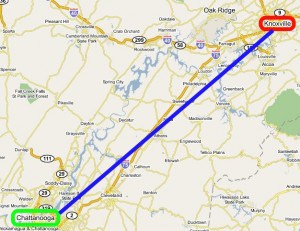

Chattanooga’s investment in community fiber broadband is beginning to pay dividends as the city benefits from an increase in high-paying, high-technology jobs. Unfortunately for cities like Knoxville, Chattanooga’s gains are their loss.

Chattanooga’s investment in community fiber broadband is beginning to pay dividends as the city benefits from an increase in high-paying, high-technology jobs. Unfortunately for cities like Knoxville, Chattanooga’s gains are their loss.

“In a lot of places, you can get the same kind of high speed service as Chattanooga. The difference is the price,” Dan Thompson of Knoxville-based IT company Claris Networks told Knoxville TV station WBIR. “Connectivity there for us is about eight to ten times cheaper in Chattanooga than it is versus Knoxville or other cities. That’s a huge deal when you’re comparing $100 a month or $800 a month.”

As a result, Claris is skipping the pricey service on offer from AT&T and Comcast and is moving jobs down I-75 to the city of Chattanooga, where publicly-owned EPB Fiber has invested in a fiber-to-the-home network that beats the pants off the competition. Claris has found gigabit broadband in Chattanooga that can be installed in days at a fraction of the price charged by the companies they deal with in Knoxville. Now Claris can invest the savings in bigger data centers and the jobs that come with them.

“Here in Knoxville and other cities, you may have to pay a premium to get speeds fast enough to support that,” Thompson said.

While companies like AT&T, Time Warner Cable, CenturyLink, and Comcast have had Chamber of Commerce support opposing community broadband in other states, Chattanooga’s local Chamber knows a good thing when it sees it. Garrett Wagley, vice president of policy and public relations for the Knoxville Chamber, tells the Knoxville station investment in infrastructure is important when recruiting new businesses to town and keep existing ones growing.

Investment in high technology networks is an important topic for the evolving economies of the mid-south region. Formerly dependent on tobacco farming, textiles, and manufacturing, states like Tennessee and the Carolinas are now investing to compete for high-technology, digital economy jobs. Public investment in broadband comes as part of that effort, and typically only after appeals to existing commercial providers fail to bring necessary upgrades.

Investment in high technology networks is an important topic for the evolving economies of the mid-south region. Formerly dependent on tobacco farming, textiles, and manufacturing, states like Tennessee and the Carolinas are now investing to compete for high-technology, digital economy jobs. Public investment in broadband comes as part of that effort, and typically only after appeals to existing commercial providers fail to bring necessary upgrades.

That “other places first” upgrade mentality continues to this day in states like South Carolina, which waited years for Time Warner Cable and local phone companies to deliver broadband speeds states further north have been receiving for several years.

For companies like Google and Amazon.com, the choice of where to locate regional data and distribution centers is often dependent on available infrastructure. Chattanooga is in a strong position to argue it already has a broadband network in place that can meet the needs of any high-tech company, at prices too low to ignore. Economic investment, jobs, and tax revenues follow. Even better, much of the revenue earned by EPB Fiber stays in Chattanooga, paying off network construction costs and allowing the public utility to invest in smart-grid technology, which could benefit electric ratepayers as well.

Christopher Mitchell at Community Broadband Networks notes Chattanooga is not alone seeing significant job gains from investment in public broadband. Just 100 miles to the northeast is Bristol, Virginia, another city that is transforming itself to support 21st century knowledge economy jobs. Bristol’s public fiber network delivers service across most of southwestern Virginia, across an area long ignored or under-served by larger commercial providers.

For cities stuck with whatever AT&T, Comcast, and Time Warner Cable decide to offer, the trickling job migration to better-wired cities could eventually become a fast-running stream. That’s why WBIR-TV questioned Knoxville city officials about why they abandoned consideration of their own public fiber network.

For cities stuck with whatever AT&T, Comcast, and Time Warner Cable decide to offer, the trickling job migration to better-wired cities could eventually become a fast-running stream. That’s why WBIR-TV questioned Knoxville city officials about why they abandoned consideration of their own public fiber network.

The City of Knoxville’s chief policy officer, Bill Lyons, told 10News there has been some discussion about constructing network infrastructure in the past.

“We did discuss this general topic very briefly early in the last administration and did not pursue it,” wrote Lyons. “There was no systematic assessment, but rather a sense that the associated investment in infrastructure was not needed given the service that was already available.”

[…] “The question we as citizens need to ask is this something we’d be willing to spend money on,” said Thompson. “I think you’d have to ask if you built this kind of network would more businesses come here. And if they would, do the tax dollars [gained by attracting news business] offset the cost that we as citizens would have to pay.”

Good-enough-for-you broadband at take-it-or-leave-it sky high prices has been the state of broadband across the mid-south for years. Unfortunately for Knoxville and other cities in Tennessee and the Carolinas, high-tech businesses are quickly discovering they don’t have to take it anymore. What cities like Knoxville lose, Chattanooga gains.

[flv]http://www.phillipdampier.com/video/WBIR Knoxville Chattanooga Fiber Attracts Jobs 12-27-11.mp4[/flv]

WBIR in Knoxville explores Chattanooga’s success in broadband, which is now starting to come at the expense of other Tennessee cities who don’t have the infrastructure to compete. (3 minutes)

Subscribe

Subscribe