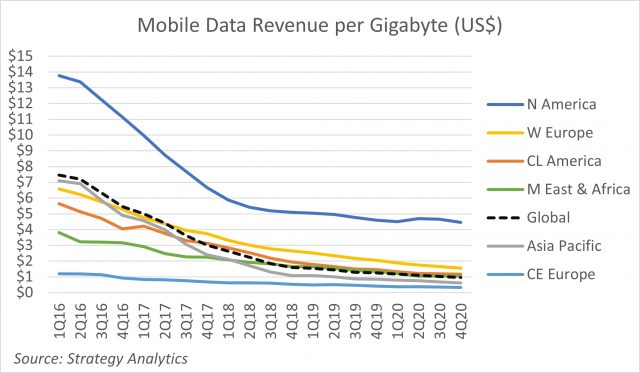

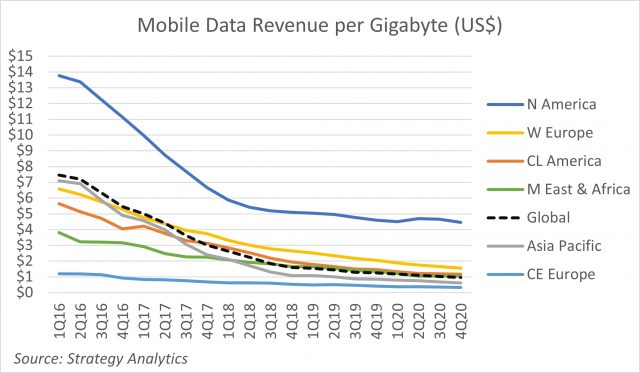

The cost to deliver a gigabyte of data over mobile networks has plummeted 88% in the last five years, yet U.S. consumers are still paying an average of four times more than the rest of the world and twice the price that Europeans pay for average, comparable mobile plans.

The cost to deliver a gigabyte of data over mobile networks has plummeted 88% in the last five years, yet U.S. consumers are still paying an average of four times more than the rest of the world and twice the price that Europeans pay for average, comparable mobile plans.

The average cost to deliver mobile data has dropped to around $1/GB, thanks to network upgrades including Massive MIMO, carrier aggregation, the wide use of 4G LTE and the gradual introduction of 5G technology. As a result, mobile pricing has dropped significantly in competitive market areas. In much of Europe, a mobile plan with a generous allowance of mobile data and a bundle of texting and voice calls now costs around $15 a month, largely due to market competition. In Luxembourg and Australia, two companies sell generous data, calling and texting plans for under $10 a month. Iliad, a mobile provider in Italy, offers a plan with unlimited calling/texting and a 50 GB data allowance, including hotspot service, for $9.60 a month.

Despite the increased pressure on pricing, U.S. consumers are still paying some of the highest prices in the world, especially when dealing with two dominant carriers — AT&T and Verizon. Broadband and mobile analyst Dave Burstein noted an increasing pricing gap between the U.S. and Western Europe that widened starting in 2018.

“U.S. prices are now twice the Europeans and four times the world average,” Burstein noted. “Prices continue to fall rapidly except in the U.S., [which has remained] almost flat the last three years.”

Burstein also noted Verizon and AT&T have both estimated wireless data costs decline 40% per year in cost per bit. But most consumers are not benefiting from the dramatic cost declines as wireless companies stubbornly refuse to reset rates. The pressure for further price reductions has also been reduced with the recent merger of Sprint and T-Mobile, which had been largely responsible for forcing AT&T and Verizon to offer more generous plans or reduce rates.

Some of the most significant mobile competition has come from cable operators, which offer plans that resell access to the established 4G networks of Verizon (Charter, Comcast) and T-Mobile/Sprint (Altice USA). While AT&T and Verizon focus on high value customers and increasingly market costly “unlimited” family data plans, cable operators have offered consumers more simplified pricing focused on value for money, including per gigabyte plans and a basic unlimited data offer. Recently, Comcast’s XFINITY Mobile introduced its own family plan pricing, which can further reduce the price for multiple lines billed together and poses a more direct threat to Verizon.

Some researchers believe that marketing mobile plans by focusing on price and data allowances will be a dead end for wireless companies hoping to deliver regular increases in the amount of revenue collected from each subscriber. If competition does pressure companies to increase data allowances and reduce pricing, companies will need to find new revenue sources to deliver the financial results their investors demand each quarter.

“With many consumers picking price plans that fit their budget first and their data usage requirements second, operators need to educate users away from high-volume, low-cost plans and the idea that 150GB is meaningfully better than 100GB,” said Josie Sephton, director of Teligen. “We are in a data pricing merry-go-round that needs to be reset.”

Phil Kendall, director of the Service Provider Group and author of a report on mobile pricing suggests operators cannot provoke upgrades to higher cost plans with higher data allowances alone.

“Operators need ‘more for more’ pricing that offers revenue uplift through better experiences and richer content rather than through more data,” Kendall said.

Subscribe

Subscribe

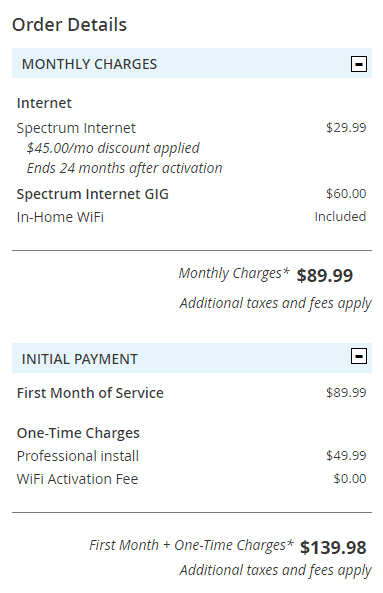

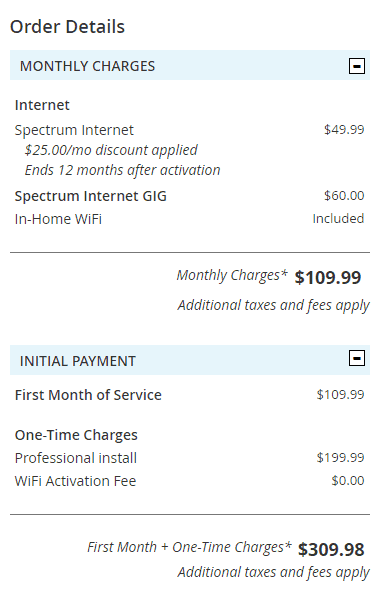

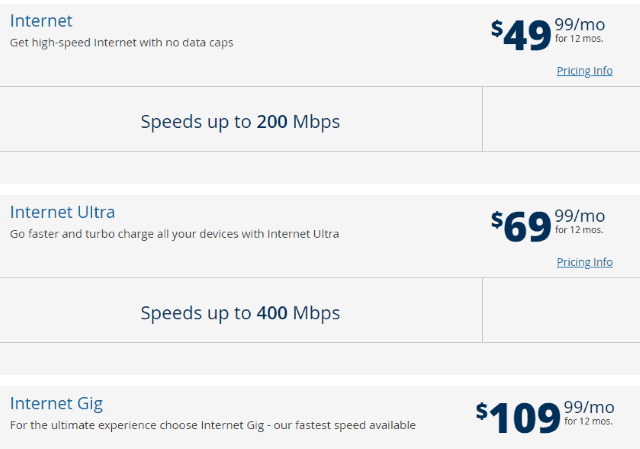

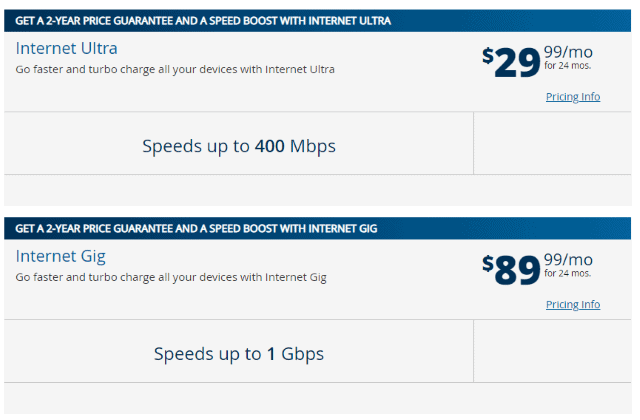

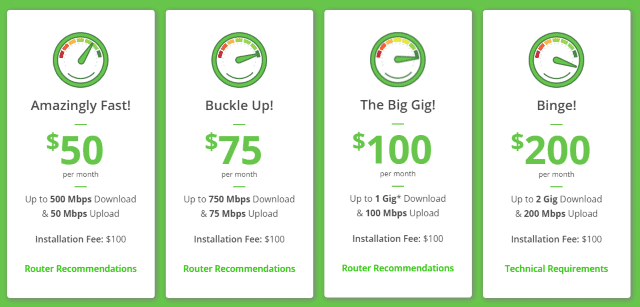

Competition is a wonderful thing. A case in point is the enormous difference Charter Spectrum charges new customers in areas where competition exists, and where it does not.

Competition is a wonderful thing. A case in point is the enormous difference Charter Spectrum charges new customers in areas where competition exists, and where it does not.

The cost to deliver a gigabyte of data over mobile networks has plummeted 88% in the last five years, yet U.S. consumers are still paying an average of four times more than the rest of the world and twice the price that Europeans pay for average, comparable mobile plans.

The cost to deliver a gigabyte of data over mobile networks has plummeted 88% in the last five years, yet U.S. consumers are still paying an average of four times more than the rest of the world and twice the price that Europeans pay for average, comparable mobile plans.