“Frontier offers a level of suckage that cannot be proportionally compared with any other company in America. Stabbing yourself with knitting needles is less painful than their snail slow internet service and dealing with customer service agents that formerly served as prison guards at a Syrian detention camp.” — A deeply dissatisfied Frontier DSL customer in Ohio

“Frontier offers a level of suckage that cannot be proportionally compared with any other company in America. Stabbing yourself with knitting needles is less painful than their snail slow internet service and dealing with customer service agents that formerly served as prison guards at a Syrian detention camp.” — A deeply dissatisfied Frontier DSL customer in Ohio

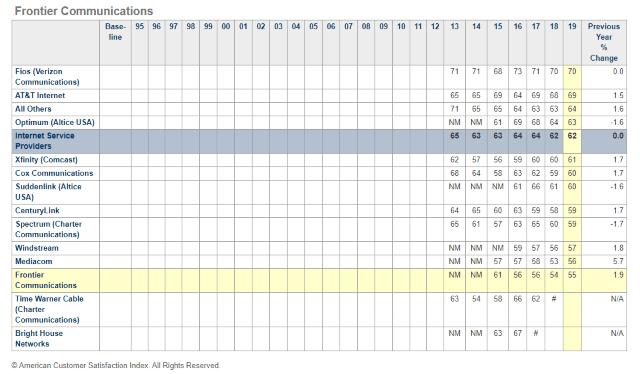

Frontier Communications has achieved a new low in customer satisfaction, wrestling away the award for America’s worst ISP from perennial favorite Mediacom, in a newly released American Customer Satisfaction Index.

No internet service provider did particularly well in customer satisfaction, but Frontier managed to alienate more of their customers than any other this year, ranking poorly in speed, reliability, and customer service. Customers also complained about being given inaccurate information, inaccurate billing, and surprise charges on their bill.

Frontier’s worst performance is delivered in legacy DSL service areas, where its aging copper wire network is often incapable of delivering 21st century broadband speeds. In many areas, speeds drop well below 10 Mbps during peak usage. Even worse, company officials signaled that the company had few plans to improve its wireline network or service experience in 2019. As a result, many customers switched providers, if one was available. If Frontier is the only option, customers often have no options.

Frontier’s worst performance is delivered in legacy DSL service areas, where its aging copper wire network is often incapable of delivering 21st century broadband speeds. In many areas, speeds drop well below 10 Mbps during peak usage. Even worse, company officials signaled that the company had few plans to improve its wireline network or service experience in 2019. As a result, many customers switched providers, if one was available. If Frontier is the only option, customers often have no options.

“For several years we have had no internet options except for Frontier. We receive 10 to 20% of the service we pay for time and time again,” wrote one customer in a complaint with the Better Business Bureau. “The service has even diminished over time, [and] whenever my work demands me to log online, I often have to leave my home at different times of the day or night to a location where I can get free Wi-Fi or drive 24 miles to my job. This is totally unacceptable. Every single weekend and every night my internet shuts off. I mean every night. Nothing has been done from a customer’s view to improve service.”

What seems to have driven Mediacom out of last place was not so much an improvement in their network or service.

“Mediacom has the second-lowest score among subscription TV services at 56, but has one of the highest-rated mobile apps, both in terms of quality and reliability,” the ACSI found.

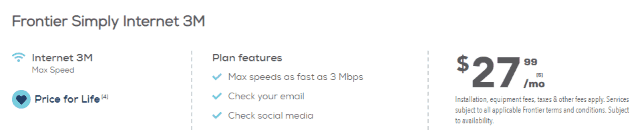

Frontier has an improved website, but still offers many potential subscribers a severe disappointment when shopping for internet plans, and finding only one:

Subscribe

Subscribe Frontier Communications will pay one smartphone addict $1,000 if they will give up their device for one week and rely on a 1990s-era obsolete flip phone instead. The cringe worthy challenge, soaked in irony, is brought to you by a phone company that delivers late 1990s-era DSL to a substantial number of its customers.

Frontier Communications will pay one smartphone addict $1,000 if they will give up their device for one week and rely on a 1990s-era obsolete flip phone instead. The cringe worthy challenge, soaked in irony, is brought to you by a phone company that delivers late 1990s-era DSL to a substantial number of its customers. Cable One has the highest average revenue per customer of any publicly traded cable company in the United States, with

Cable One has the highest average revenue per customer of any publicly traded cable company in the United States, with

CenturyLink is considering getting out of the consumer landline and broadband business and instead focusing on its profitable corporate-targeted enterprise and wholesale businesses.

CenturyLink is considering getting out of the consumer landline and broadband business and instead focusing on its profitable corporate-targeted enterprise and wholesale businesses. Frontier Communications

Frontier Communications