A very frustrated employee of Frontier Communications working in one of their Ohio offices sent Stop the Cap! a detailed report on some of Frontier’s problems with customer service, unfair fees, and other horror stories. Over the next several days, we will present excerpts of this very long and detailed open letter, starting with what it is like to work in a Frontier customer service center dealing with customers unhappy with Frontier’s way of doing business. (Stop the Cap’s comments appear in italics.)

A very frustrated employee of Frontier Communications working in one of their Ohio offices sent Stop the Cap! a detailed report on some of Frontier’s problems with customer service, unfair fees, and other horror stories. Over the next several days, we will present excerpts of this very long and detailed open letter, starting with what it is like to work in a Frontier customer service center dealing with customers unhappy with Frontier’s way of doing business. (Stop the Cap’s comments appear in italics.)

I work for a company that I am, quite frankly, frustrated with. The company is Frontier Communications.

I am currently an employee in the Marion, Ohio office/call center, and I am a customer service representative. I handle everything in terms of selling services, troubleshooting issues with telephone service, writing orders, setting up payment arrangements, etc. We occasionally refer to ourselves as universal service representatives. The latter title would admittedly sound better on a resume if my company were to ever find out that I had wrote this and fired me. So, after spending a long while working for this company I have learned a lot. I have taken every type of call that there is to take out there, ranging from a simple billing issue to someone getting absolutely screwed because of a mistake one our other representatives made.

I understand that when you have a customer base of three million residential accounts that you will take some angry calls, statistically speaking. It happens. I imagine that happens with every company out there, whether it sells phone service or a t-shirts. You will eventually run into a dissatisfied customer. I feel with Frontier, it happens way too often.

First off, before I go any further, I would like to say my supervisor and director are very knowledgeable individuals, and in no way am I implicating them in this open letter. They do their best to curb ignorance and poor customer service. I feel that the company limits their abilities to do even more to make customer service at Frontier a much more honest experience. Even the director of our call center still has to take orders from someone.

Frontier’s Shock and Awe: The $200 Early Termination Fee for a Two-Year Contract Customers Never Realized They Had

Frontier’s early termination fees and contracts often come as a surprise to customers who had no idea they signed up.

I have noticed a lot of people calling in (and leaving comments on numerous review sites, as well as our Facebook page) voicing their displeasure about suddenly finding out that they were in a two-year contract, unable to cancel their services without incurring a 200 dollar early termination fee (ETF). This is something that I hate to deal with, as there are almost always no notes on any of these accounts left by previous representatives indicating they informed the customer of an ETF. Unless it is a special circumstance, we are supposed to tell you that you are notified on every billing statement that you are in a contract, and there is nothing that we can do to waive your fees. Most of the time, if a customer is persistent, they can actually escape and have these fees credited.

Firstly, the systems we use to write orders (Salesforce and DPI — yes, we have two different and completely redundant systems that serve the same function — one just looks prettier) both automatically default to the option of a 1 year contract with the option of automatically renewing that contact indefinitely. Frontier does offer a no-contract plan, but then you will fail to receive any sort of promotional pricing. So, a rep will write an order, complete it, and most of the time fail to review with the customer they are agreeing to a one year contract. We get a LOT of these types of calls, the majority originating from orders written by our service center in DeLand, Fla. What frustrates me is the lack of protocol that makes sure a rep notifies the customer that they are indeed being put on a contract. The calls are recorded and could be reviewed, but there are still too many of these people who fly under the radar and get stuck with a fee when it is too late to opt out.

It sucks to no end to have to tell somebody that they will have to spend an extra $200 to cancel their phone and Internet service, and many are left bewildered over the fee. It is always hard to tell who has really been screwed and who is trying to dodge an ETF. So we handle it with our gut. That’s the best we can do.

Once a Frontier Customer, Always a Frontier Customer… Unless You Pay and Pray

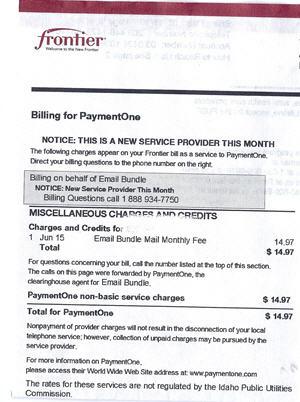

Frontier works hard at holding onto the customers they have, either with long term contracts with heavy early termination penalties or other tricks and traps that can make departing Frontier a difficult and costly ordeal. In addition to term contracts, Frontier heavily markets extra services they claim will protect your account from mischief, but in reality makes it much more difficult to switch phone companies or terminate landline service.

Locking your phone number from third party transfers also buys you a headache if you want to switch providers.

When a Frontier rep asks you to put a free service on your account that will make sure nobody else can steal it without your permission, most people agree to it. This is called a Primary Local Exchange Carrier Freeze. Representatives have an incentive to push this free service, winning a $3 bonus to our commission if you let us add it to your account.

This service makes sure any third party companies cannot port your service over to theirs without your permission. Even with your permission, they still can’t do it until a Frontier rep removes the freeze. That requires customers to call in and speak with us. This gives us a very valuable opportunity to rescue your business and get you to change your mind. Customer retention is vital, which is why Frontier pays us extra to push a service that costs you nothing.

If a customer insists on “porting out” — keeping their current phone number but moving service to a new provider — we will remove the freeze on your account, but you will pay us for doing it.

It does not cost Frontier anything to remove the freeze, but we now charge customers a $1 fee to change your provider. Want local service with one company and long distance service with another? We charge $1 for each.

When customers accept our offer to place a freeze on unauthorized third parties messing with your phone service without your permission, we are required to obtain third party verification of your desire to have this service. Frontier uses an independent verification company that is god-awful and treats customers rudely, even yelling at some who do not follow the precise verification procedure. If they don’t like your answers, the order will not go through.

Their treatment of our customers reflects poorly on Frontier, especially when a customer’s order to obtain service never gets beyond the verification process.

I’ve heard these reps rip into customers for not answering with a “yes” or “no.” In one case, a gentleman from South Carolina had simply wanted to make sure that telemarketing calls would not screw with his phone bill/service, so I offered a freeze to ease his mind. I was absolutely appalled when he was asked by the third party verifier if he authorized the changes and he replied with the usual southern-accented “ya” and the woman on the other end literally yelled at him for not answering “yes.” The customer was completely taken aback and abruptly hung up. I would have too.

As a result, I often do not bother to include line freezes on larger orders, fearing the unprofessional attitude customers might endure could sabotage my commission and the customer’s scheduled service date. I wish Frontier would utilize a different company to process and verify orders.

So You Are Leaving? Do Exactly What We Say or Lose Your Phone Number

Oh boy, do I LOVE number porting. Of course that is absolute sarcasm. So, a port-in/out on paper sounds like a rock solid type of deal. The customer can retain his or her phone number, and check out the grass on the other side, greener or browner.

The process for handling a port-in is also fairly simple, and you would think that this would not be an issue for the customer to worry about. Of course, I wouldn’t be venting about it if this were always the case.

One big mistake routinely made by Frontier and other companies is cancelling your existing telephone service before the number port is complete. Some customers want to hurry the divorce and take it upon themselves to terminate service with their old provider as soon as the new service is turned on.

Under no circumstances should you do this, as it will absolutely screw you out of keeping your phone number. This is basic knowledge instilled in every Frontier rep during training, yet screw-ups still happen when one of our reps cuts off service before the other company has taken ownership of your phone number. That means your number is gone. Sometimes the porting process takes as long as 60 days to go through, so please be patient.

Unfortunately, with no system in place to prevent ignorant reps from screwing things up, numbers get lost. Sometimes it is our fault, sometimes it is with the customer, other times the new company created the problem. But we are often the ones left to explain to a customer the phone number they have had for 40 years is gone for good.

But it can get worse once someone else randomly grabs your old number. Imagine what happens when a grandmother’s lost number is reassigned to a porn smut peddler. Now some porn shop down the way has grandma’s number. This actually happened to a customer of a major cable provider. Imagine her friends and family trying to get her only to reach these people instead. It’s not a fun mess to clean up.

Coming Up: Wheel of Installation & Modem Fees, Adventures With Missed Appointments & Lost Trouble Tickets, and Big Trouble in Little DeLand

Subscribe

Subscribe