Phillip “Oh look, more industry-backed research in denial regarding unpopular usage caps and consumption billing” Dampier

It seems America’s biggest industry-funded broadband astroturf group, Broadband for America, thinks the New America Foundation completely misses the point of “new pricing strategies” like restrictive usage caps, costly consumption-based billing, and fiendishly high overlimit fees. In a hurry, they released this particularly weak argument favoring usage pricing:

A new report by the New America Foundation suggests that “dwindling competition is fueling the rise of increasingly costly and restrictive Internet usage caps” in the broadband sector. But as we’ve explained before, these experimental new pricing strategies are actually signs of competition in the market and ultimately benefit consumers.

In terms of competition between broadband service providers, a study by Boston College Law School Professor Daniel Lyons concluded “data caps and other pricing strategies are ways that broadband companies can distinguish themselves from one another to achieve a competitive advantage in the marketplace.” He also concluded these practices were not anti-consumer: “When firms experiment with different business models, they can tailor services to niche audiences whose interests are inadequately satisfied by a one-size-fits-all flat-rate plan.” Indeed, many consumers are no longer satisfied with one-size-fits-all rate plans. Since data usage by individual users can vary dramatically, imposing a one-size-fits-all approach to pricing would result in light data users subsidizing the use of heavier ones. As Michigan State University Professor of Information Studies Steven Wildman explains, not having usage-based pricing models “means that light users pay a higher effective rate for broadband service, cross-subsidizing the activities of those who spend more time online. With usage-based pricing, those who use more bandwidth contribute more toward the cost of building and maintaining broadband networks.”

Broadband providers should be free to experiment with usage-based pricing and other pricing strategies as tools in their arsenal to meet rising broadband demand on their networks. Moving forward, Lyons recommends instituting public policies that allow providers the freedom to experiment, in order to best preserve the spirit of innovation that has characterized the Internet since its inception.

Broadband for America thinks they are clever when they introduce “academic papers” that extend credibility to their arguments. No, Broadband for America, we get the point. Your benefactors want to charge customers more money for less service and call that a fair deal.

The wheels driving their talking points start to fall off the moment one peaks under their covers:

1. Broadband for America (BfA) is America’s largest telecom industry front group, backed almost entirely by cable and phone companies and dozens of supporting groups that are typically funded by those companies, have telecom industry board members, or whose lifeblood depends on doing business with Big Telecom companies.

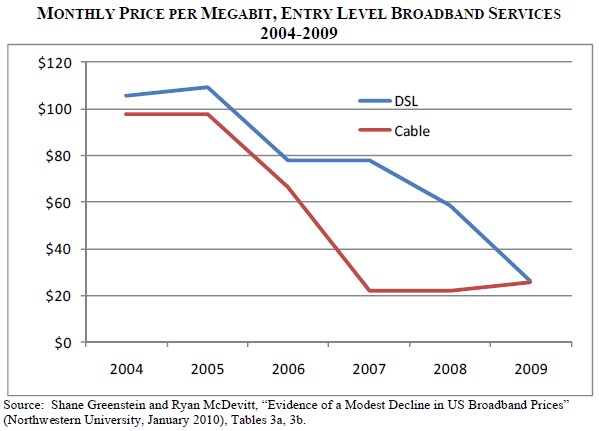

2. Experimental pricing plans that largely leave existing pricing in place –and– impose new service limitations is not a sign of competition that benefits consumers, it is proof of its absence. With today’s broadband duopoly, there is little risk imposing new fees or service restrictions when the only competition you have typically follows suit. There is no evidence that usage-based pricing is saving consumers money, particularly when broadband providers are using their marketplace power to further increase prices.

3. There is no evidence “many consumers are no longer satisfied with one-size-fits-all rate plans” for home broadband. In fact, the reverse has been proved conclusively, sometimes by industry-funded researchers.

4. With a 90-95% gross margin on broadband, there is plenty of room for price cuts –and– unlimited broadband, but why give those profits away when lack of competition doesn’t provide the necessary push. Instead, providers’ ideas of “innovative pricing” are always upwards and include usage limits, modem rental fees, and other restrictions.

5. The railroad industry argued much the same case in the early 20th century when communities complained about wide pricing disparity, depending on local competition. We all know what eventually happened there.

6. Full disclosure, as is too often the case, is completely lacking at BfA. So we’ve offered to help:

The “study by Boston College Law School Professor Daniel Lyons” is accurate. He is now a faculty member there. But BfA fails to disclose the study was actually produced on behalf of the Koch Brother-funded Mercatus Center, which specializes in industry-friendly position papers on deregulation. Lyons is also on the Board of Academic Advisers at the Free State Foundation, itself an industry-backed astroturf group that advocates on behalf of large telecom companies, among others.

His colleague Michigan State University Professor of Information Studies Steven Wildman is also an adviser at the Free State Foundation. He is also a bit more transparent about where the money comes from for his studies advocating usage-based pricing – the National Cable and Telecommunications Association (NCTA), the largest cable industry lobbying and trade group in the United States.

The only surprise Lyons and Wildman could have delivered is if they advocated against these Internet Overcharging schemes. But then they probably would not have been invited to present their findings at an NCTA Connects briefing last week entitled, “Connecting the Dots on Usage-Based Pricing.”

We at Stop the Cap! can connect the dots as well.

Subscribe

Subscribe