Stage two of the nightmare is billing problems, and one West Virginia family discovered a phone bill they couldn't imagine possible.

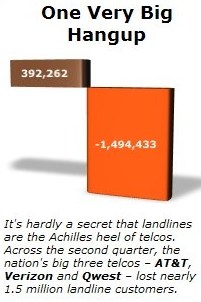

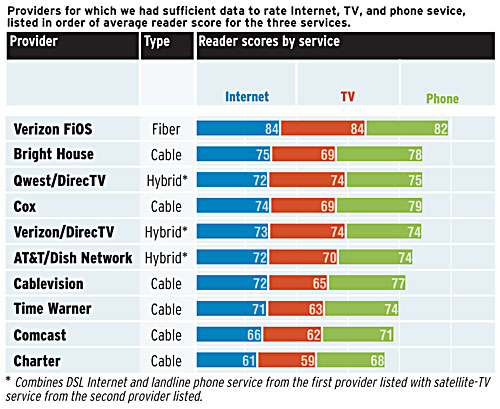

Frontier Communications’ performance in West Virginia is starting to resemble northern New England’s never ending nightmare with FairPoint, the phone company that couldn’t manage landline service for customers in Maine, New Hampshire and Vermont and ended up in bankruptcy. Things have gotten so bad, Frontier Communications now earns an “F” rating from the Better Business Bureau, called out specifically for failing to respond to complaints filed against the provider, failure to resolve the complaints they did acknowledge, and government action taken against the company for deceptive business practices.

Stop the Cap! reader Ralph in West Virginia drops us a line to share the latest progress the company is making in his part of West Virginia, or rather the lack thereof, starting with his own personal story:

The afternoon of Thursday Sep. 2nd, our phones were out of order for awhile but were working by 4pm. The DSL was still out so I waited to see if they’d get it fixed later that evening. When it was still out Friday afternoon, I called to report it and asked if they had a reported outage for the area. Their answer was no, and they proceeded to ask me to reset the modem and perform some additional diagnostic testing.

That didn’t “fix” it so they filed a trouble ticket and told me a technician would be out to check the outside wiring and, if needed, give me a new modem. Frontier never showed up, so I called again and was left on hold for 30 of the 35 minutes that phone call lasted. I was finally told that it was a known outage affecting 12 people in the area. No repairs were made on Sunday so I called on Monday and was told the problem now affected 16 people and they had no idea when it would be fixed. It was finally fixed five days after initially reporting the outage, and nobody bothered to explain why it took so long. I was later bemused to find an article in the weekly county paper that noted the outage was now up to impacting 20 people.

In your earlier report about Frontier, a spokesman for the company claimed the company follows a protocol about calling customers with service problems to see if the issues were resolved, but that call didn’t come until Sep. 8th, a full 24 hours after our DSL service was restored. Keep up the good work, maybe Frontier and other providers will realize that the system is broken and we do want and need high speed Internet.

Ralph is not alone in having trouble with Frontier. Just as Stop the Cap! reported with FairPoint’s failure in New England, service problems are just the beginning of the “fun” for transitioned customers. Billing problems come next, and Frontier followed through in spades for one West Virginia family.

Ralph is not alone in having trouble with Frontier. Just as Stop the Cap! reported with FairPoint’s failure in New England, service problems are just the beginning of the “fun” for transitioned customers. Billing problems come next, and Frontier followed through in spades for one West Virginia family.

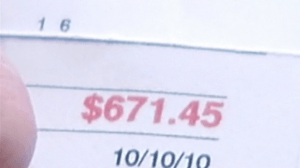

Meet Johna and Paul Snatchko, who are being billed $671.45 for dial-up Internet service calls by Frontier. Not only did Frontier fail to deliver broadband service to the northwestern part of the state, now the Snatchko family has had to quit using dial-up Internet as well because the Snatchko’s claim Frontier made accessing the service a long distance call.

“When we switched from Verizon to Frontier, they said nothing will change,” Paul told WTOV News. “Well, there’s change.”

Despite selling the Snatchko family “unlimited long distance” service, Frontier still charged every call to their ISP at the regular long distance rate. Why use dial-up in the first place?

“In this part of West Virginia, you’re very limited in your service,” Paul explained. “Dial-up is it for us. We’ve tried everything else. The only thing we could get was dial-up.”

The family also endured another Frontier specialty — the constantly changing promotional offers that are poorly explained by the company’s customer service representatives.

“They said it doesn’t include their package deal with the computer,” Johnna said, referring to a common Frontier promotion for a free netbook in return for a bundled package of services on a two year contract. “The first couple months it did and now it doesn’t include it.”

Frontier’s spokesman for the area, Bill Moon, made yet another TV appearance to try and explain it all away.

“There are billing problems that can happen anytime you have a switch over like that,” he told WTOV. “It’s probably a simple mistake on this particular customer’s bill, something that can be rectified pretty easy.”

Apparently not. Frontier told the family they have received two credits already and that is the last time the company is willing to provide them.

Despite the increasing frequency and seriousness of complaints now becoming a staple on the nightly news, Moon said incidents like this are rare. He told the station out of more than 60,000 lines of service, they’ve had about 10 problems at most.

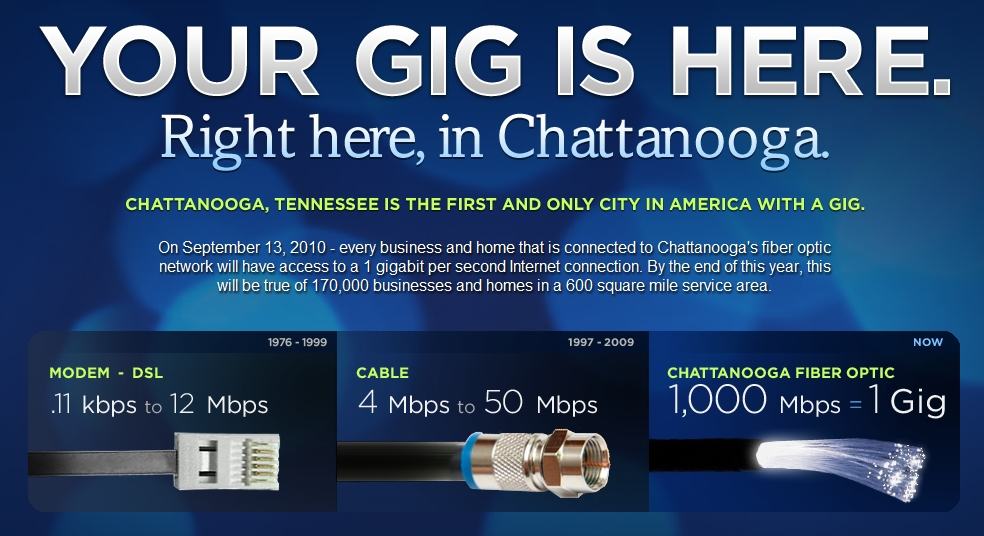

West Virginians are also waking up to the realization that Frontier’s promised “fiber upgrades” are little more than bait and switch, and they’ll never be able to directly access the fiber the company is installing. As Stop the Cap! has reported previously, Frontier’s residential customers are more likely to encounter beneficial fiber in their morning breakfast cereal than from Frontier Communications.

The Charleston media is abuzz about the fact taxpayers are footing the bill for a $40 million fiber network that the company will own free and clear, and charge top dollar prices to access. Citynet, one of Frontier’s competitors, blew the whistle over Frontier’s much-ballyhooed fiber expansion that is actually intended to serve public institutions, wholesale customers, and Frontier’s “middle-mile” network — not directly benefit consumers:

The Charleston media is abuzz about the fact taxpayers are footing the bill for a $40 million fiber network that the company will own free and clear, and charge top dollar prices to access. Citynet, one of Frontier’s competitors, blew the whistle over Frontier’s much-ballyhooed fiber expansion that is actually intended to serve public institutions, wholesale customers, and Frontier’s “middle-mile” network — not directly benefit consumers:

[…]Once Frontier spends the $40 million of taxpayer money to expand its network, it will be the sole owner of that network and the State will have no ownership rights. Thus, Frontier’s monopoly in the State of West Virginia will have been financed with taxpayer money.

Frontier will then sell services to state entities such as schools and government offices at the existing exorbitant prices. Those prices will never decrease, because no competitor can afford to spend $40 million or more of its own capital to build out its network.

Citynet, however, has provided the state with a plan for the expenditure of the taxpayer money that will expand broadband access in the state while at the same time lowering the cost of broadband access by 70 percent to 90 percent.

It is true that competitors, like Citynet, have existing contracts with Frontier for access to fiber facilities, but given that Frontier’s new network will be built with your money, it is Citynet’s position that those facilities should be made available to competitors at a nominal cost so that competitors can make their services available to the public at large at much lower prices.

Frontier has flatly refused Citynet’s proposal and intends to require competitors to pay inflated prices for access to fiber facilities it built for free.

As currently structured, the state’s plan for expanding broadband will do nothing more than expand Frontier’s monopoly, and will not address the fundamental problem of the high cost of broadband access.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/WTOV Steubenville Speaking Too Soon – Frontier’s Customers Still Complaining 9-15 and 9-28-10.flv[/flv]

WTOV-TV thought Frontier’s problems were behind them when they ran the first of two stories about the company Sep. 15th. But then they met the Snatchko family and learned they spoke too soon. Last night, they tried to determine how a West Virginia family could be charged nearly $700 for dial-up Internet service. (4 minutes)

Subscribe

Subscribe