Frontier is enticing Rochester-area customers to “say goodbye to Time Warner Cable.”

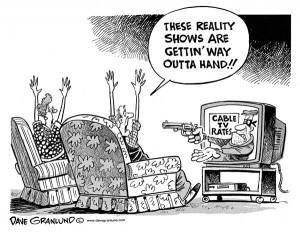

Time Warner Cable’s relentless rate increases, particularly on its broadband service, are leading to calls for more competition in the upstate New York cities of Buffalo and Rochester, now dominated by Time Warner, Verizon Communications (Buffalo), and Frontier Communications (Rochester).

“Bloodsuckers,” came the terse reply of Cathy Slocum.

Frontier Communications is making the most out of the cable company rate increases with a new “Goodbye Time Warner” ad campaign (that incidentally includes a link to Stop the Cap!’s coverage of TWC’s modem fee). It is pitching $19.99 broadband price-locked for two years — an improvement over its earlier offers thanks to a major reduction in sneaky fine print.

Customers can get up to 6Mbps service (up to 12Mbps available in limited areas) at the special offer price as long as they keep a Frontier landline active with a qualifying calling package. There are no contracts with this promotion, but Frontier’s pesky $9.99 “Broadband Processing Fee” applies if customers ever choose to disconnect Internet service. A free Wi-Fi Internet router is included and the company claims it offers “free Internet activation.” But an installation fee still applies, discounted if customers choose the self-install option. Taxes, governmental and other Frontier-imposed surcharges also apply and new Frontier customers are subject to credit approval, which will show up as an inquiry on your credit report.

In the past, we have taken Frontier to task for its expensive early termination and modem rental fees, as well as its bundling requirements, but the company has since ditched most of these as part of its new self-proclaimed reputation as “BS free.”

Unfortunately, Frontier’s DSL speeds can wildly vary, so if you take advantage of their offer, be sure to verify the speed actually get at your home or office. If the service proves too slow to your liking after installation, you can negotiate canceling within the first two weeks without any termination fees.

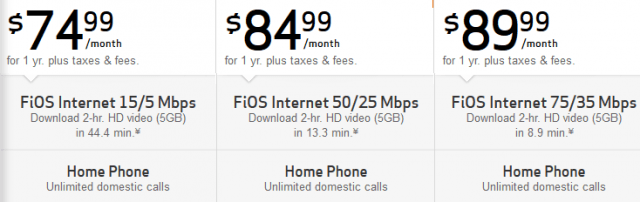

Where FiOS is available in Buffalo, Verizon is offering promotional pricing on its bundled services, including an $84.99 offer including 50/25Mbps Internet with a Verizon landline offering unlimited calling. This is cheaper than Time Warner’s offer with considerably faster upload speeds and no modem fees. In parts of Buffalo, Verizon is authorized to offer broadband and phone service only, although several suburbs have franchise agreements that allow the phone company to also sell television service. A large part of the city and other suburbs are still stuck with Verizon’s copper network, however, which means DSL is the best they can offer.

Time Warner Cable’s new customer promotions, useful when negotiating a customer retention deal, have resumed bundling Standard tier (15/1Mbps service) Internet speeds into most offers. Previously, the company bundled 3Mbps service in many of its promotions. Broadband-only customers can pay as little as $34.99 a month for a year of Internet service at 15/1Mbps speeds, assuming one buys their own cable modem. A double play offer of broadband basic television (around 20 channels, mostly local over-the-air) with 30/5Mbps Internet service is now priced at $94.97 a month after a $5.99 mandatory modem rental fee is included (not optional with this package).

Time Warner Cable executives have repeatedly told investors its higher priced promotions are intentional to increase revenue and profits even if the company loses customers by charging higher prices.

Verizon FiOS offers in the Buffalo area.

“I moved here from the New York City area a year ago where we had two cable companies — Cablevision and Verizon FiOS,” noted Stephen O’Brien. “Competition changes everything. Not only were the rates much lower than here, the companies would offer you all kinds of incentives to switch from one to the other. One time we switched and got a free iPod Touch. The argument that the rate increase is needed to cover investment is the biggest red herring of all — Cablevision and FiOS spent many times more on infrastructure, yet their rates were much lower.”

Stop the Cap! recommends Time Warner Cable customers check out our guide to getting the best deal possible from TWC.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/WGRZ Buffalo Time Warner Rate Hikes 8-6-13.flv[/flv]

WGRZ in Buffalo reports upstate New York residents are upset about two recently announced broadband rate hikes. Time Warner Cable says it needs the money to keep up its broadband service’s reliability. What alternatives do customers have? (2 minutes)

Subscribe

Subscribe

Although cable and phone companies love to declare themselves part of a fiercely competitive telecommunications marketplace, it is increasingly clear that is more fairy tale than reality, with each staking out their respective market niches to live financially comfortable ever-after.

Although cable and phone companies love to declare themselves part of a fiercely competitive telecommunications marketplace, it is increasingly clear that is more fairy tale than reality, with each staking out their respective market niches to live financially comfortable ever-after. This is hardly a “War of the Roses” relationship either. Wall Street teaches that price wars are expensive and competitive shouting matches do not represent a win-win scenario for companies and their shareholders. The two companies get along fine where Verizon has virtually given up on DSL. Time Warner Cable actually faces more competition from AT&T’s U-verse, which is not saying much. The obvious conclusion: unless you happen to live in a FiOS service area, the best deals and fastest broadband speeds are not for you.

This is hardly a “War of the Roses” relationship either. Wall Street teaches that price wars are expensive and competitive shouting matches do not represent a win-win scenario for companies and their shareholders. The two companies get along fine where Verizon has virtually given up on DSL. Time Warner Cable actually faces more competition from AT&T’s U-verse, which is not saying much. The obvious conclusion: unless you happen to live in a FiOS service area, the best deals and fastest broadband speeds are not for you. That means Time Warner Cable has an 80 percent market share. Actually, it is probably higher because that total number of households includes those who either don’t want, need, or can’t afford broadband service. Some may also rely on limited wireless broadband services from Clearwire or one of the large cell phone companies.

That means Time Warner Cable has an 80 percent market share. Actually, it is probably higher because that total number of households includes those who either don’t want, need, or can’t afford broadband service. Some may also rely on limited wireless broadband services from Clearwire or one of the large cell phone companies. Rochester remains a happy hunting ground for Internet Overcharging schemes because the only practical, alternative broadband supplier is Frontier Communications, which Time Warner Cable these days dismisses as an afterthought (remember that 80 percent market share). Without a strong competitor, Time Warner has no problem experimenting with new “usage”-priced tiers.

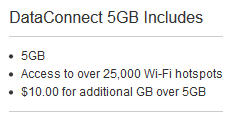

Rochester remains a happy hunting ground for Internet Overcharging schemes because the only practical, alternative broadband supplier is Frontier Communications, which Time Warner Cable these days dismisses as an afterthought (remember that 80 percent market share). Without a strong competitor, Time Warner has no problem experimenting with new “usage”-priced tiers. In nearby Ohio, the average broadband user already exceeds Time Warner’s 30GB pittance allowance, using 52GB a month. Under both plans, customers who exceed their allowance are charged $1 per GB, with overlimit fees currently not to exceed $25 per month. That 30GB plan would end up costing customers an extra $22 a month above the regular, unlimited plan. So much for the $5 savings.

In nearby Ohio, the average broadband user already exceeds Time Warner’s 30GB pittance allowance, using 52GB a month. Under both plans, customers who exceed their allowance are charged $1 per GB, with overlimit fees currently not to exceed $25 per month. That 30GB plan would end up costing customers an extra $22 a month above the regular, unlimited plan. So much for the $5 savings.

AT&T’s DataConnect plan, suitable for fixed wireless home use,

AT&T’s DataConnect plan, suitable for fixed wireless home use,  Netflix kicks off the summer

Netflix kicks off the summer