Verizon FiOS expansion is still dead while cash cow Verizon Wireless will continue to get the bulk of Verizon’s attention this year, according to a top executive.

Verizon FiOS expansion is still dead while cash cow Verizon Wireless will continue to get the bulk of Verizon’s attention this year, according to a top executive.

Verizon chief financial officer Fran Shammo delivered the latest quarterly financial results to Wall Street analysts Tuesday and had few specifics about how the Cadillac of wireless carriers will handle increasingly meddlesome competition from T-Mobile, which has torn up the comfortably profitable mobile industry’s business plan and threatened to launch an all-out price war.

Verizon Wireless remains a major earner for Verizon, delivering nearly $18 billion in revenue and $8.3 billion in adjusted profitability during the last quarter alone. Verizon is relying on the quality of its network to keep customers from bolting to less expensive competitors. This month, T-Mobile announced it was prepared to cover the early termination penalty of AT&T customers ready to switch. It’s only a matter of time before Verizon customers are treated to a similar offer and that worried investors enough to send Verizon’s share price downwards even though the company beat analyst’s earnings estimates.

Clues about Verizon’s game plan for 2014 became clearer as Shammo took questions and outlined the company’s strategy.

Wireless Will Get Most of Verizon’s Attention

Again this year, Verizon Wireless will get the bulk of Verizon’s attention and financial resources. Verizon Wireless finished 2013 with $81 billion in wireless revenue — up $5.2 billion from 2012 — which represents two-thirds of Verizon’s total earnings. The wireless business has delivered a profit margin of 49% or higher for five of the last seven quarters.

Again this year, Verizon Wireless will get the bulk of Verizon’s attention and financial resources. Verizon Wireless finished 2013 with $81 billion in wireless revenue — up $5.2 billion from 2012 — which represents two-thirds of Verizon’s total earnings. The wireless business has delivered a profit margin of 49% or higher for five of the last seven quarters.

Where do the increased earnings and profits come from?

“Service revenue growth continued to be driven by more customers and devices, increase of data usage, and smartphone penetration,” said Shammo. “Our Share Everything Plans are doing exactly what we expected — driving device adoption and stimulating higher usage — resulting in increases in both the number of devices and revenue per account.”

Shammo said little about the spectrum shortages Verizon claimed were responsible for an end to unlimited use data plans in favor of usage-capped, consumption-based billing. On the contrary, Shammo admitted Verizon expects to grow average revenue per account and profits on the back of usage billing as customers boost wireless data usage and have to upgrade to higher-priced plans in the future. Shammo also noted the company’s restrictions on early upgrades and charging upgrade/activation fees have delivered more revenue to Verizon and deterred customers from phone upgrades, which saves Verizon money.

Verizon Wireless customer bills rose an average of 7.1 percent during the fourth quarter to more than $157 per month.

“We have seen consistent growth in this metric,” said Shammo. “For the full year, average revenue per account was up nearly $10 or 6.9%.”

Some of that increase is attributable to Verizon’s higher cost Share Everything plans, which often cost customers more than the plans they abandon.

Share Everything = a higher Verizon Wireless bill for many customers.

“In just 18 months more than 46% of our postpaid accounts are on these plans,” said Shammo. “In 2013 we effectively doubled the number of accounts on Share Everything from 8.1 million to 16.2 million.”

In the coming year, Verizon plans to spend up to $17 billion on network maintenance and expansion, but the bulk of it will be spent on the wireless side of the business. Verizon has again cut investment in its wired networks.

Shammo noted Verizon Wireless plans to repurpose some of its 3G spectrum to 4G LTE service this year, which cuts costs for Verizon while stimulating usage which will eventually force many customers into data plan upgrades.

“If you look at a 3G usage moving to a 4G, we know that — and we have seen it in our base — as soon as you get on the 4G with video consumption and the quality of video your usage goes up,” said Shammo.

Verizon FiOS Expansion is Still Dead

Verizon has no plans to expand its FiOS fiber network beyond the areas where the company previously signed franchise agreements several years ago. In fact, Shammo is already reallocating money that in years past targeted FiOS expansion, shifting it to Verizon Wireless.

Verizon’s FiOS expansion is still dead. No plans for further expansion in 2014.

Shammo added Verizon will continue upgrading to fiber and decommission its copper network within existing FiOS areas, pushing customers with traditional landline service to basic FiOS phone service.

For those bypassed by FiOS, Shammo indicated it will be business as usual for Verizon, still selling DSL and phone service. But he hinted that within three years, Verizon might be open to selling off wireline customers in non-FiOS areas if a company approached Verizon with a lucrative deal. Verizon is under increased regulatory scrutiny in states like New York where there is concern Verizon is diverting resources away from deteriorating landline infrastructure in favor of its unregulated wireless network.

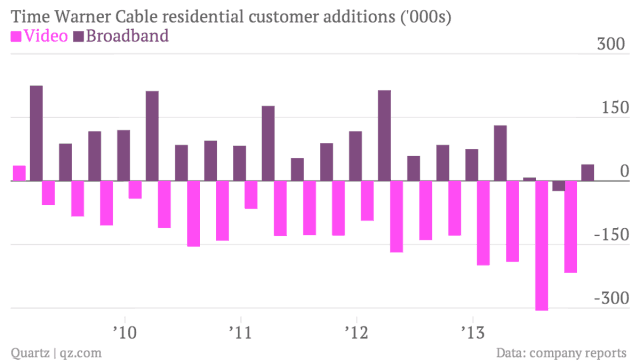

Shammo admitted Verizon stepped back from competing as hard as usual with cable competitors during the third quarter, believing consumers don’t want installers in their homes during the holiday season. As a result, the number of new FiOS customers was down from October-December. But with recent rate increases and voluntary upgrades, revenue remains up. With less than one million potential customers in the FiOS footprint still waiting for the fiber network to arrive, Shammo was comfortable stepping back from promotions temporarily.

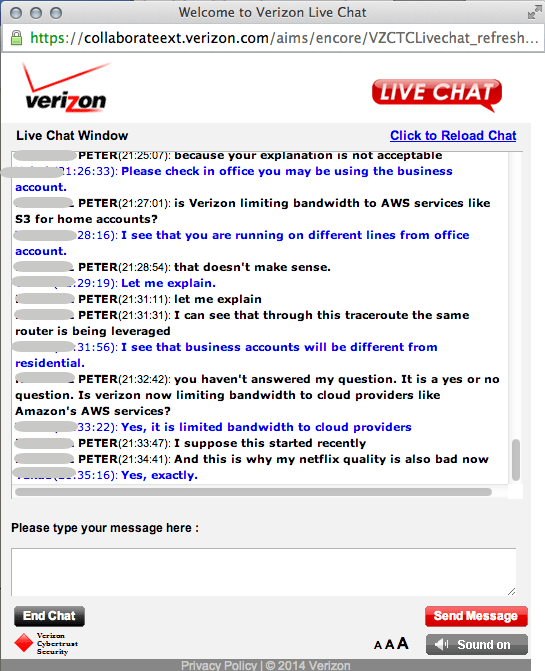

Verizon FiOS has been highly successful for Verizon’s wireline division, now representing about 73% of Verizon’s consumer revenue. More than half of Verizon’s FiOS customers have upgraded to FiOS Quantum Internet speeds, starting at 50Mbps. With that kind of success, what holds Verizon back from further expanding FiOS? Verizon’s current CEO Lowell McAdam comes from a Verizon Wireless background and seems preoccupied with the wireless business. Wall Street is also firmly against Verizon increasing investment in fiber when diverting that spending to high-profit wireless can earn a much faster, more lucrative return.

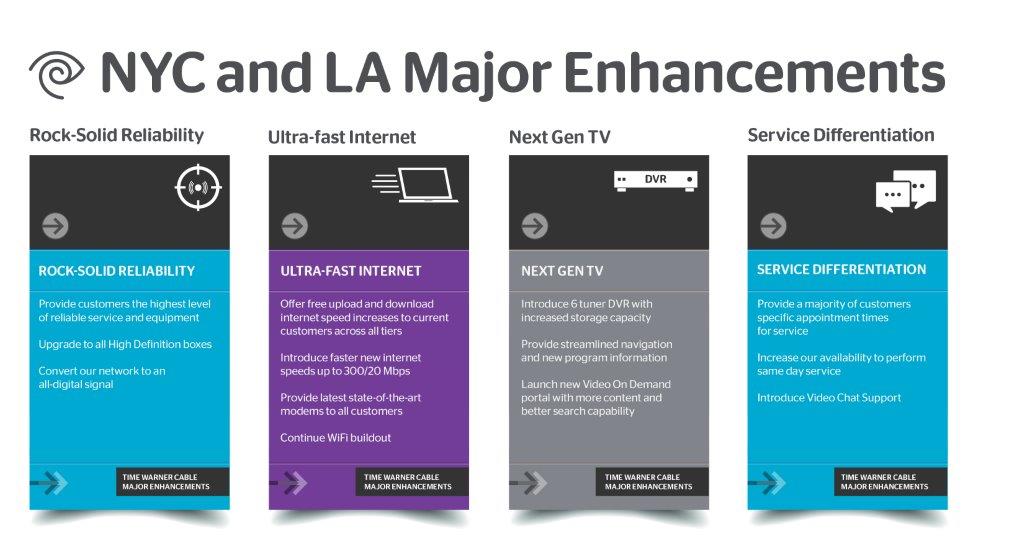

Those lucky enough to have FiOS will continue to see upgrades in 2014. Chief among them is a new proprietary router that will assure Wi-Fi service in the home more closely matches the broadband speeds customers are buying, up to 100Mbps or more.

Verizon’s Intel OnCue Acquisition Doesn’t Mean Online Cable Competition is Coming

Despite a piece in GigaOM suggesting Verizon’s acquisition of Intel’s OnCue technology was all about competing head-to-head with Comcast, Shammo downplayed any expectation Verizon was about to declare war on that cable company or anyone else:

Shammo

As far as the OnCue acquisition, look, the focus here is really to accelerate the availability of the next-generation IP video service which we will integrate into the FiOS video service. And really what we are trying to do is differentiate this even more so with fiber to the home versus others with the TV offerings and reducing the deployment costs. And this really accelerates us from if we were trying to build IP TV versus buying the IP TV technology.

From an FiOS customer perspective, we expect the benefits that they will have more elegant search and discovery activity and cost stream ease of use. But also keep in mind, with the acquisition of Verizon Wireless and becoming 100% ownership of that we also plan to take that platform and integrate it more deeply with our Verizon Wireless 4G LTE network. So that really was the strategy behind this.

Verizon Wireless Has Enough Spectrum for the Next 3-4 Years

Shammo told investors Verizon Wireless has plenty of wireless spectrum to meet customer needs for the next 3-4 years, but he did outline Verizon’s short-term plans on spectrum management:

As far as our portfolio, obviously we like the 700 megahertz for the coverage of the LTE that we did. AWS is our sweet spot at this point in time, which is the spectrum that we have been swapping for [with competing carriers], so we have a very efficient portfolio of spectrum and I think we have shown through the years that we are very efficient on how we use spectrum.

Keep in mind that, as I said, we will participate in the auctions because we will need more spectrum, but right now our current position is that with the AWS that we have and that we are launching in markets that you know in New York and San Francisco, Chicago we are lighting that spectrum up. It is pretty much completed in New York. We will continue to add to that, but keep in mind though too that we will also re-appropriate our 3G spectrum to 4G.

So we will take that PCS spectrum that has been running in our 3G network — as the volume of that network continues to decrease as we move more 3G phones to 4G, we will bring re-appropriate that spectrum over to the 4G LTE. So three to four years we are in very good shape from a spectrum holding position, but we will participate in the upcoming auctions.

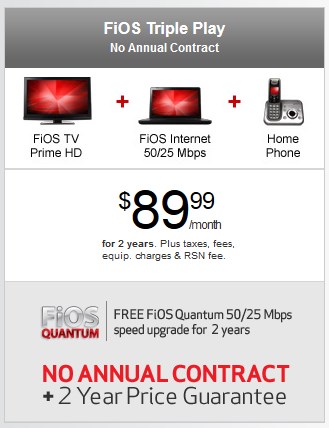

Verizon has introduced a two-year price guarantee offer and a free broadband speed upgrade for new customers signing up for FiOS Internet, TV and voice service before April 19.

Verizon has introduced a two-year price guarantee offer and a free broadband speed upgrade for new customers signing up for FiOS Internet, TV and voice service before April 19. “The current form of competition in this entire sector is essentially focused on promotional pricing, which allows customers who jump from provider to provider to get the best deal,” said Britt.

“The current form of competition in this entire sector is essentially focused on promotional pricing, which allows customers who jump from provider to provider to get the best deal,” said Britt.

Subscribe

Subscribe

Verizon FiOS expansion is still dead while cash cow Verizon Wireless will continue to get the bulk of Verizon’s attention this year, according to a top executive.

Verizon FiOS expansion is still dead while cash cow Verizon Wireless will continue to get the bulk of Verizon’s attention this year, according to a top executive. Again this year, Verizon Wireless will get the bulk of Verizon’s attention and financial resources. Verizon Wireless finished 2013 with $81 billion in wireless revenue — up $5.2 billion from 2012 — which represents two-thirds of Verizon’s total earnings. The wireless business has delivered a profit margin of 49% or higher for five of the last seven quarters.

Again this year, Verizon Wireless will get the bulk of Verizon’s attention and financial resources. Verizon Wireless finished 2013 with $81 billion in wireless revenue — up $5.2 billion from 2012 — which represents two-thirds of Verizon’s total earnings. The wireless business has delivered a profit margin of 49% or higher for five of the last seven quarters.