Cable operators and publicly owned utilities in Tennessee are battling for control over the prices companies pay to use utility poles, with facts among the early casualties.

Cable operators and publicly owned utilities in Tennessee are battling for control over the prices companies pay to use utility poles, with facts among the early casualties.

The subject of “pole attachment fees” has been of interest to cable companies for decades. In return for permission to hang cable wires on existing electric or telephone poles owned by utility companies, cable operators are asked to contribute towards their upkeep and eventual replacement. Cable operators want the fees to be as low as possible, while utility companies have sought leeway to defray rising utility pole costs and deal with ongoing wear and tear.

Little progress has been made in efforts to compromise, so this year two competing bills have been introduced by Republicans in the state legislature to define “fairness.” One is promoted by a group of municipal utilities and the other by the cable industry and several corporate-backed, conservative front groups claiming to represent the interests of state taxpayers and consumers.

Some background: Tennessee is unique in the pole attachment fee fight, because privately owned power companies bypassed a lot of the state (and much of the rest of the Tennessee Valley and Appalachian region) during the electrification movement of the early 20th century. Much of Tennessee is served by publicly owned power companies, which also own and maintain a large percentage of utility poles in the state.

Some of Tennessee’s largest telecom companies believe they can guarantee themselves low rates by pitching a case of private companies vs. big government utilities, with local municipalities accused of profiteering from artificially high pole attachment rates. Hoping to capitalize on anti-government sentiment, “small government” conservatives and telecom companies want to tie the hands of the pole owners indefinitely by taking away their right to set pole attachment rates.

The battle includes fact-warped editorials that distort the issues, misleading video ads, and an effort to conflate a utility fee with a tax. With millions at stake from pole attachment fees on tens of thousands of power poles throughout the state, the companies involved have launched a full-scale astroturf assault.

Grover Norquist’s Incendiary “Pole Tax”

Conservative Grover Norquist, president of Americans for Tax Reform wrote that the pole attachment fee legislation promoted by public utilities would represent a $20 million dollar “tax increase” from higher cable and phone bills. Even worse, Norquist says, the new tax will delay telecom companies from rushing new investments on rural broadband.

Norquist

In reality, Americans for Tax Reform should be rebranded Special Interests for Tax Reform, because the group is funded by a variety of large tobacco corporations, former clients of disgraced lobbyist Jack Abramoff, and several wealthy conservative activists with their own foundations.

Norquist’s pole “tax increase” does not exist.

The Federal Communications Commission (FCC) provides guidelines and a formula for determining pole attachment rates for privately owned utilities, but permits states to adopt their own regulations. Municipal utilities are exempted for an important reason — their rates and operations are often already well-regulated.

Stop the Cap! found that pole attachment revenue ends up in the hands of the utility companies that own and keep up the poles, not the government. Municipal utilities stand on their own — revenue earned by a utility stays with the utility. Should a municipal utility attempt to gouge other companies that hang wires on those poles, mechanisms kick in that guarantee it cannot profit from doing so.

A 2007 study by the state government in Tennessee effectively undercut the cable industry’s argument that publicly owned utilities are overcharging cable and phone companies that share space on their poles. The report found that “pole attachment revenues do not increase pole owners’ revenue in the long run.”¹

The Tennessee Valley Authority, which supplies electricity across Tennessee, regularly audits the revenues and costs of its municipal utility distributors and sets end-user rates accordingly. The goal is to guarantee that municipal distributors “break even.” Any new revenue sources, like pole attachment fees, are considered when setting wholesale electric rates. If a municipal utility overcharged for access to its poles, it will ultimately gain nothing because the TVA will set prices that take that revenue into account.

Freedom to Distort: The Cable Lobby’s Astroturf Efforts

Freedom to distort

Another “citizens group” jumping into the battle is called “Freedom to Connect,” actually run by the Tennessee Cable Telecommunications Association (TCTA). Most consumers won’t recognize TCTA as the state cable lobby. Almost all will have forgotten TCTA was the same group that filed a lawsuit to shut down EPB’s Fiber division, which today delivers 1,000Mbps broadband service across the city and competes against cable operators like Comcast and Charter Cable.

One TCTA advertisement claims that some utilities are planning “to double the fees broadband providers pay to the state’s government utilities.”

In reality, cable companies have gone incognito, hiding their identity by rebranding themselves as “broadband providers.” No utility has announced it plans to “double” pole attachment fees either.

TCTA members came under fire at a recent hearing attended by state lawmakers when Rep. Charles Curtiss (D-Sparta) spoke up about irritating robocalls directed at his constituents making similar claims.

“What was said was false,” Curtiss told the cable representatives at the hearing. “You’ve lost your integrity with me. Whoever made up your mind to do that, you’re in the wrong line of work.”

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/TCTA Pole Attachment Fees Ad 3-13.flv[/flv]

TCTA — Tennessee’s cable industry lobbying group, released this distorted advertisement opposing pole attachment fee increases. (1 minute)

The Chattanooga Free-Press’ Drew Johnson: Independent Opinion Page Editor or Well-connected Activist with a Conflict of Interest?

Johnson (Times Free Press)

In its ad campaign, the TCTA gave prominent mention to an article in Chattanooga’s Times-Free Press from Feb. 27: “Bill Harms Consumers, Kills Competition.”

What the advertisement did not say is it originated in an editorial published by Drew Johnson, who serves as the paper’s conservative opinion editor. Johnson has had a bone to pick with Chattanooga’s public utility EPB since it got into the cable television and broadband business.

That may not be surprising, since Johnson is still listed as a “senior fellow” at the “Taxpayers Protection Alliance,” yet another corporate and conservative-backed astroturf group founded by former Texas congressman Dick Armey of FreedomWorks fame.

Johnson’s journalism credentials? He wrote a weekly column for the conservative online screed NewsMax, founded and funded by super-wealthy Richard Mellon Scaife and Christopher Ruddy, both frequent donors to conservative, pro-business causes.

TPA has plenty to hide — particularly the sources of their funding. When asked if private industry backs TPA’s efforts, president David Williams refused to come clean.

“It comes from private sources, and I don’t reveal who my donors are,” he told Environmental Building News in January.

Ironically, Johnson is best known for aggressively using Tennessee’s open records “Sunshine” law to get state employee e-mails and other records looking for conflicts of interest or scandal.

Newspaper readers may want to ask whether Johnson represents the newspaper, an industry-funded sock puppet group, or both. They also deserve full disclosure if the TPA receives any funding from companies that directly compete with EPB.

The Institute from ALEC: The Institute for Policy Innovation’s Innovative Way to Funnel AT&T and Comcast Money Into the Fight

Provider-backed ALEC advocates for the corporate interests that fund its operations.

Another group fighting on the side of the cable and phone companies against municipal utilities is the Institute for Policy Innovation. Policy counsel Bartlett D. Cleland claimed the government is out to get private companies that want space on utility poles.

“The proposed new system in HB1111 and SB1222 is fervently supported by the electric cooperatives and the government-owned utilities for good reason – they are merely seeking a way to use the force of government against their private sector competitors,” Cleland said. “The proposal would allow them to radically raise their rates for pole attachments to multiples of the national average.”

The facts don’t match Cleland’s rhetoric.

In reality, the state of Tennessee found in their report on the matter in 2007 that Tennessee’s pole attachment fees are “not necessarily out of line with those in other states.”²

In fact, some of the state’s telecom companies seemed to agree:

- EMBARQ (now CenturyLink) provided data on fees received from other service providers in Tennessee, Virginia, South and North Carolina. In these data, Tennessee’s rates ($36.02 – $47.41) are similar to those in North Carolina ($23.12-$52.85) and Virginia ($28.94 – $35.77). Rates were lower in South Carolina.

- Cable operators, who have less infrastructure on poles than telephone and electric utilities, paid even less. Time Warner Cable provided mean rates per state showing Tennessee ($7.70) in the middle of the pack compared to Florida ($9.83) and North Carolina ($4.86 – $13.64).

In addition to his role as policy counsel, Cleland also happens to be co-chair of the Telecommunications and Information Technology Task Force of the American Legislative Exchange Council (ALEC). Members of that committee include Comcast and AT&T — Tennessee’s largest telecom companies, both competing with municipal telecommunications providers like EPB.

¹ Analysis of Pole Attachment Rate Issues in Tennessee, State of Tennessee. 2007. p.23

² Analysis of Pole Attachment Rate Issues in Tennessee, State of Tennessee. 2007. p.12

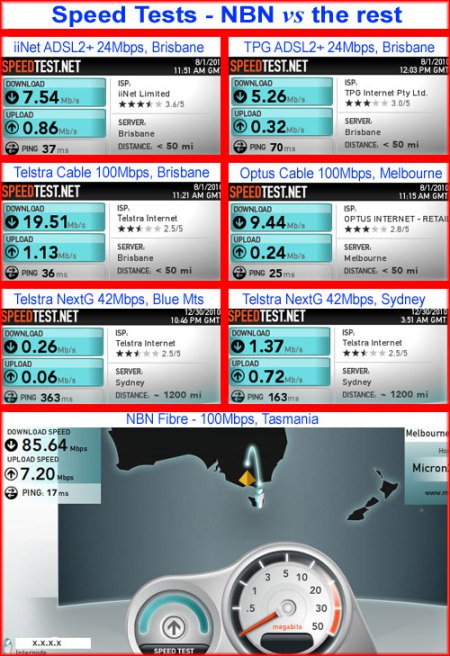

While large private corporations return profits to shareholders and avoid major infrastructure upgrades, publicly owned municipal providers are moving customers to carefully planned and budgeted fiber-to-the-home networks that offer service at speeds AT&T, the state’s largest telecom company, cannot touch.

While large private corporations return profits to shareholders and avoid major infrastructure upgrades, publicly owned municipal providers are moving customers to carefully planned and budgeted fiber-to-the-home networks that offer service at speeds AT&T, the state’s largest telecom company, cannot touch. SMU will spend $2 million to extend fiber service this year, decommissioning copper telephone wires and coaxial cable as it brings the new network online in different sections of the community.

SMU will spend $2 million to extend fiber service this year, decommissioning copper telephone wires and coaxial cable as it brings the new network online in different sections of the community.

Subscribe

Subscribe

Residents of some cities north of Dallas are in the unique position of being able to choose between two phone companies and at least one cable operator for television, phone, and broadband service.

Residents of some cities north of Dallas are in the unique position of being able to choose between two phone companies and at least one cable operator for television, phone, and broadband service.

Cable operators and publicly owned utilities in Tennessee are battling for control over the prices companies pay to use utility poles, with facts among the early casualties.

Cable operators and publicly owned utilities in Tennessee are battling for control over the prices companies pay to use utility poles, with facts among the early casualties.

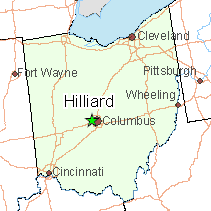

The city council of Hilliard, Ohio is offering Verizon $4.2 million in tax breaks to move 1,500 Verizon employees to the community of 28,000 and hire 500 new employees to join them.

The city council of Hilliard, Ohio is offering Verizon $4.2 million in tax breaks to move 1,500 Verizon employees to the community of 28,000 and hire 500 new employees to join them. Critics call it truly short-changing local government.

Critics call it truly short-changing local government.