AT&T Mobility thinks it has a winning strategy when it took away unlimited data plans, forcing new customers to choose high-priced, usage-limited alternatives. But a new survey from Wall Street research firm Sanford Bernstein found AT&T customers will grab, claw, and scream to keep the peace of mind that comes from having the choice of an unlimited use plan.

AT&T Mobility thinks it has a winning strategy when it took away unlimited data plans, forcing new customers to choose high-priced, usage-limited alternatives. But a new survey from Wall Street research firm Sanford Bernstein found AT&T customers will grab, claw, and scream to keep the peace of mind that comes from having the choice of an unlimited use plan.

Sanford Bernstein’s study found a large number of customers willing to abandon any carrier that takes unlimited data away from them. About a third of the more than 800 people responding said AT&T’s move toward usage-based billing left them with a bad impression of the wireless carrier. That’s particularly bad for AT&T, which already scores as America’s lowest-rated wireless company according to Consumer Reports.

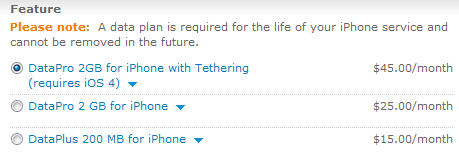

AT&T mitigated some of the potential damage by letting existing customers keep their unlimited data plans when they ceased selling the unlimited option this past June. New customers are forced to choose between two limited-use plans — $15 for 200MB or $25 for 2GB of usage (a tethering option is also available.) Existing customers will only face that hard choice if or when they change phones, presumably in the next year or two.

Had they not grandfathered in existing customers, Sanford Bernstein’s research suggests a large proportion of customers forced to give up unlimited data would quit AT&T even if it meant buying a new phone and paying a higher bill just to get the unlimited data option back. When AT&T eventually forces these customers’ hands, Sanford Bernstein predicts trouble.

According to the study, more than 58 percent of the lowest data users said they would dump AT&T overboard and switch to another provider with an unlimited plan. For heavier users, more than two-thirds are prepared to take their business elsewhere.

But even with overwhelming evidence like that, AT&T and some Wall Street analysts think Internet Overcharging schemes do customers a favor.

“Customers generally have strongly negative perceptions about Usage-Based Pricing, and these are often not correlated with self-interest,” Bernstein analyst Craig Moffett said in a research note analyzing the findings of the survey conducted this past summer. “It is fashionable to argue that loyalty to carriers is dead (except perhaps to Verizon Wireless, whose service level is perceived to be markedly higher than that of its competitors). The new conventional wisdom is that carrier loyalty has been replaced with loyalty to the device. But high inclination to switch carriers and phones to maintain an unlimited plan suggest that perhaps the plan itself is more important than either one.”

The Wall Street firm’s research is hardly news to consumers, who have repeatedly expressed loathing contempt for Internet Overcharging schemes like so-called “usage-based billing,” “data caps,” and speed throttles that kick in when carriers decide customers have used the service enough.

Consumers are willing to pay a higher price just knowing they will never face dreaded “bill shock” — a wireless company bill filled with hefty overlimit fees charged for excessive data usage. They also have no interest in being penalized by arbitrary usage limits that punish offenders with speed throttles that reduce wireless speeds to dial-up or lower.

AT&T was the first major carrier to throw down the gauntlet and force customers into choosing between a “budget plan” that is easy to exceed at just 200MB of usage per month or an inadequate, overpriced 2GB tier that costs just five dollars less than the now-abandoned unlimited use plan.

Wall Street firms like Sanford Bernstein worry their investor clients may be exposed to a revenue massacre when competing carriers like Verizon Wireless, which retains an unlimited plan for now, unveils its own version of the popular Apple iPhone. The result could be a massive stampede of departing customers headed for top-rated Verizon Wireless, even if it means paying early termination fees.

AT&T spokesman Mark Siegel sees things very differently however, telling CNET News AT&T’s new limited option plans deliver more choice and flexibility for data-hungry users.

“We have found that our customers in fact like usage-based billing,” he said. “They appreciate having choices in data plans. This is probably because a majority of customers can reduce their costs through our plans.”

If true, Siegel could prove that contention by revealing how many of AT&T’s grandfathered-in unlimited data customers were willing to give up that plan and downgrade to one of the new limited use plans. Siegel declined.

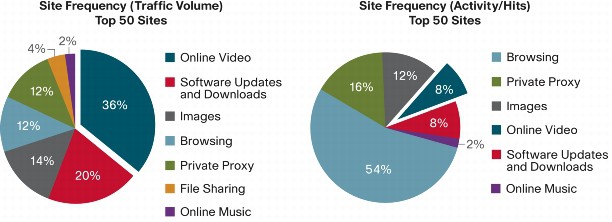

Moffett told CNET News his firm’s study found large numbers of existing customers using just a few hundred megabytes of usage per month who want to pay for an unlimited pricing plan, if only as insurance. For many, they recognize the smartphone-oriented explosion of data applications will only grow their usage further in the days ahead, and what may be a tolerable usage limit today will be downright paltry tomorrow.

Underusing an unlimited data plan represents fat profits for AT&T, but doesn’t solve the problem of getting price-resistant customers to upgrade their older phones. AT&T believes cheaper, limited use plans may do the trick. But the company also decided to eliminate the unlimited use option, fearing some customers could cannibalize profits by downgrading currently underutilized unlimited service, knowing they could always return to an unlimited data plan when use justified it.

Verizon Wireless Sees the Light And Throws a “Sale” on Its Unlimited Data Plan, But for How Long?

Verizon Wireless Sees the Light And Throws a “Sale” on Its Unlimited Data Plan, But for How Long?

Meanwhile, Verizon Wireless has settled on a more aggressive strategy to win many of its month-by-month customers back to two year service agreements with smartphone upgrades tied to an “unlimited data plan sale” that reminds would-be customers they still offer unlimited data, and gives many the chance to pay $10 less per month for it.

Customers either upgrading a current device to a smartphone on a family plan or adding a new line of service with a smartphone on a family plan will get $10 per month credit for each new smartphone line, for up to 24 months. Although the plan was originally designed to promote “free extra lines” by crediting back Verizon’s $9.99 charge for each additional line of service, in many markets Verizon salespeople are now spinning the credit as a “sale on the unlimited data plan” instead.

Even primary line customers on a family plan can upgrade to a smartphone and get the credit.

But customers with expired contracts on legacy plans no longer sold by Verizon will have to give those up and start a new Family SharePlan starting at $69.99 per month for 700 shared minutes. For those on popular retired plans like America’s Choice Family SharePlan, that represents a $10 rate hike for the exact same number of minutes and a loss of features including deducting mobile web use from available minutes instead of charging $1.99 per megabyte for access.

The unlimited data plan will effectively cost $20 a month for each smartphone on the account, and customers who want to use text messaging or other messaging features are likely going to need another add-on plan to cover that, starting at $5 a month. And then the junk fees and government mandated charges further increase the bill:

- Tolls, taxes, surcharges and other fees, such as E911 and gross receipt charges, vary by market and as of November 1, 2010, add between 5% and 39% to your monthly bill and are in addition to your monthly access fees and airtime charges.

- Monthly Federal Universal Service Charge on interstate & international telecom charges (varies quarterly based on FCC rate) is 12.9% per line.

- The Verizon Wireless monthly Regulatory Charge (subject to change) is 13¢ per line.

- Monthly Administrative Charge (subject to change) is 83¢ per line.

Still, Verizon’s $10 sale may be enough to convince some customers avoiding smartphone upgrades to take the plunge. Those doing so until the end of today through Verizon’s website can get free activation of their new phones.

Verizon hopes the offer will push a number of its legacy plan customers to abandon their old plans and grab a new smartphone at a subsidized price, putting those customers back on two year contracts. The offer expires January 7, 2011 (and the $10 credits stop after 24 months). The sale is only good on the unlimited data plan.

Subscribe

Subscribe