The people of Malta will soon have a choice between a cable broadband provider offering 250/20Mbps service or a fiber to the home network now under construction that will be capable of delivering gigabit broadband across the island — all without usage limits or speed throttles.

The people of Malta will soon have a choice between a cable broadband provider offering 250/20Mbps service or a fiber to the home network now under construction that will be capable of delivering gigabit broadband across the island — all without usage limits or speed throttles.

Starting this month, for €96 per month ($128), customers of Melita can buy a triple play package of phone, broadband, and cable television that includes a free upgrade to 250/20Mbps.

“The FibrePower 250 product leverages the investments Melita has made in the past years and further strengthens the company’s position as Malta’s fastest service provider,” said Michael Darmanin, director of marketing and corporate services at Melita. “We are seeing an exponential growth in demand for higher speeds and capacity. This is driven by more people connected in the same household or business, more devices and more consumption of video over the Internet.”

Darmanin added the Maltese people want fast and unlimited broadband service, and they will deliver it, starting at Tigne Point (Midi) and Fort Cambridge in Sliema. The service will then gradually be rolled out in other Maltese communities.

Malta, in the Mediterranean Sea, has a population of around 450,000. The country has two major telecom companies: Melita which delivers cable service and GO, which delivers DSL service over the telephone network. Vodafone used to offer a now-discontinued WiMAX service across the island, which never had a significant market share.

The Maltese government made broadband expansion a national priority and set regulatory policies that would increase competition. But the government also insisted that telecom market improvements also benefit customers, and the country laid the foundation of its broadband policy on encouraging the development of a nationwide fiber to the home network.

The Maltese government made broadband expansion a national priority and set regulatory policies that would increase competition. But the government also insisted that telecom market improvements also benefit customers, and the country laid the foundation of its broadband policy on encouraging the development of a nationwide fiber to the home network.

The tradeoff: the government would deregulate the broadband marketplace and remove regulatory obstacles and unnecessary red tape governing pole usage and underground trenching, but in return providers must meet government objectives towards enhancing broadband speeds and price competition.

As a result, Melita has aggressively invested in cable broadband upgrades that have delivered broadband speeds faster than what most Americans and Canadians can buy from their cable providers. The cable operator plans to be among the earliest adopters of DOCSIS 3.1 which will support up to 10/1Gbps broadband speeds.

As a result, Melita has aggressively invested in cable broadband upgrades that have delivered broadband speeds faster than what most Americans and Canadians can buy from their cable providers. The cable operator plans to be among the earliest adopters of DOCSIS 3.1 which will support up to 10/1Gbps broadband speeds.

Not to be outdone, GO is rolling out its own fiber to the home network supporting interactive IPTV and faster broadband speeds. It will then be able to retire its DSL service, which now provides respectable Internet speeds up to 35Mbps.

Subscribe

Subscribe

One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets.

CenturyLink now sells up to 40Mbps speeds in Omaha, with a 300GB monthly usage cap. The company has not said if it intends to apply a usage limit on its fiber customers.

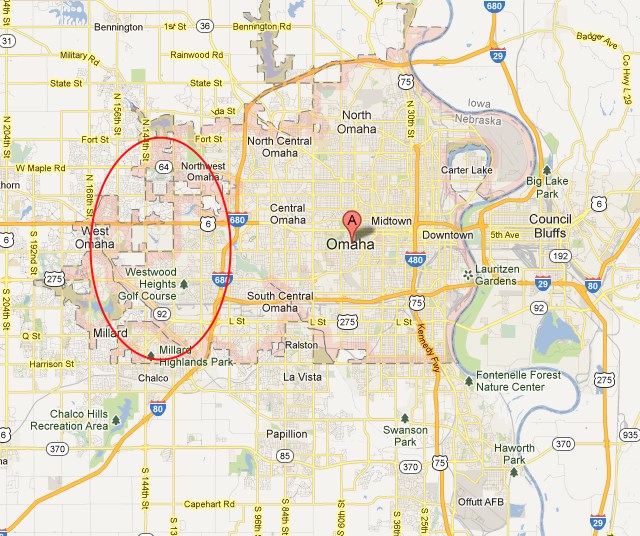

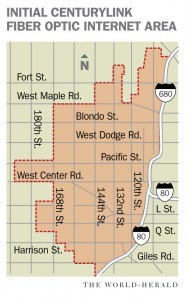

CenturyLink now sells up to 40Mbps speeds in Omaha, with a 300GB monthly usage cap. The company has not said if it intends to apply a usage limit on its fiber customers. Only around 12% of metropolitan Omaha will have access to the experimental fiber service, primarily those living in West Omaha. The network will bypass residents that live further east. The boundaries of the forthcoming fiber network are notable: West Omaha comprises mostly affluent middle and upper class professionals and is one of the wealthiest areas in the metropolitan region. Winning a right to offer service on a limited basis within Omaha is an important consideration for telecom companies like CenturyLink.

Only around 12% of metropolitan Omaha will have access to the experimental fiber service, primarily those living in West Omaha. The network will bypass residents that live further east. The boundaries of the forthcoming fiber network are notable: West Omaha comprises mostly affluent middle and upper class professionals and is one of the wealthiest areas in the metropolitan region. Winning a right to offer service on a limited basis within Omaha is an important consideration for telecom companies like CenturyLink.