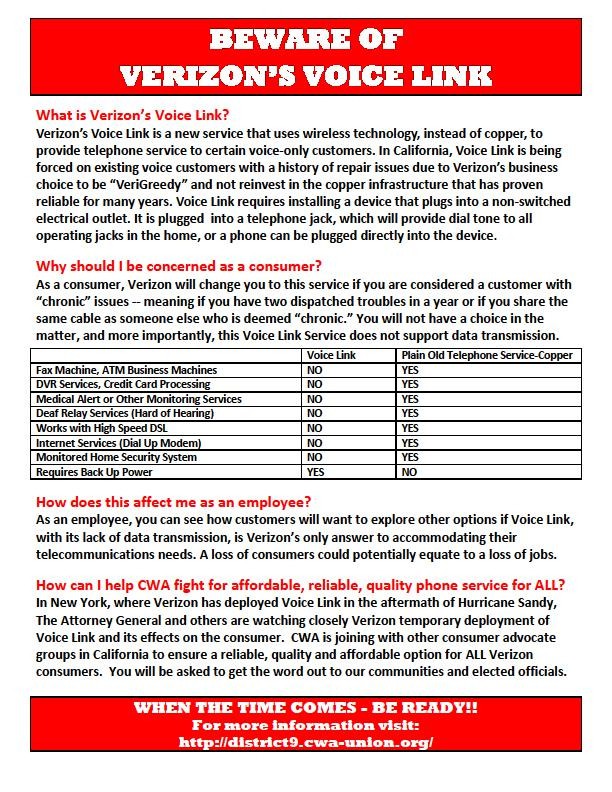

Despite warnings from public safety officials the wireless landline alternative proposed by Verizon is unreliable and potentially a threat to the safety and well-being of customers, Verizon is moving full speed ahead to deploy Voice Link service in New York and New Jersey communities where existing Verizon landlines have deteriorated and FiOS fiber optics is a distant dream.

Despite warnings from public safety officials the wireless landline alternative proposed by Verizon is unreliable and potentially a threat to the safety and well-being of customers, Verizon is moving full speed ahead to deploy Voice Link service in New York and New Jersey communities where existing Verizon landlines have deteriorated and FiOS fiber optics is a distant dream.

On July 12, the Communications Workers of America reported that Verizon’s repair call centers in New York City are now assigning employees to Voice Link-related jobs.

“In addition, CWA members report that technicians are receiving specialized Voice Link installation training and are being assigned to carry out installations in the Buffalo and Watertown areas,” said Chris Shelton, vice president of CWA District 1.

The union also confirmed no further expansion work was being done on Verizon’s FiOS fiber network outside of the areas already committed by the company. Verizon FiOS is only available in a few Buffalo suburbs and not available in Watertown at all.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/CWA District 1 VP speaks about Verizon Voice Link 6-13-13.mp4[/flv]

CWA District 1 vice president Chris Shelton summed up Verizon’s aggressive deployment of Voice Link: “We can’t allow these dirty bastards to do this to their own customers, who they don’t give a s**t about….” (Warning: Strong Language) (3 minutes)

Sullivan County

More than 130 county executives, legislators, mayors, town supervisors, and councilors representing 68 New York State communities including Albany, Syracuse, Rochester, Binghamton, Plattsburgh, Ithaca, Jamestown, Poughkeepsie, Rome, and Elmira called on the PSC to declare Voice Link an experimental service and not allow it to serve as the sole service offering on Fire Island or anywhere else:

The Commission stated that “[it] has been the Commission’s policy that utilities determine how to provision service via any combination of facilities – wires, fiber optics, electronics – so long as the tariffed service meets the Commission’s prescribed rules and customer expectations.”

Voice Link, as currently offered, does not meet Municipalities’ expectations. Instead, Voice Link would jeopardize municipalities’ ability to fulfill their responsibility to protect the safety of the citizens who reside and work in their communities. The broad and significant implications of Verizon’s proposed tariff warrant a full investigation. New technology should be deployed after solutions are found, not before.

Municipalities urge the Commission to develop a full factual record and to offer interested stakeholders the opportunity to participate fully in this important proceeding. Municipalities rely on the Commission to guide the evolution of the state’s telecommunications infrastructure in a manner that protects citizens’ safety and promotes economic development.

The legislators called Voice Link a threat to public safety and its installation hampered communities from protecting local residents.

In Sullivan County, where Verizon is attempting to introduce Voice Link as an option for seasonal residents, Undersheriff Eric Chaboty said using wireless service carries risks in an emergency.

Chaboty

At a press conference covered by the Mid-Hudson News Service, Chaboty made it clear homeowners should not feel pressured to sign up for Voice Link. Chaboty recounted a story of his neighbor’s house catching fire and the owner called 911 from a cell phone using the same wireless network Voice Link would use. The call was mistakenly routed to another county instead of Sullivan County 911, and by the time the call reached the correct emergency responders, the family’s home burned to the ground.

Stories like that may explain why Verizon has taken great pains to disclaim responsibility for a customer’s inability to reach 911 or be connected to the correct public safety operator.

Assemblywoman Aileen Gunther (D-Forestburgh) was incredulous Verizon would even attempt to introduce Voice Link in the rural Catskill Mountains, which is notorious for lousy cell reception.

“Too much of this county has no service at all and no hope on the horizon,” she told the audience. “Until the time comes when companies like Verizon are willing to make the investment to ensure reliable and thorough coverage, products like Voice Link are an insult and a danger to our community.”

Legislators across the state also suspect Voice Link will create an incentive for Verizon to neglect its already-deteriorating copper wire network, accelerating the need to deploy its preferred wireless solution. But the thought of achieving business priorities at the possible cost of public safety bothered the 134 legislators who signed a petition sent to the PSC.

“When outside plant is inadequately maintained, consumers’ safety is jeopardized because their dial tones may not function when they need to reach emergency services,” the petition explained.

Brookhaven town supervisor Edward P. Romaine held his own news conference at the Davis Park Ferry Terminal in Patchogue last week. He worried that Verizon was attempting to get its foot in the door with Voice Link, and will use any approval to quickly expand it as a “sole service option” elsewhere.

“Our concern isn’t only for Fire Island,” Romaine said. “Our concern is while they’re impacting a few communities in Fire Island, this . . . will spread to all of Fire Island and possibly to the main island.”

[flv width=”512″ height=”308″]http://www.phillipdampier.com/video/CBS This Morning No more landlines Verizon wont fix storm damaged wires 7-19-13.flv[/flv]

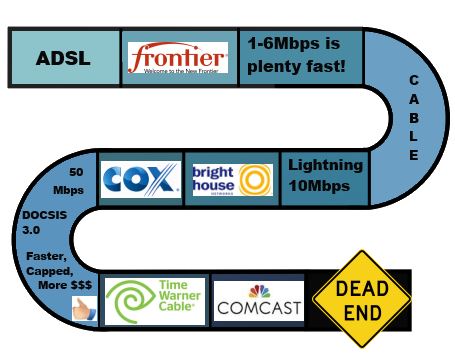

CBS’ This Morning covered Verizon’s plans to drop landline service in Mantoloking, N.J., on an off shore barrier island. Residents really don’t want Voice Link as the replacement, but at least they have an alternative. Unlike on Fire Island, Mantoloking is served by a cable company – Comcast. (3 minutes)

Subscribe

Subscribe Time Warner Cable won’t engage in an expensive bidding war for ownership of Hulu so it is trying to convince the online video venture’s current owners not to sell.

Time Warner Cable won’t engage in an expensive bidding war for ownership of Hulu so it is trying to convince the online video venture’s current owners not to sell. Hulu’s new owners could continue to offer the service much the same way it is provided today, with a free and pay version. But most expect the new owners will throw up a programming “pay wall,” requiring users to authenticate themselves as a pay television customer before they can watch Hulu programming. If Time Warner Cable acquired a minority interest and the current owners stayed in place, Time Warner Cable TV customers could benefit from free access to certain premium Hulu content, now sold to others for $8 a month. That premium content would presumably be available to U-verse customers if AT&T emerges the top bidder, or DirecTV could offer Hulu to satellite subscribers to better compete with cable companies’ on-demand offerings.

Hulu’s new owners could continue to offer the service much the same way it is provided today, with a free and pay version. But most expect the new owners will throw up a programming “pay wall,” requiring users to authenticate themselves as a pay television customer before they can watch Hulu programming. If Time Warner Cable acquired a minority interest and the current owners stayed in place, Time Warner Cable TV customers could benefit from free access to certain premium Hulu content, now sold to others for $8 a month. That premium content would presumably be available to U-verse customers if AT&T emerges the top bidder, or DirecTV could offer Hulu to satellite subscribers to better compete with cable companies’ on-demand offerings. The Los Angeles Times reports that pay TV distributors are in a rush to make deals, not only to offer more viewing options for customers, but to potentially get rid of expensive and cumbersome set-top boxes.

The Los Angeles Times reports that pay TV distributors are in a rush to make deals, not only to offer more viewing options for customers, but to potentially get rid of expensive and cumbersome set-top boxes. “We just don’t see the need of delivering [gigabit broadband] to consumers.” —

“We just don’t see the need of delivering [gigabit broadband] to consumers.” —

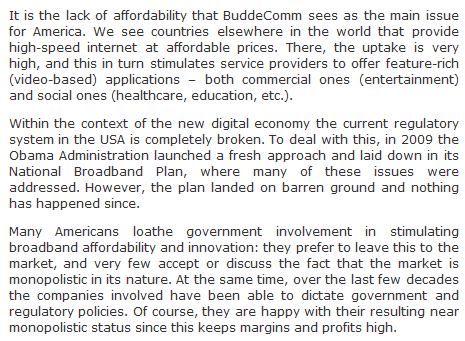

Attention broadband planners: Although broadband deployment strategies differ around the world, a new report decisively concludes there is only one network technology proven to meet the demands of broadband users both today and tomorrow: a national fiber optic network.

Attention broadband planners: Although broadband deployment strategies differ around the world, a new report decisively concludes there is only one network technology proven to meet the demands of broadband users both today and tomorrow: a national fiber optic network.

West Virginia has spent nearly three times more than it anticipated for each mile of fiber optics being laid by Frontier Communications as part of the state’s taxpayer-funded broadband expansion project, according to a new report.

West Virginia has spent nearly three times more than it anticipated for each mile of fiber optics being laid by Frontier Communications as part of the state’s taxpayer-funded broadband expansion project, according to a new report.