Zimbabwe believe broadband access isn’t just an essential utility —  At the outset in Victoria Falls, Fibroniks will offer unlimited use packages up to 100Mbps, with a commitment customers can access whatever they want, whenever they want, at a guaranteed fixed monthly price. Liquid Telecom already supplies fiber service in the capital city of Harare, but Tudor believes getting into smaller communities in the country is essential.

At the outset in Victoria Falls, Fibroniks will offer unlimited use packages up to 100Mbps, with a commitment customers can access whatever they want, whenever they want, at a guaranteed fixed monthly price. Liquid Telecom already supplies fiber service in the capital city of Harare, but Tudor believes getting into smaller communities in the country is essential. As a consequence of reclassifying broadband as a utility service to protect Net Neutrality, the FCC may have

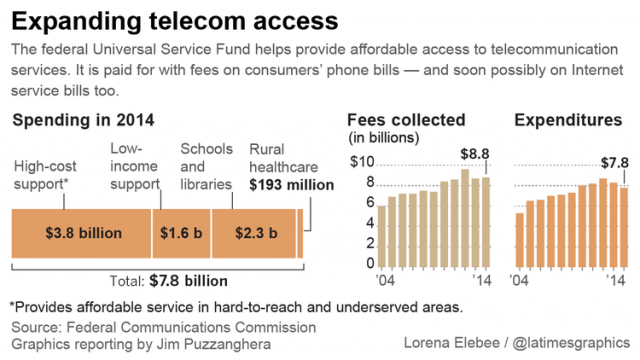

As a consequence of reclassifying broadband as a utility service to protect Net Neutrality, the FCC may have  The fund has increasingly shifted towards Internet connectivity and service, but only telephone customers now pay a USF surcharge on their bill.

The fund has increasingly shifted towards Internet connectivity and service, but only telephone customers now pay a USF surcharge on their bill.

What will happen in Verizon service areas that are not considered priorities?

What will happen in Verizon service areas that are not considered priorities?