Dan McCarthy, Frontier’s president and chief operating officer, commented, “This transaction is an exciting opportunity for Frontier. We are well-positioned to maximize value for our shareholders and create a great experience for new customers. We have four FiOS markets today from our 2010 transaction with Verizon, and a high level of familiarity with the systems underlying these properties. We plan to flash-cut convert these properties to Frontier’s systems as we did in states including West Virginia and Connecticut.”

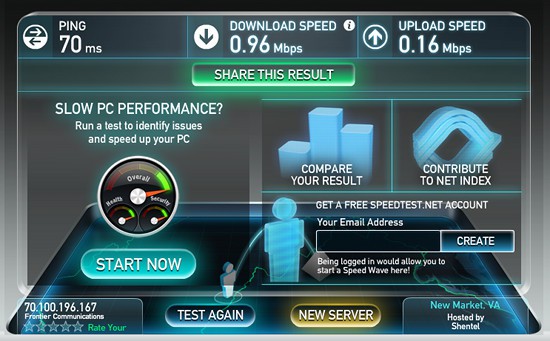

But Frontier’s “flash cut” conversions in West Virginia and Connecticut led to months of serious service and billing problems leading to two state-level investigations into Frontier’s performance. Problems are still ongoing in parts of Connecticut several months after Frontier transferred Connecticut territories from AT&T. Customers in West Virginia continue to criticize Frontier Communications for its underwhelming broadband performance.

But Frontier’s “flash cut” conversions in West Virginia and Connecticut led to months of serious service and billing problems leading to two state-level investigations into Frontier’s performance. Problems are still ongoing in parts of Connecticut several months after Frontier transferred Connecticut territories from AT&T. Customers in West Virginia continue to criticize Frontier Communications for its underwhelming broadband performance.

Saibus Research, a Wall Street analyst, said they were “stunned” Frontier was repeating the same mistake it made back in 2010 when it acquired other former GTE service areas from Verizon.

“We remembered that its $8.7 billion wireline purchase in 2010 did not work out so well for it,” wrote the analyst. “When we consider that Frontier’s share price declined by nearly 60% from 2010-2012 after the deal closed before recovering those losses since 2012, we were shocked that Frontier’s share price increased by 10.6% in response to its announcement that it was buying assets from Verizon. Frontier’s pro forma revenue has declined by 30% since 2009, its residential consumer base declined by 33%, its operating income declined by 34% and its dividend declined by 60% since then.”

“Albert Einstein said that insanity is doing the same thing over again and expecting a different result and we think that Frontier’s CEO Maggie Wilderotter has come down with a serious case of insanity for her willingness to buy whatever Verizon is selling,” said Saibus Research. “As such, we think income-oriented telecom investors should consider accumulating shares of Verizon, and selling or shorting Frontier.”

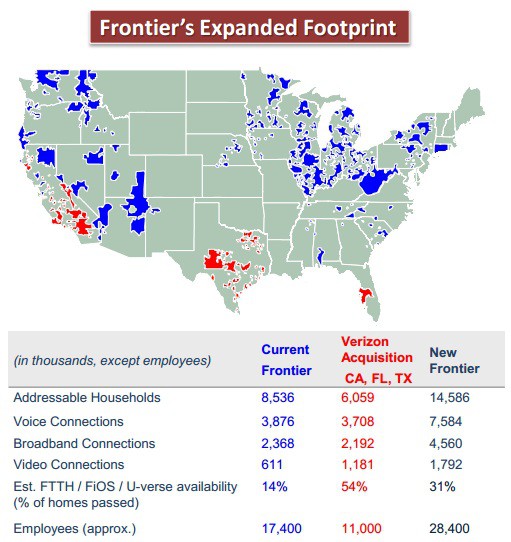

Frontier will accumulate billions in new debt to fund the transaction, bad news for legacy Frontier customers still served by the company’s copper wire networks. Frontier hoped to realize $500 million in cost reductions from its 2010 acquisition of Verizon territories in the Pacific Northwest, West Virginia, and several midwestern states. Instead of savings, it ended up spending millions to rehabilitate deteriorating landlines Verizon underinvested in for years. The new unsecured debt load will likely cut into available funds to upgrade older networks, particularly in the northeast and inside New York, Ohio and Pennsylvania.

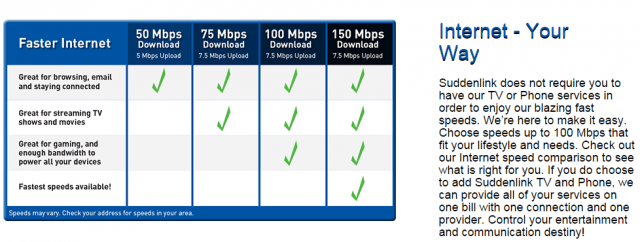

Frontier will get marginal improvements in programming costs from the greater volume discounts its larger customer base qualifies to receive. But outside of Connecticut (Frontier U-verse) and Washington, Oregon, Indiana and South Carolina (Frontier FiOS), the rest of Frontier’s customers will continue to be offered Dish Network satellite service and various flavors of DSL.

If approved by regulators, the transaction will be finalized in 2016.

Subscribe

Subscribe

The Republican leadership of West Virginia’s House of Delegates is alleged to have quietly placed a ban on considering any bill that could potentially offend Frontier Communications, frustrating state lawmakers attempting to introduce broadband improvement and consumer protection measures.

The Republican leadership of West Virginia’s House of Delegates is alleged to have quietly placed a ban on considering any bill that could potentially offend Frontier Communications, frustrating state lawmakers attempting to introduce broadband improvement and consumer protection measures.

He foreshadowed the forthcoming landline sale in January when he told an investor conference he was willing to make significant cuts to Verizon’s wired networks.

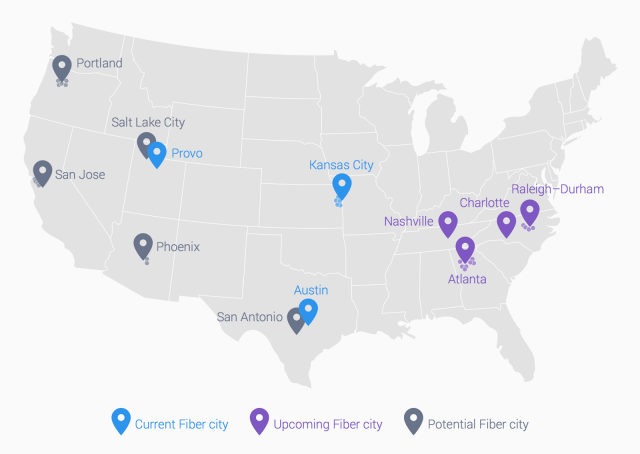

He foreshadowed the forthcoming landline sale in January when he told an investor conference he was willing to make significant cuts to Verizon’s wired networks. Google has announced it will bring its fiber broadband service to four new cities — Atlanta, Charlotte, N.C., Raleigh-Durham, N.C. and Nashville, Tenn., according to

Google has announced it will bring its fiber broadband service to four new cities — Atlanta, Charlotte, N.C., Raleigh-Durham, N.C. and Nashville, Tenn., according to

Google officials have also been reportedly sensitive to local government red tape and regulation. In Portland, the Journal reports Google has put any fiber expansion on hold there because Oregon tax-assessment rules would value Google’s property based on the value of their intangible assets, such as brand. That would cause Google’s property taxes in Oregon to soar. Until the Oregon state legislature makes it clear such rules would not apply to Google Fiber, there will be no Google Fiber in Portland.

Google officials have also been reportedly sensitive to local government red tape and regulation. In Portland, the Journal reports Google has put any fiber expansion on hold there because Oregon tax-assessment rules would value Google’s property based on the value of their intangible assets, such as brand. That would cause Google’s property taxes in Oregon to soar. Until the Oregon state legislature makes it clear such rules would not apply to Google Fiber, there will be no Google Fiber in Portland.