Houston residents excited by this week’s launch of AT&T U-verse with GigaPower have been quickly disappointed after learning the service is available practically nowhere in Houston and likely won’t be for some time.

Houston residents excited by this week’s launch of AT&T U-verse with GigaPower have been quickly disappointed after learning the service is available practically nowhere in Houston and likely won’t be for some time.

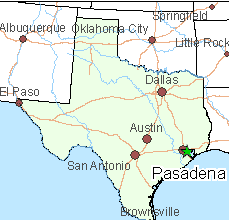

The upgrade, offering up to 1,000/1,000Mbps broadband, was launched Monday with an announcement “select residents” in Bellaire, Pasadena, and northwest Harris County, Tex. will be the first to get the service.

Bellaire, known as the “City of Homes,” is a primarily residential community of 6,000 houses surrounded by the city of Houston. AT&T’s Houston headquarters are located in Bellaire, and the company maintains good relations with the local government. Larry Evans, AT&T’s vice president and general manager for South Texas told the Houston Chronicle that is a key factor for getting GigaPower upgrades. Evans said Bellaire, Pasadena and northwest Harris County have been very cooperative in clearing red tape and letting AT&T install fiber infrastructure for GigaPower with a minimum of fuss from permitting and zoning authorities.

Bellaire is a mostly residential community surrounded by Houston.

The larger city of Pasadena, with a population approaching 150,000 is another case where close cooperation with the city government made the difference. The city council contracts with AT&T to supply telecom services to the local government as well.

As in other AT&T service areas, actual availability of GigaPower is extremely limited. A search of prospective addresses in Pasadena found service available in only a few neighborhoods. In Bellaire, only a few streets now qualify for service. We were unable to find a single address in “northwest Harris County” that qualified for U-verse with GigaPower, but AT&T claims that “surrounding communities” would also have access, without disclosing the names of any of them. That makes it extremely difficult to accurately use AT&T’s service qualification tool to verify coverage.

Jim Cale found he pre-qualified on the website for U-verse with GigaPower service, but his hopes were dashed when a representative informed him his order was canceled because, in fact, GigaPower was not actually available on his street.

“My neighborhood was wired with fiber to the home when it [was built] a few years ago,” shared “Ed From Texas.” “AT&T is the provider and that was one of its advertised features. Who do I need to harass at AT&T to get Gigapower turned on for us?”

Gene R. is in a similar predicament:

“I can’t even get U-Verse and I am two blocks from loop 610,” he said. “AT&T says they don’t know when it will be available. I suspect…never.”

Richard dumped AT&T in the past for not meeting the speeds U-verse advertises, but is hopeful an all-fiber network might finally bring better speeds.

“I dropped AT&T’s MaxPlus because I never got anything approaching the 18Mbps speed I was being billed for,” he wrote.

“I dropped AT&T’s MaxPlus because I never got anything approaching the 18Mbps speed I was being billed for,” he wrote.

AT&T will sell several U-verse with GigaPower plans in Houston. The packages below include waivers of equipment, installation and activation fees, if you agree to allow AT&T to monitor your browsing activity:

- U-verse High Speed Internet Premier: Internet speeds up to 1Gbps starting as low as $110 a month, or speeds at 300Mbps as low as $80 a month, with a one year price guarantee;

- U-verse High Speed Internet Premier + TV: Internet speeds up to 1Gbps and qualifying TV service starting as low as $150 a month, or speeds at 300Mbps and qualifying TV service as low as $120 a month, with a one year price guarantee;

- U-verse High Speed Internet Premier + TV + Voice: Internet speeds up to 1Gbps with qualifying TV service and Unlimited U-verse Voice starting as low as $180 a month, or speeds at 300Mbps with qualifying TV service and Unlimited U-verse Voice as low as $150 a month, with a two-year price guarantee.

These offers all include a provision in the service agreement allowing AT&T to spy on your browsing habits ostensibly to supply “targeted advertising.” But the terms and conditions do not limit AT&T from broadening its monitoring of your usage for other purposes. If you opt out, the price goes up to $109 monthly for 300Mbps service and $139 monthly for 1Gbps broadband and you will pay installation and activation fees.

AT&T says the monitoring is done purely to power its targeted ads. Some examples:

- If you search for concert tickets, you may receive offers and ads related to restaurants near the concert venue;

- After you browse hotels in Miami, you may be offered discounts for rental cars there;

- If you search for a car online, which may include window shade, you may receive an email notifying you of a local dealership’s sale;

- If you are exploring a new home appliance at one retailer, you may be presented with similar appliance options from other retailers.

“You might receive these offers or ads online, via email or through direct mail,” says AT&T on their Internet Preferences page.

The “price guarantee” provision is actually a contract obligating you to stay with U-verse for 1-2 years or face an early termination fee of $180. AT&T also warns your Internet speeds will deteriorate “if two or more HD shows [are] viewed at same time.” Usage caps apply, as usual. GigaPower customers signed up for the fastest speeds receive 1 terabyte, or 1,000 gigabytes, of data per month. Customers will get warnings if they exceed the cap twice. The third time, and going forward after that, they’ll pay a $10 fee for each 50GB over the cap.

Subscribe

Subscribe

Despite the success of FiOS, Verizon’s senior management continues to devote more attention to its highly profitable Verizon Wireless division, spending an even larger proportion of its total capital investments on wireless services.

Despite the success of FiOS, Verizon’s senior management continues to devote more attention to its highly profitable Verizon Wireless division, spending an even larger proportion of its total capital investments on wireless services. AT&T CEO Randall Stephenson’s public hissy fit against the Obama Administration’s sudden backbone on Net Neutrality may complicate AT&T’s plans to win approval of its merger with DirecTV. forcing AT&T to retract threats to suspend fiber buildouts if the administration moves forward with its efforts to ban Internet fast lanes.

AT&T CEO Randall Stephenson’s public hissy fit against the Obama Administration’s sudden backbone on Net Neutrality may complicate AT&T’s plans to win approval of its merger with DirecTV. forcing AT&T to retract threats to suspend fiber buildouts if the administration moves forward with its efforts to ban Internet fast lanes.