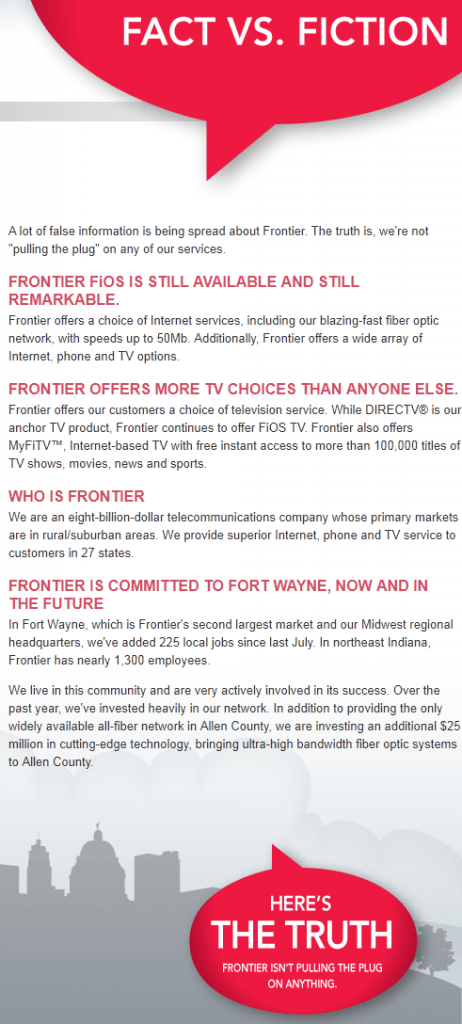

Frontier's Facts - Frontier's new website to counter Comcast's claims about FiOS. (click to enlarge)

Frontier Communications has fired back at Comcast after the Fort Wayne, Indiana cable company erected billboards telling residents Frontier was pulling the plug on its acquired FiOS fiber optic network.

On Wednesday, Frontier purchased a full-page ad in The Journal Gazette headlined, “Comcast Doesn’t Let the Facts Get in the Way of a Good Story! Here’s the Truth: Frontier Isn’t Pulling the Plug on Anything.” It also launched a new website — Frontier Facts — telling customers it is not “pulling the plug” on any of its services.

Roscoe Spencer, Frontier’s local general manager, tells customers:

Recently, one of our competitors put up billboards, placed inserts in the newspapers and sent mailings to customers indicating we had pulled the plug on FiOS. This statement is simply not true, and we have taken legal action to insist that these false claims be stopped immediately.

Spencer

The spat began when Comcast began trying to recruit disaffected Frontier TV customers who found a massive rate increase notice in bills sent earlier this year. Frontier blamed the rate increase on the loss of volume discounts former owner Verizon obtained for its FiOS TV service for television programming. Frontier has sought to negotiate with programmers directly instead of working through a cooperative buying group, so the prices it pays for popular cable networks are much higher than what Comcast pays for a comparable video package.

Frontier watchers suggest the company is well aware its new video pricing is uncompetitive and customers will take their business elsewhere. Frontier quickly began marketing DirecTV, a satellite provider, as a suitable replacement for those unhappy with the rate increase. But Comcast also saw an opportunity to pick up new customers at the phone company’s expense, including through the use of billboards Frontier claims are misleading.

Frontier stresses its FiOS platform will continue to provide telephone, television, and broadband service, despite what Comcast’s billboards might suggest.

Despite the involvement of attorneys, Comcast has continued to thumb its nose at Frontier’s legal department. Frontier spokesman Matt Kelley told the Journal Gazette Comcast was supposed to remove the billboards by Monday of this week, but they remain in place.

The cable company calls it a case of old fashioned competition.

Stop the Cap! reader Kevin calls Frontier’s marketing to get customers to drop FiOS TV for DirecTV a real blast from the past.

“It remains difficult for Frontier to sell people on its advanced fiber network when it is heavily marketing customers to get off of it and switch to DirecTV, a service that looked ultra-modern in the 1990s but today is just a rain-faded, pixellated nuisance,” Kevin says. “Frontier blew it, Comcast took advantage of their strategic blunders, and now the whining has begun.”

“It remains difficult for Frontier to sell people on its advanced fiber network when it is heavily marketing customers to get off of it and switch to DirecTV, a service that looked ultra-modern in the 1990s but today is just a rain-faded, pixellated nuisance,” Kevin says. “Frontier blew it, Comcast took advantage of their strategic blunders, and now the whining has begun.”

Kevin is a former Verizon FiOS customer who was switched to Frontier when Verizon exited Fort Wayne.

“Verizon knew what they were doing, but eventually decided a few small cities in Indiana were not worth their time or interest, so they sold us off to Frontier, who ended up with a fiber network they’ve shown little interest in running except as an adopted curiosity,” Kevin adds. “When we got notice of the rate increase, we canceled the TV service and now watch over the air television for free, supplemented with Netflix and Hulu.”

Kevin says Frontier ultimately did him a favor, discovering he was fine without a pay television package.

“Outside of breaking news and sports, you can get most everything else online. Why pay more?”

Subscribe

Subscribe The latest contract dispute over cable programming between The Weather Channel and Verizon FiOS has deprived Verizon customers of The Weather Channel, but more than a few viewers who don’t live for storm porn don’t seem to notice or care.

The latest contract dispute over cable programming between The Weather Channel and Verizon FiOS has deprived Verizon customers of The Weather Channel, but more than a few viewers who don’t live for storm porn don’t seem to notice or care. AccuWeather also called out The Weather Channel for preempting the weather for “Fat Guys in the Woods” and “Prospectors” — two Weather Channel reality shows that may encounter bad weather, but don’t report on it.

AccuWeather also called out The Weather Channel for preempting the weather for “Fat Guys in the Woods” and “Prospectors” — two Weather Channel reality shows that may encounter bad weather, but don’t report on it.