Carbon Hill, Ala.

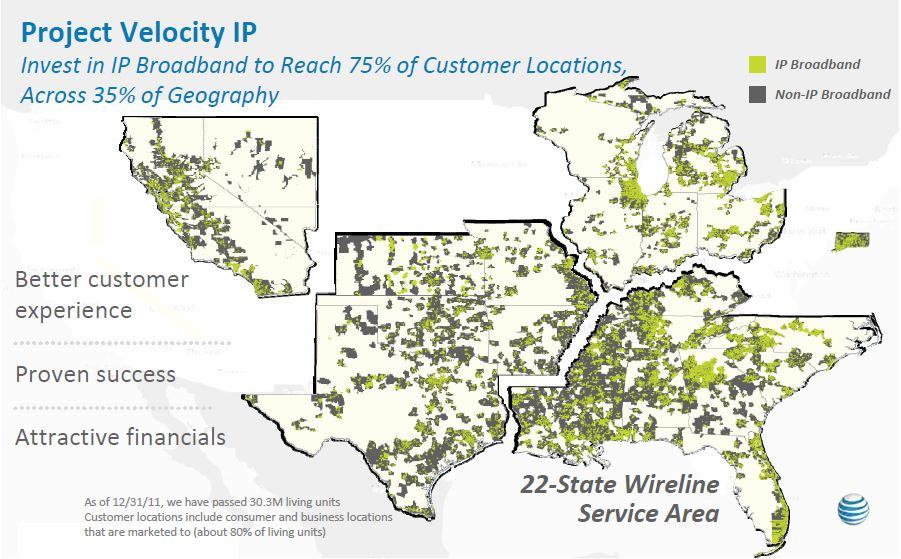

AT&T is seeking permission to disconnect traditional landline service in Alabama and Florida as it plans to abandon its copper wire network and move towards Voice Over IP in urban areas and force customers to use wireless in suburbs and rural communities.

AT&T’s BellSouth holding company has asked the Federal Communications Commission to approve what it calls “an experiment,” beginning in the communities of West Delray Beach, Fla., and Carbon Hill, Ala.

The first phase of the plan would start by asking residents to voluntarily disconnect existing landline service in favor of either U-verse VoIP service or a wireless landline replacement that works with AT&T’s cellular network. In the next phase of the experiment, traditional copper-based landline service would be dropped altogether as AT&T and the FCC study the impact.

“We have proposed conducting the trials in Carbon Hill, Ala., and in West Delray Beach, Fla.,” AT&T writes on the company’s blog. “We chose these locations in an effort to gain insights into some of the more difficult issues that likely will be presented as we transition from legacy networks. For example, the rural and sparsely populated wire center of Carbon Hill poses particularly challenging economic and geographic characteristics. While Kings Point’s suburban location and large population of older Americans poses different but significant challenges as well. The lessons we learn from these trials will play a critical role as we begin this transition in our approximately 4700 wire centers across the country to meet our goal of completing the IP transition by the end of 2020.”

The transition may prove more controversial than AT&T is willing to admit. A similar effort to move landline customers to wireless service was met with strong resistance when Verizon announced it would not repair wired infrastructure on Fire Island, N.Y., damaged by Hurricane Sandy. Hundreds of complaints were registered with the New York Public Service Commission over the poor quality of service residents received with Verizon’s wireless landline replacement. The company eventually abandoned the wireless-only transition and announced it would also offer FiOS fiber optic service to customers seeking a better alternative.

The transition may prove more controversial than AT&T is willing to admit. A similar effort to move landline customers to wireless service was met with strong resistance when Verizon announced it would not repair wired infrastructure on Fire Island, N.Y., damaged by Hurricane Sandy. Hundreds of complaints were registered with the New York Public Service Commission over the poor quality of service residents received with Verizon’s wireless landline replacement. The company eventually abandoned the wireless-only transition and announced it would also offer FiOS fiber optic service to customers seeking a better alternative.

“Be ready, beware,” Jim Rosenthal, a seasonal Fire Island resident, told Bloomberg News when asked what communities need to know about the changes. “Get your ducks in order. Make the alliances. Speak loudly, make sure you’re not roadkill.”

Customers that have already dropped landline service in favor of wireless and do not depend on AT&T for broadband will not notice any changes. Neither will customers subscribed to U-verse phone and broadband service. But those who rely on AT&T DSL are likely to lose their wired broadband service and asked to switch to a very expensive wireless broadband alternative sold by AT&T. That alternative may be their only broadband option if the neighborhood is not serviced by a cable competitor.

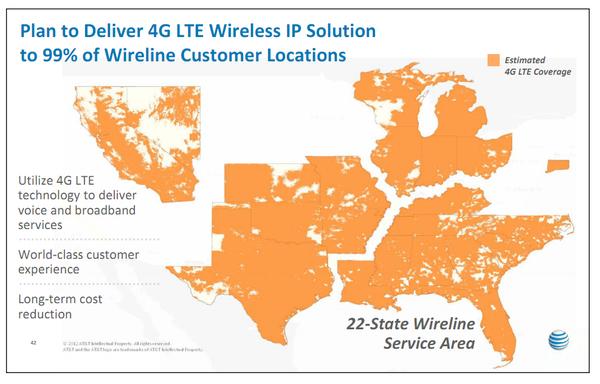

The biggest impact will be in rural Carbon Hill, where 55% of AT&T customers will only be able to get wireless phone and broadband service, according to AT&T documents. At least 4% of local residents will get no service at all from AT&T, because they are outside of AT&T’s wireless coverage area. The phone company has no plans to expand its U-verse deployment in the rural community northwest of Birmingham. In contrast, every customer in West Delray Beach will be offered U-verse service. That means AT&T’s DSL customers will eventually be forced to switch to either U-verse for broadband or a wireless broadband plan that costs $50 a month, limited to 5GB of usage.

AT&T promises the transition will be an upgrade for customers, but that isn’t always true.

AT&T’s wireless home phone replacement is not compatible with fax machines, home or medical monitoring services, credit card machines, IP/PBX phone systems, dial-up Internet, and other data services. AT&T also disclaims any responsibility for mishandled 911 emergency calls that lack accurate location information about a customer in distress. The company also does not guarantee uninterrupted service or coverage.

AT&T chose Carbon Hill, which was originally a coal mining town, because it represents the classic poor, rural community common across AT&T’s service area. At least 21 percent of customers live below the poverty line. Many cannot afford cable service (if available). AT&T selected Alabama and Florida because both states have been friendly to its political agenda, adopting AT&T-sponsored deregulation measures statewide. AT&T was not required to seek permission from either state to begin its transition, and it is unlikely there will be any strong oversight on the state level.

“We looked for places where state law wasn’t going to be an issue, where the regulatory and legal environment in the state was conducive to the transition,” admitted Christopher Heimann, an AT&T attorney, at a briefing announcing the experiment.

Verizon faced a very different regulatory environment in New York, where unhappy Fire Island customers dissatisfied with Verizon’s wireless landline replacement Voice Link found sympathy from Attorney General Eric Schneiderman, who appealed to the state PSC to block the service. Sources told Stop the Cap! the oversight agency was planning to declare the service inadequate, just as Verizon announced it would offer its fiber optic service FiOS as an alternative option on the island.

Voice Link sparked complaints over dropped calls, poor sound quality, inadequate reception, and inadequacy for use with data services of all kinds. Customers were also upset Verizon’s service would not work as well in the event of a power interruption and the company disclaimed responsibility for assured access to 911.

Carbon Hill, Ala.

Although millions of Americans have disconnected landline telephone service in favor of wireless alternatives, traditional landlines are still commonly used in businesses and by poor and elderly customers. Many medical and security monitoring services also require landlines.

The loss of AT&T’s wired network could also mean no affordable broadband future for rural residents — wireless broadband is typically much more expensive. AT&T admits it will not guarantee DSL customers they will be able to keep wired broadband after the transition.

AT&T will “do our very best” to provide Internet-based services in trial areas, Bob Quinn, senior vice president for federal regulatory matters, said in a 2012 blog post proposing the trials.

“For those few we cannot reach with a broadband service, whether wireline or wireless, they will still be able to keep voice service,” Quinn said. “We are very cognizant that no one should be left behind in this transition.”

AT&T is likely to be the biggest winner if it successfully scraps its copper network. The company wants to drop landline service completely by 2020, saving the company millions while ending government oversight and eliminating service obligations.

“It’s a big darn deal,” said AT&T CEO Randall Stephenson. “The amount of cost that it removes from our legacy businesses is dramatic and it’s significant.”

[flv]http://www.phillipdampier.com/video/ATT The Next Generation IP Network 2-21-14.mp4[/flv]

An AT&T-produced video showing a sunny future with IP-based phone service. But the future may not be so great for AT&T’s rural DSL customers. (1:31)

Subscribe

Subscribe

This year, AT&T apparently conceded it was just too tough to convince the legislature to let them disconnect hundreds of thousands of rural Kentucky phone customers at the company’s pleasure, so this time they have permitted rural wired service to continue, with some exceptions that make life easier for AT&T.

This year, AT&T apparently conceded it was just too tough to convince the legislature to let them disconnect hundreds of thousands of rural Kentucky phone customers at the company’s pleasure, so this time they have permitted rural wired service to continue, with some exceptions that make life easier for AT&T.

AT&T’s investment in U-verse expansion is expected to peak this year as part of its “Project VIP” effort to bring the fiber to the neighborhood service to more areas and offer faster broadband speeds to current customers.

AT&T’s investment in U-verse expansion is expected to peak this year as part of its “Project VIP” effort to bring the fiber to the neighborhood service to more areas and offer faster broadband speeds to current customers.

Verizon FiOS expansion is still dead while cash cow Verizon Wireless will continue to get the bulk of Verizon’s attention this year, according to a top executive.

Verizon FiOS expansion is still dead while cash cow Verizon Wireless will continue to get the bulk of Verizon’s attention this year, according to a top executive. Again this year, Verizon Wireless will get the bulk of Verizon’s attention and financial resources. Verizon Wireless finished 2013 with $81 billion in wireless revenue — up $5.2 billion from 2012 — which represents two-thirds of Verizon’s total earnings. The wireless business has delivered a profit margin of 49% or higher for five of the last seven quarters.

Again this year, Verizon Wireless will get the bulk of Verizon’s attention and financial resources. Verizon Wireless finished 2013 with $81 billion in wireless revenue — up $5.2 billion from 2012 — which represents two-thirds of Verizon’s total earnings. The wireless business has delivered a profit margin of 49% or higher for five of the last seven quarters.

Stop the Cap! reader Steve L. has heard enough of AT&T’s promises that deregulation would bring more competition and better deals to Californians.

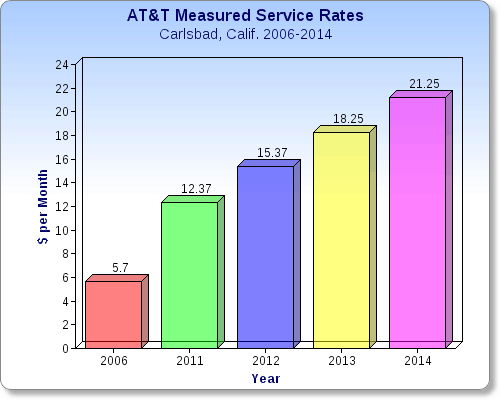

Stop the Cap! reader Steve L. has heard enough of AT&T’s promises that deregulation would bring more competition and better deals to Californians. “After surcharges, fees, and taxes, my bill will be nearly $30 per month for measured rate service, representing a near doubling of cost in just a 22-month period,” Steve writes. “I have no other choice than AT&T for a true powered landline, but I am rejecting this latest increase and plan to test and move to a VoIP system.”

“After surcharges, fees, and taxes, my bill will be nearly $30 per month for measured rate service, representing a near doubling of cost in just a 22-month period,” Steve writes. “I have no other choice than AT&T for a true powered landline, but I am rejecting this latest increase and plan to test and move to a VoIP system.” AT&T’s rates have shot up as much as 222 percent for the average Californian’s measured rate phone service. Some customers, including our reader, found rates nearly three times higher than they were before deregulation. In the last few years, AT&T has increased prices on landline service and calling features even more dramatically across the state:

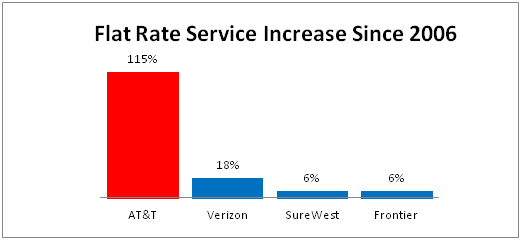

AT&T’s rates have shot up as much as 222 percent for the average Californian’s measured rate phone service. Some customers, including our reader, found rates nearly three times higher than they were before deregulation. In the last few years, AT&T has increased prices on landline service and calling features even more dramatically across the state: AT&T defends the increases by suggesting rates were artificially restrained by rate regulators under the old system, and the new higher prices reflect economic reality and the deregulated marketplace. But AT&T’s rate increases have blown past other service providers in the state. Verizon’s flat rate service only increased 18 percent since deregulation. Independent providers SureWest and Frontier Communications have only raised prices by about six percent.

AT&T defends the increases by suggesting rates were artificially restrained by rate regulators under the old system, and the new higher prices reflect economic reality and the deregulated marketplace. But AT&T’s rate increases have blown past other service providers in the state. Verizon’s flat rate service only increased 18 percent since deregulation. Independent providers SureWest and Frontier Communications have only raised prices by about six percent.