Gooch

A bill in the Georgia legislature that would divert a portion of a state fund that currently subsidizes rural landlines towards rural internet expansion ran into trouble last week after lobbyists representing AT&T and several small rural telephone companies announced opposition to the measure.

Sen. Steve Gooch (R-Dahlonega), the chief sponsor of Senate Bill 65, is seeking to boost subsidy funds to expand high-speed internet in unserved areas of the state. His bill would designate up to $35 million annually towards construction of new broadband connections. Without the measure, state residents would instead see a reduction in Universal Access Fund (UAF) fees on their monthly phone bills beginning later this year. But if the bill passes, modest UAF charges would continue at 2020 levels for an additional nine years, expiring June 30, 2030.

Georgia’s Senate Regulated Industries Committee reviewed the current state of rural broadband funding in a meeting held last Thursday in Atlanta. Gooch noted Gov. Brian Kemp already set aside $20 million for rural broadband in the 2021 state budget, but he felt more needed to be done.

“Twenty million dollars […] is a good start,” Gooch said. “But we need to put more money into this year after year until the problem is fixed.”

Gooch’s measure has attracted 20 co-sponsors in the legislature so far:

| 1. | Gooch, Steve | 51st |

| 2. | Miller, Butch | 49th |

| 3. | Cowsert, Bill | 46th |

| 4. | Tillery, Blake | 19th |

| 5. | Harper, Tyler | 7th |

| 6. | Hatchett, Bo | 50th |

| 7. | Brass, Matt | 28th |

| 8. | Anderson, Lee | 24th |

| 9. | Goodman, Russ | 8th |

| 10. | Walker, III, Larry | 20th |

| 11. | Burns, Max | 23rd |

| 12. | Ginn, Frank | 47th |

| 13. | Thompson, Bruce | 14th |

| 14. | Hickman, Billy | 4th |

| 15. | Anavitarte, Jason | 31st |

| 16. | Summers, Carden | 13th |

| 17. | Robertson, Randy | 29th |

| 18. | McNeill, Sheila | 3rd |

| 19. | Tippins, Lindsey | 37th |

| 20. | Watson, Ben | 1st |

Georgia’s cable and phone companies appear much less supportive of Gooch’s effort. Leading the charge against Gooch’s bill was AT&T Georgia. Kevin Curtin, AT&T’s assistant vice president of legislative affairs in Georgia, said diverting money from the UAF Fund to rural broadband expansion was unnecessary.

“There are many federal government programs doling out substantial amounts of funding to spread broadband,” Curtin said. AT&T has regularly pointed to the FCC’s Rural Digital Opportunity Fund (RDOF) as the best source of rural broadband funding. The 10-year, $9.2 billion program has already designated $326.5 million for rural broadband expansion in Georgia. But it will take years for RDOF to dispense its available funds.

The state’s largest lobbying group for the cable industry does not care for the bill either.

“We want to continue to try to bring broadband to every Georgia citizen,” said Hunter Hopkins, interim executive director of the Georgia Cable Association. “Let’s just put more money in the general fund versus tinkering with the UAF.”

Rural Georgians are usually left waiting indefinitely for private industry investment to expand rural internet access. Instead, rural utility cooperatives are now stepping up to solve the rural broadband problem in parts of the state, often without waiting for government subsides.

Rural Georgians are usually left waiting indefinitely for private industry investment to expand rural internet access. Instead, rural utility cooperatives are now stepping up to solve the rural broadband problem in parts of the state, often without waiting for government subsides.

Last week, Conexon, a fiber overbuilder and internet service provider teamed up with two member-owned utility co-ops with a plan to bring high-speed gigabit internet to 80,000 homes and businesses in 18 rural Middle Georgia counties.

The partnership will combine utility co-op investments of $135 million from Central Georgia EMC and $53 million from Southern Rivers Energy with $21.5 million from Conexon to build a new, 6,890 mile fiber to the home broadband network over the next four years that will serve residents in Bibb, Butts, Clayton, Coweta, Crawford, Fayette, Henry, Jasper, Jones, Lamar, Meriwether, Monroe, Morgan, Newton, Pike, Putnam, Spalding, and Upson counties. Monroe County has also offered $1.3 million to incentivize the partnership to break ground in that county as quickly as possible.

Customers in rural Georgia have given up waiting for companies like AT&T and Windstream to expand high-speed internet service.

“The majority of members in our service area have no access to the quality, high-speed internet service they so desperately need. That changes today,” said Southern Rivers Energy President and CEO Michael McMillan. “We know electric cooperatives play a critical role in connecting underserved areas and we are proud to partner with Conexon to help bridge the digital divide for our communities. This partnership will enable thousands of rural Georgians to finally access the same online connections as those in more urban areas, while allowing us to maintain focus on our core mission – providing reliable, affordable electricity to our members.”

Subscribe

Subscribe

Charter’s Spectrum Community Investment Loan Fund (the Loan Fund) will invest

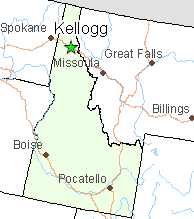

Charter’s Spectrum Community Investment Loan Fund (the Loan Fund) will invest  Even with the threat of COVID-19 and a virtual nationwide work-from-home initiative, the new owners of Frontier Communications’ network in Washington, Oregon, Montana and Idaho are moving rapidly to repair persistent network issues, create a backup network, and lay the foundation to bring fiber to the home service to 85% of its customers over the next three years.

Even with the threat of COVID-19 and a virtual nationwide work-from-home initiative, the new owners of Frontier Communications’ network in Washington, Oregon, Montana and Idaho are moving rapidly to repair persistent network issues, create a backup network, and lay the foundation to bring fiber to the home service to 85% of its customers over the next three years.

Among the first towns to get fiber service are Kellogg, Moscow, and Coeur d’Alene — all in Idaho. Work has already commenced and is expected to be finished by fall. Ziply wants to keep construction costs as low as possible, so it intends to do aerial deployment of fiber by wrapping the optical cable around existing copper wire telephone cables already on the pole. This process, known as “overlashing” will simplify installation by not requiring additional space to place fiber cables next to existing telephone wiring or going to the effort of removing the existing copper wiring, which raises costs.

Among the first towns to get fiber service are Kellogg, Moscow, and Coeur d’Alene — all in Idaho. Work has already commenced and is expected to be finished by fall. Ziply wants to keep construction costs as low as possible, so it intends to do aerial deployment of fiber by wrapping the optical cable around existing copper wire telephone cables already on the pole. This process, known as “overlashing” will simplify installation by not requiring additional space to place fiber cables next to existing telephone wiring or going to the effort of removing the existing copper wiring, which raises costs. To further speed fiber upgrades, Ziply acquired Wholesail Networks, already contracted to manage fiber network design for Ziply. Company officials quickly identified multiple weak spots in Frontier’s network, particularly relating to its resiliency when fiber cables were cut or copper wiring was stolen. Ziply is building in network redundancy, with each portion of its network served by at least two sets of fiber cabling and identical equipment in each of more than 130 central switching offices. In many markets, Ziply will maintain at least three redundant fiber connections to make certain if one (or two) networks go down, customers can still be served by a third with no interruption in service.

To further speed fiber upgrades, Ziply acquired Wholesail Networks, already contracted to manage fiber network design for Ziply. Company officials quickly identified multiple weak spots in Frontier’s network, particularly relating to its resiliency when fiber cables were cut or copper wiring was stolen. Ziply is building in network redundancy, with each portion of its network served by at least two sets of fiber cabling and identical equipment in each of more than 130 central switching offices. In many markets, Ziply will maintain at least three redundant fiber connections to make certain if one (or two) networks go down, customers can still be served by a third with no interruption in service.