BCE, Inc., the parent company of Bell Canada, has acquired Manitoba Telecom Services, Inc. (MTS), in a deal worth $3.9 billion, further enlarging Canada’s largest telecommunications company.

BCE, Inc., the parent company of Bell Canada, has acquired Manitoba Telecom Services, Inc. (MTS), in a deal worth $3.9 billion, further enlarging Canada’s largest telecommunications company.

“Under the terms of this transaction, MTS will achieve much more than it could have as an independent company,” Manitoba Telecom president and CEO Jay Forbes said in a conference call with analysts. “BCE’s commitment to invest $1 billion over five years into Manitoba’s telecommunications infrastructure will also contribute greatly to the prosperity of our province and the quality of our customer experience.”

Many MTS customers and consumer advocates disagree with Forbes’ assessment, noting the deal will further consolidate Canada’s wireless marketplace by eliminating the province’s largest wireless carrier – MTS. The wireless business has nearly 500,000 customers – by far the largest provider in the region. Under the deal, BCE will sell off about one-third of MTS’ customers and retail storefronts to competitor Telus in a separate transaction.

Manitoba and neighboring residents in Saskatchewan pay some of the lowest prices for telecom services in Canada. MTS offers unlimited, flat rate Internet plans for both its broadband and wireless customers — plans likely to disappear or become more expensive after Bell takes over. The result, according to one Canadian telecom expert, will be higher rates.

“With MTS out of the way — and Bell and Telus sharing the same wireless network — prices are bound to increase to levels more commonly found in the rest of the country,” lawyer Michael Geist wrote on his blog.

The deal is also likely to deliver a death-blow to a government commitment assuring Canadians of at least four competing choices for wireless service. If Bell’s buyout is approved by regulators, Manitoba will be served by just three competitors — all charging substantially more than MTS.

…but soon we’ll be with Bell.

“Compare Bell’s wireless pricing for consumers in Manitoba and Ontario,” offered Geist. “The cost of an unlimited nationwide calling share plan in Manitoba is $50. The same plan in Ontario is $65. The difference in data costs are even larger: Bell offers 6GB for $20 in Manitoba. The same $20 will get you just 500MB in Ontario. In fact, 5GB costs $50 in Ontario, more than double the cost in Manitoba for less data. The other carriers such as Rogers and Telus also offer lower pricing in Manitoba. The reason is obvious: the presence of a fourth carrier creates more competition and lower pricing.”

That Manitoba Telecom would be up for sale at all came as a result of its controversial privatization in 2006 under a previous Conservative provincial government. The decision to privatize came despite a commitment from then-Premier Gary Filmon that Manitoba Telecom should remain a provincially-owned telecom company. Critics point to one possible reason for the flip-flop. Shortly after leaving politics, Filmon was appointed to the board of directors of the privatized company and was given $1.4 million in director fees and compensation over ten years, along with company shares with hundreds of thousands of dollars.

Economist Toby Sanger compared costs and returns of Manitoba Telecom and SaskTel, Saskatchewan’s publicly-owned telecommunications company. After two decades, the cost of a basic landline with SaskTel is $8 less per month than MTS, and SaskTel paid $497 million in corporate income taxes to the citizens of Saskatchewan – SaskTel’s shareholders – over the past five years, compared to $1.2 million paid by MTS over the same time period. In 2014, the CEO of SaskTel earned $499,492 compared to $7.8 million paid to the CEO of MTS for managing a very similar sized operation.

The acquisition will be reviewed by the Canadian Radio-television and Telecommunications Commission, the Competition Bureau and Industry Canada, and could be approved later this year or early 2017.

Subscribe

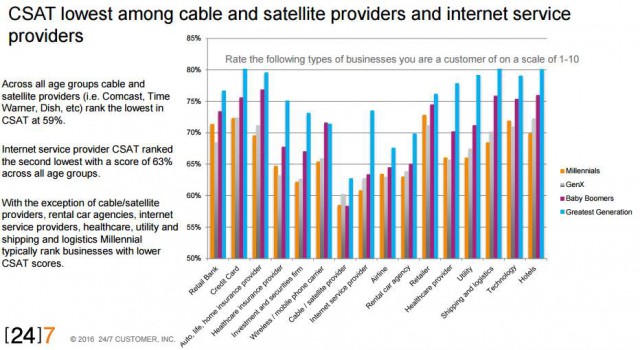

Subscribe It’s all hands on deck for a cable industry desperate to protect billions in revenue earned from a monopoly stranglehold on the set-top box, now under threat by a proposal at the FCC to open up the market to competition.

It’s all hands on deck for a cable industry desperate to protect billions in revenue earned from a monopoly stranglehold on the set-top box, now under threat by a proposal at the FCC to open up the market to competition.

Californians will have their chance to speak out about the proposed merger of Charter Communications and Time Warner Cable at a public hearing in Los Angeles tonight before an administrative law judge working for the California Public Utilities Commission (CPUC).

Californians will have their chance to speak out about the proposed merger of Charter Communications and Time Warner Cable at a public hearing in Los Angeles tonight before an administrative law judge working for the California Public Utilities Commission (CPUC). We remain suspicious about Charter’s commitment to not impose usage caps or usage pricing for only three years. Most consumers will not see much of a change in the broadband marketplace over the next few years. Charter can afford to wait 36 short months before potentially slapping on usage caps/billing — after winning additional regulatory approval to buy out even more companies. While the CEO of Time Warner Cable will walk away with over $100 million in golden parachute benefits if he successfully sells Time Warner Cable, we anticipate most customers will win a higher bill.

We remain suspicious about Charter’s commitment to not impose usage caps or usage pricing for only three years. Most consumers will not see much of a change in the broadband marketplace over the next few years. Charter can afford to wait 36 short months before potentially slapping on usage caps/billing — after winning additional regulatory approval to buy out even more companies. While the CEO of Time Warner Cable will walk away with over $100 million in golden parachute benefits if he successfully sells Time Warner Cable, we anticipate most customers will win a higher bill.