Bypassed in favor of richer opportunities to the east, western Massachusetts residents are empowering their communities to deliver 21st century broadband the big cable and phone companies have neglected to offer.

Bypassed in favor of richer opportunities to the east, western Massachusetts residents are empowering their communities to deliver 21st century broadband the big cable and phone companies have neglected to offer.

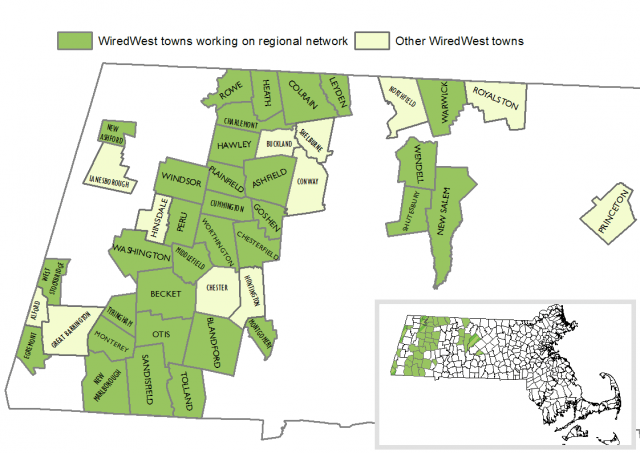

One of the largest public co-op broadband networks ever attempted is racking up huge wins so far in referendums being held in 32 towns across the region. The vote is needed to secure financing for construction of the last mile of the network in each community, delivering fiber optic service to individual homes and businesses.

Last summer the Massachusetts legislature passed the IT Bond Bill, which included $50 million to support critical last mile network construction efforts in unserved parts of the Commonwealth. But the rest of the money has to come from residents of each unserved community. A two-thirds vote is needed in each town to finance these construction expenses and at least 40% of residents must pre-register for service and pay a refundable deposit of $49, which will be applied to their first month’s bill. So far, more than 4,000 households have done exactly that, showing good faith in a project that won’t begin delivering service for an estimated 2-3 years.

As votes take place across the region, the response has been remarkable, with the warrant article passing overwhelmingly. In one town, it was even unanimous.

The excitement in western Massachusetts rivals a Google Fiber announcement. Reports indicate broadband-supporting crowds well exceeded the capacity of meeting rooms. In Cummington, the overflow left people in the hallways. In Plainfield, they gave up on their designated meeting room and moved everyone to the church across the street. In Shutesbury, even the gym and overflow areas weren’t enough. Some residents ended up on the preschool playground looking for an open spot. Nine communities for better broadband, zero opposed, with many more to go.

In small communities, signing up 40% of residents in advance can be a challenge. In Washington, it was achieved only hours before the approval meeting. In Middlefield, an additional 100 households are needed as that community is only at 14% of their signup goal. Montgomery needs 85 more backers as they sit at 39% of goal, and in Peru — 111 at 33% to goal.

For broadband in western Massachusetts, the vote is nothing less than a referendum on moving forward or getting left behind indefinitely.

Hussain Hamdan of Hawley, has launched a one-man war on public broadband, actively seeking signatures on a petition to pull his community of 347 out of the project, claiming it is too costly. Hamdan argues wireless broadband is a more suitable solution for the town. His petition, signed by at least 36 residents, wants no part of the WiredWest initiative, but he’d go further. Hamdan proposes to outlaw municipal utility services altogether, forbid selectmen or other town boards from appropriating a single penny for any WiredWest project, prohibit spending on postage for any mailings discussing public broadband, and even making sure town officials attending a function on municipal broadband are not reimbursed for their mileage expenses. Coincidentally, another Hamdan petition seeks the right to recall elected officials, ensuring any ousted politician cannot be re-elected to office for at least three years. (Hamdan denies his recall election proposal targets any town official specifically.)

Despite all this, Hamdan claims he is for bringing high-speed Internet access to town, just not through WiredWest. Unfortunately for the 300+ other residents of Hawley that did not sign the petition, Hamdan’s enthusiasm for alternative service has not been matched by a single interested provider seeking to fill Hawley’s broadband chasm.

Because Mr. Hamdan didn’t do his homework, we have, and here are the “alternatives” Hawley residents can actually consider:

Convincing Time Warner Cable to Come to Town

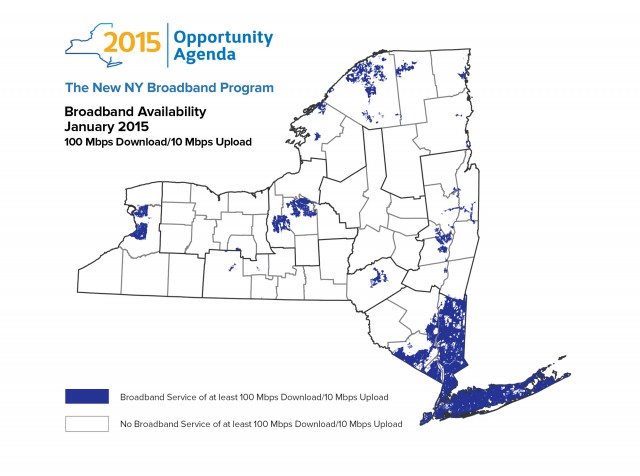

Assuming Time Warner Cable was somehow persuaded to offer service, as they already do in parts of western Massachusetts, they will expect considerable compensation to extend their cable network to a community that fails to meet their Return on Investment requirements. It will be an uphill battle. Next door in upstate New York, Time Warner Cable needed $5.3 million in taxpayer incentives just to expand service to, at most, 5,320 homes or businesses around the state that were already close to existing Time Warner service areas, but had no access to cable before. Conclusion: Time Warner Cable already serves the areas they feel comfortable serving.

Assuming Time Warner Cable was somehow persuaded to offer service, as they already do in parts of western Massachusetts, they will expect considerable compensation to extend their cable network to a community that fails to meet their Return on Investment requirements. It will be an uphill battle. Next door in upstate New York, Time Warner Cable needed $5.3 million in taxpayer incentives just to expand service to, at most, 5,320 homes or businesses around the state that were already close to existing Time Warner service areas, but had no access to cable before. Conclusion: Time Warner Cable already serves the areas they feel comfortable serving.

Mark Williams, who lives in Lee – Berkshire County, wanted Time Warner Cable service at his home. Lee has franchised Time Warner Cable to provide service throughout the community, so Williams didn’t think twice about ordering service. When the company arrived, it found his driveway was 100 feet too long.

Time Warner has a formula that determines who will pay to install necessary infrastructure. If a certain number of properties are located within a specific radius, they cover the costs. If a community isn’t presently served, if residents live too far apart, or have an unusual property, Time Warner expects the town or resident to cover part of their costs. In Williams’ case, $12,000 was initially quoted to wire his home back in 2010. Because Time Warner had already committed to provide service in the area, the bad publicity that resulted from that installation fee forced Time Warner to back down. But in unserved communities, the costs spiral even higher. Residents on the fringe of a cable coverage area are routinely quoted, $15,000, $20,000, even $35,000 just to get a cable line extended to a single home from a nearby street. We’re not sure how far away Hawley is from the nearest Time Warner Cable service area, but it is a safe bet the company would need enormous taxpayer-funded incentives from local residents to extend universal cable service in the community.

If both Time Warner and WiredWest were providing service side-by-side in Hawley today, residents would pay Time Warner Cable $911/yr for 20Mbps Turbo Internet broadband, including the $8/mo modem lease fee or $588/yr to WiredWest for 25Mbps broadband. WiredWest would save residents $323 a year — and help pay off its infrastructure costs while keeping the money in the community.

Assuming Time Warner Cable is never going to be an option, which we think is likely, the wireless alternatives suggested by Hamdan largely do not exist at this time, are unfeasible, or no longer meet the FCC’s minimum definition of broadband.

White Space Broadband: Can It Work in Western Mass.?

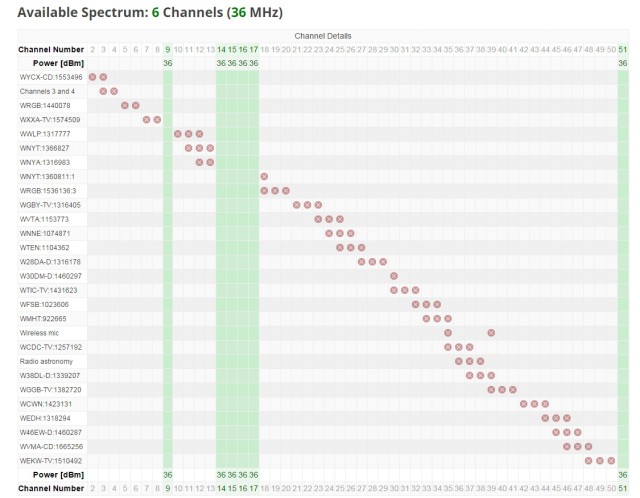

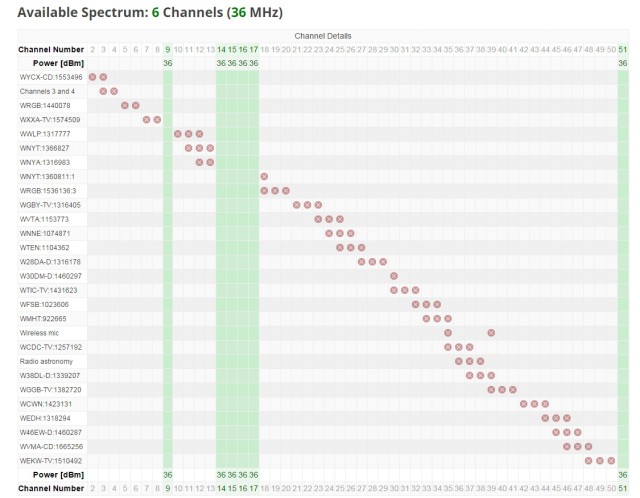

First, let’s consider “white space” broadband – high-speed wireless Internet access delivered over unused TV channels. At the moment, this service is still in the experimental stages in most areas, but as Stop the Cap! previously reported, it has promise for rural communities. Unfortunately, despite Hawley’s small size and rural location, the current database of available free channels to offer white space Internet access in the area is discouraging, based on the address of the community’s town office on Pudding Hollow Drive. There are just six open channels because of an abundance of TV signals in Connecticut, Vermont, Massachusetts, and New York that get precedence. Of these six, there are just four optimal choices – UHF channels 14-17. In our previous story highlighting Thurman, N.Y.’s white space project, there are 17 open channels in that area, none on VHF or reserved for radio astronomy. Feel free to use the database to see how many open channels are available in your local area.

Not much room at the inn. White space broadband will be a challenge in signal-dense northeastern states.

But the news may be even worse. The FCC is currently preparing to “repack” the UHF dial around the country by consolidating existing stations on a smaller number of channels. The freed up bandwidth will be auctioned off to cell phone companies to boost their networks. This month, we learned the wireless industry’s largest lobbying group is pushing hard to force other users to vacate “their” spectrum the moment they begin testing on those frequencies. Interference concerns and the dense number of TV signals already operating in the northeastern U.S. means it is very likely communities like Hawley will have even less opportunity to explore white space broadband as an option.

What About Wireless ISPs?

Second, there are traditional Wireless ISPs (WISPs) which do a reasonably good job reaching very sparsely populated areas, as long as customers are willing to sacrifice speed and pay higher costs.

BlazeWIFI advertises service in the rural community of Warwick, Mass (zip code: 01378). But it is anything but a bargain. The least expensive plan is $99.99 a month and that offers the dismally slow speed of 1.5Mbps for downloading and only 512kbps for uploading. It also includes a data cap of 25GB a month. That is slowband and a last resort. It’s more expensive, it’s slower, and it is usage-capped.

Some WISPs offer faster service, but few are equipped to handle the FCC’s definition of 25Mbps as the minimum speed to qualify as broadband. In short, this technology may eventually be replaced by white space broadband where speeds and capacity are higher, as long as suitable unused channel space exists.

What About Wireless Home Internet Plans from AT&T, Verizon Wireless?

What About Wireless Home Internet Plans from AT&T, Verizon Wireless?

Third, there are wireless broadband solutions from the cell phone providers. Only Hawley residents can decide for themselves whether AT&T and Verizon Wireless deliver robust reception inside the community. If they do, both companies offer wireless home Internet service.

The base charge for AT&T’s plan is $20 for unlimited nationwide phone calling + $60/mo for a 10GB Wireless Home Internet Plan. There is a 2-yr contract and a $150 early termination fee. Since the average household now uses between 15-50GB of Internet service per month (lower end for retired couples, 35GB median usage for AT&T DSL customers, but even more for young or large families), you have to upgrade the plan right from the start. A more suitable 20GB plan is $90/month. A 30GB plan runs $120 a month. The overlimit fee is $10/GB if you run over your plan’s limit. You will also be billed “taxes & federal & state universal service charges, Reg. Cost Recovery Charge (up to $1.25), gross receipts surcharge, Admin. Fee & other gov’t assessments which are not gov’t req’d charges.” Verizon’s plan is similar.

You must have robust cell coverage for this service to work and be ready for speeds of 5-20Mbps, getting slower as more customers join a cell tower. The lowest rate available runs about $90 a month after taxes and fees are calculated and you need to switch it off when you approach 10GB of usage to avoid additional fees.

What is the Best Option?

No broadband? No sale.

As we have seen across the United States, communities offered the possibility of fiber optic Internet are embracing it, some even begging for the technology. There is simply no better future-proof, high-capacity broadband technology available. But installing it has been costly – a fact every provider has dealt with. Most rural providers treat fiber optic technology as an investment in the future because it has very low maintenance costs, is infinitely upgradable, and can offer a foundation on which current and future high-bandwidth online projects can expand.

The fact is, western Massachusetts has been left behind by Comcast and Time Warner Cable, as well as Verizon. Nobody in the private sector is coming to the rescue. Verizon has stopped expanding its FiOS fiber network and all signs point to its growing interest in exiting the landline and wired broadband business altogether in favor of its higher profit Verizon Wireless. Cable operators strictly adhere to a Return on Investment formula and will not expand service areas without major taxpayer support.

In communities in more conservative states like Tennessee and North Carolina, the obvious choice was for local governments and municipal power companies to provide the service other providers won’t. Despite the industry funded scare stories, projects like EPB Fiber in Chattanooga and GreenLight in Wilson, N.C., are doing just fine and attract new businesses and jobs into both regions. They offer far superior service to what the local cable and phone company offer in those areas.

It is unfortunate rural residents have to effectively pay more to get a service urban areas already have, but to go without would be disastrous for school-age children, local entrepreneurs, agribusiness workers, and tele-medicine.

Mr. Hamdan argues Hawley cannot afford WiredWest. But if one looks deeper at the alternatives, it becomes clear Hawley can’t afford not to be a part of a service that is likely to be ubiquitous across the region. Even those not interested in the Internet can ask any realtor how important Internet access is to a homebuyer that considers inadequate broadband a deal-breaker. That could cost much more than the $350/yr Mr. Hamdan theoretically suggests WiredWest will cost Hawley.

Mr. Hamdan offers no real answers for his community about alternatives that are available, affordable, and capable of providing the kind of service WiredWest is proposing. Voters should carefully consider the economic impact of leaving their community in a broadband backwater as the rest of the region advances towards fiber optic broadband. That is the cost that is too high to pay.

[flv]http://www.phillipdampier.com/video/Wired West Western Mass broadband woes 1-15.mp4[/flv]

Wired West project coordinators didn’t have to go far to hear broadband horror stories in western Massachusetts, which has some of the worst Internet access in the world. (17:51)

Bypassed in favor of richer opportunities to the east, western Massachusetts residents are empowering their communities to deliver 21st century broadband the big cable and phone companies have neglected to offer.

Bypassed in favor of richer opportunities to the east, western Massachusetts residents are empowering their communities to deliver 21st century broadband the big cable and phone companies have neglected to offer.

Subscribe

Subscribe Frontier Communications, just hours after passing its first hurdle —

Frontier Communications, just hours after passing its first hurdle —  With Frontier’s attention currently occupied by its latest Verizon transaction, analysts do not expect to see a deal with FairPoint struck before 2017. That could allow Frontier’s rivals — CenturyLink and Windstream to approach FairPoint first. But neither of those two companies have recently been active acquiring new landline service areas.

With Frontier’s attention currently occupied by its latest Verizon transaction, analysts do not expect to see a deal with FairPoint struck before 2017. That could allow Frontier’s rivals — CenturyLink and Windstream to approach FairPoint first. But neither of those two companies have recently been active acquiring new landline service areas.

Assuming Time Warner Cable was somehow persuaded to offer service, as they already do in parts of western Massachusetts, they will expect considerable compensation to extend their cable network to a community that fails to meet their Return on Investment requirements. It will be an uphill battle. Next door in upstate New York, Time Warner Cable

Assuming Time Warner Cable was somehow persuaded to offer service, as they already do in parts of western Massachusetts, they will expect considerable compensation to extend their cable network to a community that fails to meet their Return on Investment requirements. It will be an uphill battle. Next door in upstate New York, Time Warner Cable

What About Wireless Home Internet Plans from AT&T, Verizon Wireless?

What About Wireless Home Internet Plans from AT&T, Verizon Wireless?

A Florida utility company has told federal regulators it is certain Verizon has a plan to exit its landline and wired broadband businesses within the next ten years to become an all-wireless service provider.

A Florida utility company has told federal regulators it is certain Verizon has a plan to exit its landline and wired broadband businesses within the next ten years to become an all-wireless service provider. “Verizon has not increased its efforts to deploy wireline broadband in the last three years; and there is no evidence that Verizon has used the capital saved on joint use rates for the expansion of wireline broadband,” FP&L officials write. “Indeed, all of the evidence shows that Verizon is abandoning its efforts to build out wireline broadband.”

“Verizon has not increased its efforts to deploy wireline broadband in the last three years; and there is no evidence that Verizon has used the capital saved on joint use rates for the expansion of wireline broadband,” FP&L officials write. “Indeed, all of the evidence shows that Verizon is abandoning its efforts to build out wireline broadband.”