Altice, which operates Cablevision’s Optimum brand cable service in New York, New Jersey, and Connecticut, has informed regulators of a broad-based “rate event” that will take effect on June 1, 2018. Unless a customer is currently enrolled in a price-locked promotion, these new rates generally affect all customers, except as noted.

Altice, which operates Cablevision’s Optimum brand cable service in New York, New Jersey, and Connecticut, has informed regulators of a broad-based “rate event” that will take effect on June 1, 2018. Unless a customer is currently enrolled in a price-locked promotion, these new rates generally affect all customers, except as noted.

Altice told Connecticut regulators the rate changes “reflect the rising cost of programming and our significant investment in the customer experience. Optimum pricing is competitive when compared with other providers, and the Company continues to offer a wide array of products to meet all consumer needs and budgets.”

Altice has told Wall Street a different story, noting it is prioritizing a reduction of the company’s massive debts that came from aggressive acquisitions of other cable systems. Altice also told investors in February Altice USA will distribute a special cash dividend to shareholders of $1.5 billion to celebrate Altice USA’s split from its Netherlands-based parent company Altice NV. The company also told shareholders it was happy with its latest profitable results, showing Altice’s residential business growing to just over 80% of total revenue, up 2.9% in 2017 and 1.8% in the fourth quarter of 2017. Business services is growing in mid single digits.

Altice also plans to continue increasing marketing on its advanced all-in-one-box solution — Altice One, which costs $25 a month.

Changes effective June 1, 2018:

• Set-Top Box: For customers who elect to receive a traditional set-top box from Optimum, the monthly rate will increase from $10.00 to $11.00. Does not apply to existing commercial customers.

• CableCARD: For customers who request a CableCARD from Optimum, the monthly rate will increase from $2.00 to $2.50.

• Sports Surcharge: To partially cover the continually increasing costs that programmers charge Altice to carry sports, the Sports Surcharge will increase from $6.97 to $7.97, for customers subscribing to the Optimum Core or higher tiers. (Broadcast Basic & Economy customers are not charged the Sports Surcharge.)

• Broadcast TV Surcharge: New residential Broadcast Basic and above customers currently pay a $3.99 monthly “Broadcast TV Surcharge” to partially offset the high costs that broadcasters charge. This fee will increase to $4.99 a month and will also be applied to existing Broadcast Basic residential customers and new commercial customers.

• Broadcast Basic Tier: New residential customers currently pay $19.99 per month for Broadcast Basic. To align basic tier rates, this same rate will apply to existing residential Broadcast Basic customers currently paying a monthly rate over $13.95. As an accommodation to existing Basic Tier customers currently paying $13.95/month, the new monthly Basic rate will be $14.95.

• Sports and Entertainment Package: This a la carte subscription will increase from $8.95 to $10.00.

• Residential Service Protection Plan: In addition to the free 24/7 technical support that Optimum offers all customers, the optional Service Protection plan covers any fees assessed for service visits. To align our rates, existing customers who currently pay $4.99/month will pay the same $6.99 fee currently applicable to new customers.

• Restoration Fee: Optimum customers who do not pay their bill within 30 days of the due date, despite multiple reminder notices, are currently subject to a $4.99 per service fee to restore their service. Effective June 1, the minimum service restoration fee will be $10.00 for single and double product customers and $15.00 for triple product customers.

• Installation Fee: Starting June 1, the prices paid by customers for standard and premium installations will increase from $69.00 to $99.00 and $99.00 to $129.00, respectively. Customers are being notified 30 days in advance for each of these changes through bill messages or inserts. In addition, rate information will be available on our website at www.optimum.net.

Subscribe

Subscribe

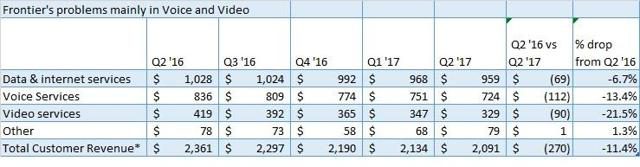

Frontier Communications spent $2 billion in 2014 to purchase AT&T’s Connecticut wireline business, believing it could make a fortune selling internet and cable television service to wealthy Nutmeg State residents over a network AT&T upgraded to fiber-to-the-neighborhood service several years earlier.

Frontier Communications spent $2 billion in 2014 to purchase AT&T’s Connecticut wireline business, believing it could make a fortune selling internet and cable television service to wealthy Nutmeg State residents over a network AT&T upgraded to fiber-to-the-neighborhood service several years earlier.