Time Warner Cable admitted this morning extracting more revenue from existing customers was more important than attracting new ones, and long time subscribers responded by canceling service in above average numbers.

Time Warner Cable admitted this morning extracting more revenue from existing customers was more important than attracting new ones, and long time subscribers responded by canceling service in above average numbers.

In a conference call largely hosted by incoming CEO Robert Marcus, a number of Wall Street analysts listened to Marcus’ vision for Time Warner under his forthcoming leadership. Marcus offered competing, potentially incompatible visions in his defense of a lackluster quarter: charge existing customers higher prices for service to boost average revenue per subscriber (ARPU) while also improving the customer-company relationship.

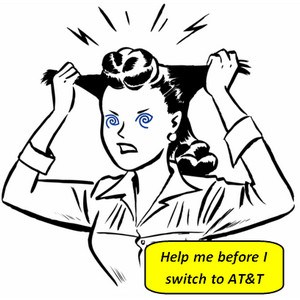

For most of 2013, Time Warner has been aggressively moving away from heavily discounted promotional offers to attract customers. Both outgoing CEO Glenn Britt and Marcus have repeatedly stressed heavy discounting of service during the past two years is now over, and the company is looking forward to resetting prices higher when the promotions end later this year.

It is part of the company’s plan to “drive better performance in the residential business.” An unfortunate side effect is that the company continues to lose video and phone customers and its broadband service growth has been so slow, one analyst called it “anemic.” The company’s quarterly results show Time Warner added only 8,000 new broadband customers in the last three months. The company still earned $1.42 billion from broadband sales alone over the last three months, mostly because of rising broadband bills.

Courtesy: Jacobson

Offsetting that growth, TWC lost 191,000 residential video subscribers, leaving it with about 11.9 million video customers. At least 56,000 customers also pulled the plug on Time Warner Cable telephone service.

“As we discussed before, this [new pricing] approach represents a conscious decision to pursue subscribers with higher ARPU, higher profit and lower churn even if that means fewer connects,” said Marcus as he defended the results. “So it’s not a surprise that as in the first quarter of 2013, subscriber net adds were down in the second quarter on a year-over-year basis.”

As customers deal with increasing prices for cable television and broadband service and the irritation of modem rental fees, many are cutting back on their packages to keep their bill stable.

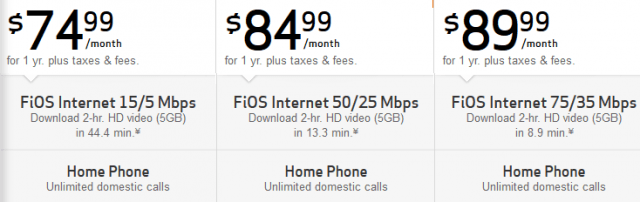

Marcus admitted customer sign ups of triple play — phone, broadband, and cable TV service — were way down in the second quarter and a lot fewer single and double-play customers were convinced to upgrade. The company’s promotional offers have come with a higher price and slower broadband service, often only 3Mbps.

In a number of markets, especially in the midwest, customers are shopping around for other providers. They are finding AT&T U-verse to be a formidable competitor.

“Throughout the quarter, U-verse was pretty aggressive with a beacon price of $79 for their triple play and $49 for their double play,” said Marcus. “I would characterize those as aggressive promotional prices, and they had an impact. I would say that the impact was more pronounced as the quarter wore on. We’ve now responded to that in the market, and I expect that our relative performance should improve there.”

But for much of the rest of the country where competition is less robust, Time Warner intends to continue to hold the line on pricing and resist discounting even if it means subscribers threaten to cancel.

Time Warner Cable has gotten itself ready for an onslaught of unhappy customers, assigning nearly 1,000 employees to staff four national customer retention centers dedicated to trying to persuade customers not to leave. But these specially trained representatives have a dual mission — keep customers with Time Warner Cable, but don’t give away the store doing so.

Stock buybacks and shareholder dividends were a major priority for Time Warner Cable’s cash on hand.

“Not only are our reps saving more customers, they are also preserving more ARPU among the customers they save,” said Marcus. “As promotional roll-offs peak in the second half of 2013, we expect that our new retention capabilities will drive better revenue growth.”

In the broadband market, Time Warner changed little in the second quarter except to raise prices on service and equipment. Marcus could only point to the addition of 3,500 new Wi-Fi hotspots, mostly in New York City, as its signature achievement over the past three months.

On the residential side, broadband revenues were up 12.5%, but most of that growth came from a combination of the modem lease fee, an increase in the number of 30/5 and 50/5Mbps customers and a successful Turbo promotion.

Results for video and voice were considerably worse. Revenues were down about 4%.

But the company managed to report its highest ARPU ever, with customers now paying an average of more than $105 a month for Time Warner service. Most of that increase came from rising broadband prices.

Time Warner Cable has also been preoccupied with spending excess cash on hand to buy back its own stock, which creates shareholder value. Time Warner expects to spend at least $2.5 billion on stock buybacks this year. Shareholders also received $829 million in dividends (113% of Time Warner’s free cash flow).

“We repurchased 6.6 million shares for $638 million, and through July, we have repurchased approximately 83 million shares at an average cost of around $78.50 per share since we began the program in November of 2010,” reported chief financial officer Arthur T. Minson.

Time Warner Cable’s Board of Directors recently approved increasing spending up to $4 billion on stock buybacks.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/WRGB Albany TWC Modem Fee 7-31-13.flv[/flv]

WRGB in Albany reports Time Warner Cable customers are angry about another price hike on the company’s modem lease fee effective Aug. 18. WRGB recommends customers buy their own modems to avoid the fee. Time Warner Cable’s Glenn Britt admitted earlier the fee is really just a hidden rate increase. (3 minutes)

“There is a monetization gap between how those channels are doing and how they should be doing measured by how peer cable channels are doing,” Burke explained. “In other words we are not paid as much as we think we should be given our ratings and our positioning by cable and satellite companies.”

“There is a monetization gap between how those channels are doing and how they should be doing measured by how peer cable channels are doing,” Burke explained. “In other words we are not paid as much as we think we should be given our ratings and our positioning by cable and satellite companies.”

Subscribe

Subscribe

“Nearly 30 percent of people are on a prepay mobile plan in 2013,” said Ed Davalos, lead product marketing manager at AT&T, during a recent Greentech Media webinar. “That cannot be overlooked. The consumer has already changed.”

“Nearly 30 percent of people are on a prepay mobile plan in 2013,” said Ed Davalos, lead product marketing manager at AT&T, during a recent Greentech Media webinar. “That cannot be overlooked. The consumer has already changed.”

The average owner of a large home that wants an alarm system, the ability to observe everything indoors and out, and remotely control doors, thermostats and electric outlets will pay AT&T $1,740 in installation fees and a recurring monthly charge of $69.95 a month for deluxe peace of mind.

The average owner of a large home that wants an alarm system, the ability to observe everything indoors and out, and remotely control doors, thermostats and electric outlets will pay AT&T $1,740 in installation fees and a recurring monthly charge of $69.95 a month for deluxe peace of mind.

Time Warner Cable admitted this morning extracting more revenue from existing customers was more important than attracting new ones, and long time subscribers responded by canceling service in above average numbers.

Time Warner Cable admitted this morning extracting more revenue from existing customers was more important than attracting new ones, and long time subscribers responded by canceling service in above average numbers.