Shaw is western Canada’s dominant cable operator.

While American cable companies have cut back investing in their high-speed broadband services as competition languishes, a price and service war has erupted between western Canada’s biggest cable and phone companies, with consumers winning the benefits of increased investment and fierce competition.

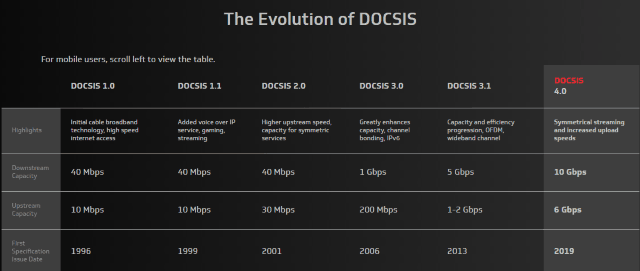

Shaw Communications, the largest cable company west of Ontario, has just upped the ante with the introduction of 1,500/100 Mbps unlimited internet service for $127 (all prices in $US) a month. The new speed tier, known as Fibre+ Gig 1.5, is delivered over Shaw’s existing DOCSIS 3.1 cable broadband network, and is already available in Winnipeg, Calgary, Edmonton, Vancouver, and Victoria, and is gradually expanding outwards to smaller cities, including Banff in Alberta, and Burnaby and Dawson’s Creek in British Columbia. Shaw also offers a traditional gigabit unlimited plan in most of its service area, offering 940/25 Mbps for $88/month. Both high-speed plans include a two-year contract.

“The hard work and investments we’ve made in building, upgrading and expanding our Fibre+ and Fast LTE networks and services — nearly $22.8 billion over the past seven years — allow us to deliver these ultrafast speeds to western Canadians over our existing infrastructure,” said Zoran Stakic, chief operating officer and chief technology officer. “These ongoing investments are the foundation to providing our customers service beyond one gigabit today and ultrafast speeds to more places in the future.”

“We know that there’s a growing segment of people — including heavy gamers, content creators and super streamers — who need access to ultrafast internet services, and that need has only increased during the pandemic as many of our customers manage the reality of having multiple people working from home and sharing bandwidth,” said Paul Deverell, president of Consumer, Shaw Communications. “With the launch of our Fibre+ Gig 1.5 product, we are delivering the speeds and capacity needed by today’s super users and data-heavy customers, while confirming Shaw’s position as the western Canadian leader in gigabit speed deployment.”

Telus is western Canada’s largest phone company.

Shaw’s increased investment is designed to fend off its chief competitor, Telus. In 2020, Shaw discovered a growing number of its broadband customers defecting in favor of Telus, the region’s telephone company. Telus is expanding its own high-speed offering, which relies on fiber to the home service. In some areas, Telus offers 940/940 Mbps service on a two-year contract for $76 a month and a 1,500/940 Mbps plan for $127 a month — which matches Shaw’s price but vastly exceeds Shaw in upload speed. To further sweeten the deal, Shaw gives its premium-speed internet customers discounts on Shaw Mobile services — including the exclusive rate of $25 per month on Unlimited Data wireless plans for Shaw Fibre+ Gig 1.5 and Fibre+ Gig internet subscribers.

Shaw claims its infrastructure has made it possible to offer gigabit service to at least one million more western Canadians than Telus. Telus has been gradually scrapping its legacy copper wire network in favor of fiber optics, but will likely take over a decade to complete the transition in significantly populated communities.

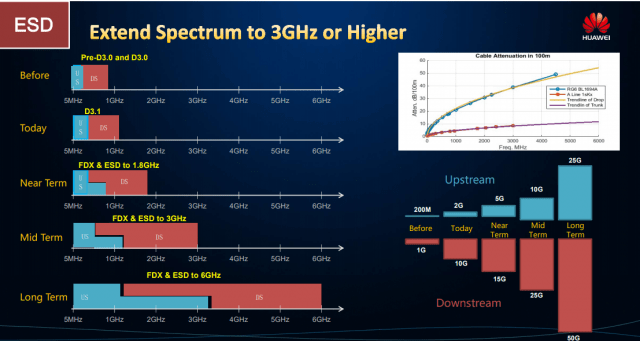

While Canadian cable companies are pushing DOCSIS 3.1 to the limit, American cable companies have taken it easy this year, reducing estimated budgets for network investment, returning to data caps, and putting further upgrades to next generation DOCSIS 4.0 on hold for at least a year or two. With AT&T and Verizon distracted and focused on spending billions to build 5G wireless networks, both companies have stopped significant expansion of fiber-to-the-home service for residential customers, reducing competitive pressure on cable operators. This reduced competition allows cable companies an opportunity to raise rates on broadband customers, and Charter Spectrum has done exactly that, announcing a general $5/month increase on residential internet service to take effect by the start of 2021.

Subscribe

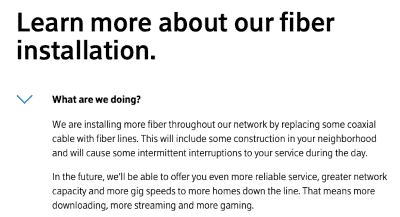

Subscribe Some Comcast customers are receiving notifications their service may be briefly interrupted as a result of ongoing network enhancements:

Some Comcast customers are receiving notifications their service may be briefly interrupted as a result of ongoing network enhancements: Comcast is currently preparing its network for full duplex DOCSIS 4.0 service by adopting “node plus zero” network architecture, which in plainer terms means removing signal amplifiers from existing lines and replacing a significant percentage of its copper coaxial cable infrastructure with fiber optics. The fiber network upgrades are reportedly bringing more consistent and faster internet speed on a more reliable network as soon as the switch is complete. Most customers won’t see fiber cables replacing the current cable line coming into their homes, however. The upgrade is mostly taking place on utility poles and, in some places, underground as Comcast replaces copper wiring with optical fiber cables.

Comcast is currently preparing its network for full duplex DOCSIS 4.0 service by adopting “node plus zero” network architecture, which in plainer terms means removing signal amplifiers from existing lines and replacing a significant percentage of its copper coaxial cable infrastructure with fiber optics. The fiber network upgrades are reportedly bringing more consistent and faster internet speed on a more reliable network as soon as the switch is complete. Most customers won’t see fiber cables replacing the current cable line coming into their homes, however. The upgrade is mostly taking place on utility poles and, in some places, underground as Comcast replaces copper wiring with optical fiber cables. CableLabs unveiled the final DOCSIS 4.0 specification today, dramatically improving upload speeds and offering the potential of much faster internet service from cable operators in the next few years.

CableLabs unveiled the final DOCSIS 4.0 specification today, dramatically improving upload speeds and offering the potential of much faster internet service from cable operators in the next few years.

Despite assurances from FCC Chairman Ajit Pai that the repeal of net neutrality would inspire cable operators to increase investment in broadband, a year-long virtual spending freeze by the nation’s top cable operators has resulted in a major vendor pulling out of the next generation cable broadband standard until there are signs cable companies are prepared to spend money on upgrades again.

Despite assurances from FCC Chairman Ajit Pai that the repeal of net neutrality would inspire cable operators to increase investment in broadband, a year-long virtual spending freeze by the nation’s top cable operators has resulted in a major vendor pulling out of the next generation cable broadband standard until there are signs cable companies are prepared to spend money on upgrades again. FDX has already been the victim of delays. Originally planned as an incremental upgrade for DOCSIS 3.1, FDX is now scheduled to be included in CableLabs’ DOCSIS 4.0 specification, which is not expected to be released for a few years. FDX will be one of several new features incorporated into the next cable broadband standard, which will allow for low latency connections and an expanded amount of coaxial cable spectrum that can be devoted to broadband services.

FDX has already been the victim of delays. Originally planned as an incremental upgrade for DOCSIS 3.1, FDX is now scheduled to be included in CableLabs’ DOCSIS 4.0 specification, which is not expected to be released for a few years. FDX will be one of several new features incorporated into the next cable broadband standard, which will allow for low latency connections and an expanded amount of coaxial cable spectrum that can be devoted to broadband services.

Industry trade association NCTA reports that Comcast, Charter, Cox, Mediacom, Midco, Rogers (Canada), Shaw Communications (Canada), Vodafone (Europe), Taiwan Broadband Communications, Telecom Argentina, Liberty Global (Europe/Latin America) are all implementing the industry’s 10G initiative, with lab trials already underway, and field trials beginning in 2020. DOCSIS 4.0 will ultimately be a part of that project.

Industry trade association NCTA reports that Comcast, Charter, Cox, Mediacom, Midco, Rogers (Canada), Shaw Communications (Canada), Vodafone (Europe), Taiwan Broadband Communications, Telecom Argentina, Liberty Global (Europe/Latin America) are all implementing the industry’s 10G initiative, with lab trials already underway, and field trials beginning in 2020. DOCSIS 4.0 will ultimately be a part of that project.