Altice, the new owner of Cablevision, is not following the rest of the U.S. cable industry by rolling out the next generation of cable broadband — DOCSIS 3.1 — and will instead scrap coaxial cable entirely in favor of a new, all-fiber network.

Altice, the new owner of Cablevision, is not following the rest of the U.S. cable industry by rolling out the next generation of cable broadband — DOCSIS 3.1 — and will instead scrap coaxial cable entirely in favor of a new, all-fiber network.

The cable industry has depended on some form of coaxial cable to offer its service since about 1950, when the first mom and pop operators set up shop offering community antenna television service in areas that could not easily receive over the air TV stations. Most American cable systems today still use the coaxial cable installed in millions of homes starting in the 1970s, supplemented by outdoor coaxial cable that is often 10-20 years old, supported by a more recent fiber backbone network that improves system reliability and maintenance.

Cable systems were originally designed to deliver analog cable television signals, but over the years bandwidth has been set aside to offer ancillary services like video game products, home security and alarm monitoring, digital radio/music, telephone, and broadband. Because of the billions of dollars invested in existing cable networks, the idea of scrapping existing wiring in favor of fiber optics has been largely rejected by the industry as too costly. As broadband service increasingly becomes cable’s most important service, network engineers have instead worked to realign bandwidth to support faster internet speeds, most commonly by upgrading to more efficient cable broadband transmission standards and by removing space hogs like analog television channels from the lineup.

Regardless of what the cable industry does to increase the efficiency of its hybrid coaxial-fiber networks (known as ‘HFC’), they will never achieve the capacity and robustness of all-fiber networks, which may be why Altice is seeking to stop investing in old technology in favor of something new and better.

Regardless of what the cable industry does to increase the efficiency of its hybrid coaxial-fiber networks (known as ‘HFC’), they will never achieve the capacity and robustness of all-fiber networks, which may be why Altice is seeking to stop investing in old technology in favor of something new and better.

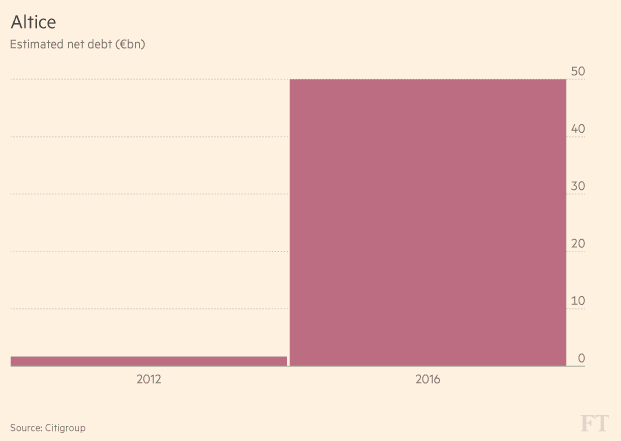

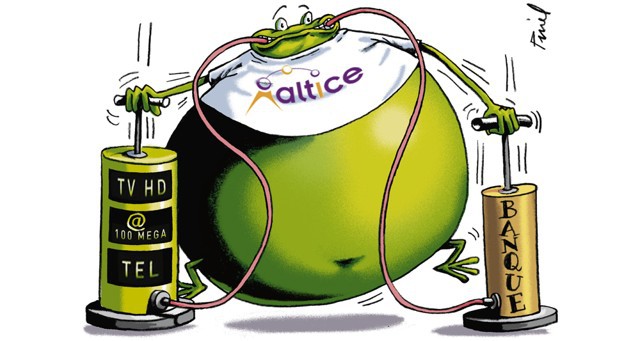

Altice’s management is legendary in its zeal to cut costs, so an expensive deployment of fiber to the home service to 8.3 million Cablevision/Optimum and Suddenlink customers would seem contrary to the company’s promise to wring out about $900 million in cost savings for the benefit of shareholders after acquiring Cablevision. DOCSIS 3.1 is clearly a cheaper alternative than rewiring millions of homes for all-fiber service. Last summer, Liberty Global CEO Mike Fries estimated that Liberty Global’s costs to deploy the cheaper DOCSIS 3.1 option in Europe would bring gigabit speeds to customers for about $21 per home — a fraction of the cost of tearing out coaxial cable and replacing it with fiber, estimated to cost about $500 a customer.

But Altice wants to future-proof its network with fiber technology that can support profitable next-generation services that may need speed in excess of a gigabit. Dexter Goei, Altice USA’s chairman and CEO, told Multichannel News Altice was not interested in undertaking incremental upgrades every few years trying to keep up with the internet speed demands of its customers:

Goei

Going with a DOCSIS 3.1 game plan “felt to us as one step forward but not a step forward enough relative to what we see as the future of continued connectivity and higher bandwidth usage,” Dexter Goei, Altice USA’s chairman and CEO, said in an interview, noting that the operator has reached an “inflection point” as it sees a disproportionate number of gross broadband subscriber additions taking higher and higher Internet speed tiers.

“We’re big believers in this trend continuing, and we really are moving toward a 10-gig world,” Goei said. “And to sit around and do this in multiple steps doesn’t make any sense [so we decided] to skip over DOCSIS 3.1 and get straight to the point.”

The cable industry may also be exaggerating the cost of fiber upgrades, especially when they cite the financial challenges experienced by Verizon (FiOS) and AT&T (U-verse) as both built out their respective fiber and fiber-copper networks from the ground up. Cablevision and Suddenlink will not have to build fiber networks from end to end because a significant part of their networks already include a substantial amount of fiber optics. Altice would simply extend the amount of fiber in its network to reach each customer.

Fiber to the home upgrades for Cablevision and Suddenlink customers.

Wall Street remains concerned about where the money to build the project, dubbed “Generation Gigaspeed,” is coming from. The Communications Workers of America is also afraid the money will come, in part, from significant downsizing and salary cuts.

Earlier this week, Altice announced it was spinning off its engineering and technical workers to a new independent entity — Altice Technical Services (ATS). When the spinoff is complete, it will employ as many as 4,500 of Altice’s current workforce of 17,000 employees nationwide, and will eventually manage Cablevision and Suddenlink service calls, outdoor network plant design, construction and maintenance, and house all of Altice’s employees servicing commercial accounts.

Although details remain murky, the union is concerned Altice could be engineering an end run around the New York Public Service Commission’s order approving the buyout of Cablevision if Altice did not lay off any New York workers for the next four years.

“We’re very concerned,” CWA District 1 assistant to the vice president Robert Master said. “But we haven’t fully unpacked it yet. We don’t know what they have in mind.”

CWA District 1 organizer Tim Dubnau was more blunt, telling Multichannel News: “We definitely smell a rat.”

Assuming ATS is configured as an independent entity, it will not be required to adhere to the NY PSC order prohibiting reductions of Cablevision’s customer-facing workforce in New York State, which theoretically could allow Altice to dramatically downsize.

Assuming ATS is configured as an independent entity, it will not be required to adhere to the NY PSC order prohibiting reductions of Cablevision’s customer-facing workforce in New York State, which theoretically could allow Altice to dramatically downsize.

Outside of New York, Altice’s cost cutting has followed a long established pattern company executives have followed in Europe for years, where Altice also offers service. In France, battles over toiletries and office supplies resulted in workers bringing their own toilet tissue to work. Downsizing, despite regulatory orders prohibiting layoffs, went ahead in France as company officials thumbed their noses at regulators. In the United States, a familiar pattern is emerging, charges Altice’s critics. Almost 600 call center workers were terminated in November in Connecticut, and other cutbacks have taken place in North Carolina and other states.

Late last week, the NY Post reported Cablevision employees are now complaining about an increasingly miserable office life as they endure penny-penching from their bosses. In New York, top management reportedly ordered the removal of many office printers to reduce the expense of replacement ink cartridges. Office cleaning expenses have also been reportedly slashed by increasing the length of time between cleanings. Even the cost of an ice machine for a break room has come under intense scrutiny, as cost management specialists demand better deals and less costly equipment. Much of the removed equipment provides one last service to Altice – a tax write-off after being removed from service and donated to charities.

Employees report unprecedented intensity of cost cutting and lengthy scrutiny of almost every expense. Some claim to have resorted to buying certain equipment and supplies out of pocket just to avoid drawing management scrutiny. Employee morale is reportedly low — especially at Cablevision, where reduced pay packages predominate under Altice ownership. Management has told employees to hold out for a planned IPO, which could allow them to reap some of the benefits of a Wall Street-fueled cash-raising exercise likely to be put to work buying up other cable operators in 2017.

Employees report unprecedented intensity of cost cutting and lengthy scrutiny of almost every expense. Some claim to have resorted to buying certain equipment and supplies out of pocket just to avoid drawing management scrutiny. Employee morale is reportedly low — especially at Cablevision, where reduced pay packages predominate under Altice ownership. Management has told employees to hold out for a planned IPO, which could allow them to reap some of the benefits of a Wall Street-fueled cash-raising exercise likely to be put to work buying up other cable operators in 2017.

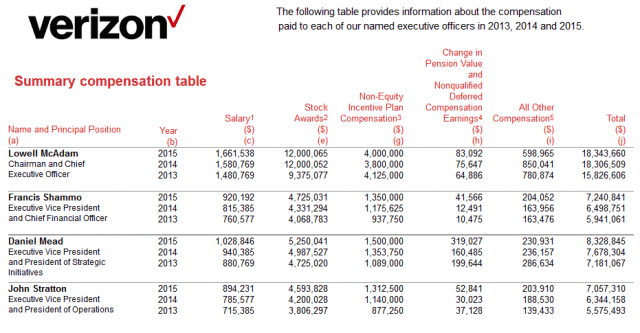

The pain of cost-cutting isn’t exactly reaching the top level executive suites, however. Despite a very public dispensing of Cablevision’s lush Dolan family corporate jet immediately after Altice took ownership of Cablevision, a replacement nearly identical to the original was quietly been put into service for the benefit of Altice’s management, according to the newspaper.

Assuming Altice can raise the money to pay for its fiber upgrade, it is expected to be completed within five years for all Cablevision and most, but not all Suddenlink customers.

Subscribe

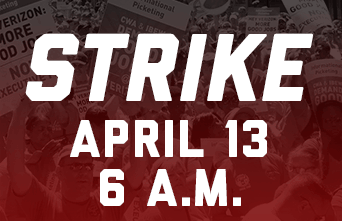

Subscribe The Communications Workers of America just proved there is strength in numbers. After 39,000 network technicians and customer service representatives employed by Verizon Communications went on strike April 13 after nearly a year without a contract, Wall Street pondered the potential impact of $200 million in lost business for Verizon’s FiOS, phone and television services.

The Communications Workers of America just proved there is strength in numbers. After 39,000 network technicians and customer service representatives employed by Verizon Communications went on strike April 13 after nearly a year without a contract, Wall Street pondered the potential impact of $200 million in lost business for Verizon’s FiOS, phone and television services.

Billionaire cable magnate and

Billionaire cable magnate and

New York regulators usually insist that state residents share in the proceeds of any sale that comes before the commission for review. In most cases, this is in the form of an agreement to invest in infrastructure or service improvements, improve customer service standards, and protect jobs. As with Time Warner Cable and Charter, the staff recommended the commission first consider a roughly 50/50 share of any deal savings or synergies, evenly split between customers and shareholders.

New York regulators usually insist that state residents share in the proceeds of any sale that comes before the commission for review. In most cases, this is in the form of an agreement to invest in infrastructure or service improvements, improve customer service standards, and protect jobs. As with Time Warner Cable and Charter, the staff recommended the commission first consider a roughly 50/50 share of any deal savings or synergies, evenly split between customers and shareholders. “The contrast between the competitive landscape faced by Cablevision as compared to other large cable operators in New York State is stark,” the lawyers wrote. “Verizon FiOS is available in just two Comcast communities, 3% of Time Warner Cable communities, and zero Charter communities in the state.”

“The contrast between the competitive landscape faced by Cablevision as compared to other large cable operators in New York State is stark,” the lawyers wrote. “Verizon FiOS is available in just two Comcast communities, 3% of Time Warner Cable communities, and zero Charter communities in the state.”

The Communications Workers of America has told the New York Public Service Commission it should reject Altice’s proposal to buy Cablevision for more than $17 billion, claiming it’s a bad deal for customers and employees alike.

The Communications Workers of America has told the New York Public Service Commission it should reject Altice’s proposal to buy Cablevision for more than $17 billion, claiming it’s a bad deal for customers and employees alike. “As late as the morning of Feb. 5, [the Joint Applicants] have continued their grudging and incomplete disgorgement of relevant and probative material to which CWA is entitled,” the CWA wrote. “CWA now possesses documents and data which are contradictory and require reconciliation.”

“As late as the morning of Feb. 5, [the Joint Applicants] have continued their grudging and incomplete disgorgement of relevant and probative material to which CWA is entitled,” the CWA wrote. “CWA now possesses documents and data which are contradictory and require reconciliation.” New York City’s Office of the Public Advocate is no fan either. In

New York City’s Office of the Public Advocate is no fan either. In