Frontier’s new mascot

I’m sure more than a few readers work for a company with a marketing department that churns out advertising and imagery that leaves you shaking your head wondering what they were thinking.

There are some employees at Frontier Communications who are head-scratching this week as the company unleashes “Frontier’s First Ever Spokesman.”

His name is Francis Abraham Buffalo (his friends get to call him “Frank.”) He’s a… buffalo.

An internal memo obtained by Stop the Cap! informs employees Frank is prepared to bulldoze his way through “the clutter and get consumers buzzing.”

“Think of the Aflac duck and the Geico gecko,” a Frontier executive writes. “People have a truly positive association with them that translates into a positive feeling for those companies.”

But can a new mascot really change perceptions about a company more than the quality of the products or services a company provides (or doesn’t)?

For the record, your editor has never been particularly moved by either the duck or the gecko, and I, along with many other Americans, stopped watching television commercials years ago with the advent of the DVR. I have also never bought a product or service based on anything other than its merits and price. Frontier’s buffalo will not change that.

The mascot search involved a nationwide focus group of at least 800 customers and non-customers who were shown a series of “try-outs” involving lip-synched ducks, pigs, and various other creatures you may have last encountered as roadkill.

“Frank was the top choice, lifting our preference rating over the competition by 8 points and decreasing the competition by 3 points. That’s a net 11 point increase for Frontier and solid support that we’re on the right path,” the company trumpets.

Of course, their cable competitors can always suggest while Frontier is busy playing with animals, they are delivering far faster broadband service and a better package of phone, broadband, and television service that does not involve a third-party satellite dish stuck on your roof.

Of course, their cable competitors can always suggest while Frontier is busy playing with animals, they are delivering far faster broadband service and a better package of phone, broadband, and television service that does not involve a third-party satellite dish stuck on your roof.

Even some Frontier employees were less than enthusiastic about the endeavor, already predicting the response ads from the competition.

“I thought the pig would’ve been a better choice,” writes one. “I can just see the competition running ads about not getting ‘Buffaloed’ by Frontier!”

Most of the excitement among employees seems to emanate from the office that envisioned the campaign and spent a lot of money to make it happen.

“A landmark decision in the continuing evolution of Frontier,” jokes a Frontier worker less than thrilled with the result.

Even Frontier executives admit that Frank might be a big, fat target:

“We have also heard some concerns from our employees that we are proactively addressing in the campaign so our competitors won’t take advantage of our new brand spokesperson.”

“Frank will be a boffo buffalo. A solid, truth-talking machine that doesn’t like fuss or tricks – and neither do we. We play it straight — price guarantees and no contracts make it easy for consumers to understand our products and services. So if anyone asks, Frank is not here to “buffalo” or trick anyone (call Cable if you want that!). He doesn’t deal with BS or malarkey, and that means no hidden fees, no surprises.”

Phillip “It’s actually an American bison” Dampier

Frontier is asking for advice on how to make Frank a better buffalo and offer any additional feedback. At Stop the Cap! we are always willing to help, so we publicly offer advice for our hometown phone company.

- The American buffalo is actually the American bison, but that probably sounds too French (it is actually Greek, but nobody wants to get too close to Greece these days). The bison’s story is remarkably similar to phone companies like Frontier. It once roamed across the American landscape in great herds but was targeted to near extinction. Just like your landline. It still maintains “near threatened” status, and is only gradually making a comeback with the help of conservation efforts. While our ancestors shared their lives with the bison, most people today will only meet one in a zoo or park. We are unsure why Frontier would want to associate itself with an animal best known in the past and unlikely to be seen today.

- Lip-synching animals (and babies) has become cliché. We were not too impressed with the voice talent Frontier decided to use for their animals either. Instead, check out Telus, western Canada’s biggest phone company. They turn animal wrangling into an art form, using various critters in their ads for phone, broadband, and wireless service. Telus compliments their animal friends with Canadian musicians to visually and musically deliver whatever message the company wants to share.

- While Frontier may have eliminated some of its old tricks like contract termination, equipment, service protection, and surcharge fees from customer bills, many of us have long memories of the surprise steep cancellation fees charged when dropping landline service that we kept for 20+ years. Others found Frontier’s inadequate DSL only slightly less annoying than the $100+ service termination fee thrown on the last bill. Some of those fees are still being charged to customers, including a particularly silly broadband account service order charge that still stings departing customers. It is hard to accept Frontier’s new marketing messages when the company is still baiting the traps.

- Frontier’s reputation problem does not come from poor advertising. It comes from a poor selection of products and services. Frontier until recently has simply refused to keep up with the reality of today’s broadband market. Sorry, basic DSL will no longer cut it, particularly when a competitor arrives. Cable can still out-class Frontier’s broadband products even after upgrades to ADSL2+ and VDSL. Frontier bills are still loaded with surprise surcharges and extras that raise the out-the-door price, sometimes even higher than what cable charges. The more important question to ask focus groups is why people do business with Frontier. Is it because they have to or they want to?

Frontier still does not evoke “cutting edge” anything. Frontier FiOS, inherited from Verizon, is the child nobody wants to talk about.

For years, Frontier only offered ADSL at speeds that stopped keeping up with cable a decade ago, even in large metro areas like Rochester, N.Y. When the company advertised “up to” in association with broadband speeds, it meant it: advertise up to 12Mbps but deliver service as slow as 3.1Mbps. With VDSL, 25Mbps might be doable, but cable already offers 30/5 or 50/5Mbps that is a sure thing.

Frontier’s landline service is generally reliable and works even with a power outage if you have a wired phone. But the company charges too much for a phone line many people are now jettisoning in favor of their cell phone and the company is still pushing long distance calling plan bundles that are now irrelevant. Does anyone under 35 know what a toll-call is?

Frontier’s “television” service for most customers is a third-party reseller agreement with a satellite provider with its own contract and conditions. Exciting? Not exactly.

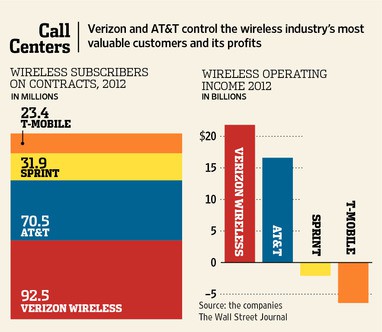

There isn’t much to see here. AT&T and Verizon have spent money to earn money. The only major success story from AT&T’s landline business is its U-verse platform. Verizon FiOS delivers the most formidable competition cable operators like Time Warner Cable and Cablevision have seen. Even CenturyLink has invested in Prism, a fiber to the neighborhood system that can deliver a true triple-play package of services that give customers a reason to stay.

Frontier has Frank the Buffalo and some long-overdue technology upgrades that probably won’t win back a lot of customers.

So what are the strengths Frontier can sell?

- In most markets, Frontier has no hard limit on broadband usage. That is an attractive selling point where cable operators slap usage caps on customers. Usage caps can and do trigger customer defections;

- Frontier phone service is generally more reliable than cable or Voice over IP. Talk to customers in storm-struck areas who lost power and cable, but their phone line kept on working;

- Frontier ADSL2+ and VDSL can outperform rural cable operators who have either oversold their shared network or don’t offer higher DOCSIS 3 speeds yet;

- Frontier Wi-Fi, if vastly expanded, can be a useful free add-on and selling tool in areas served by cable operators that do not offer the service. But Frontier Wi-Fi hotpots have to be more commonly encountered to make a difference.

Above all, Frontier must keep upgrading its network to stay competitive. Once you lose customers, they can be extremely hard to get back. For many of us, establishing an account with the phone company meant significant installation fees and several days before a crew would turn up to connect service. Frontier knows perfectly well going back to the phone company after leaving is a high hurdle many never attempt.

The best mascot a company like Frontier can adopt are real customers and employees talking about their satisfaction with the changes Frontier is making. Without that, the customers that left will probably always think of Frontier as yesterday’s news. Using an American buffalo that neared extinction itself is probably not going to change that perception.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Frontier Animal Mascot Tryouts 4-13.flv[/flv]

Here are Frontier’s animal mascot tryouts. (1 minute)

Subscribe

Subscribe

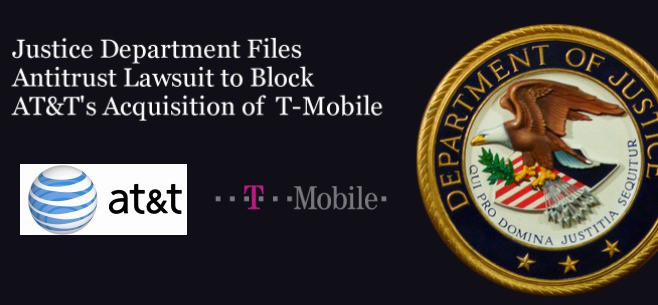

The Justice Department echoes critics’ contentions that given a chance, large wireless carriers will “warehouse” acquired spectrum, unused, denying it from the competition. Carriers object to that claim, calling it baseless. But incentives remain for providers to drag their feet: spectrum warehousing forces competitors to pay even higher prices for other scarce spectrum, the necessity of constructing a larger network of costly cell towers to offer robust coverage, and fighting customers’ perceptions of inferior quality indoor phone reception.

The Justice Department echoes critics’ contentions that given a chance, large wireless carriers will “warehouse” acquired spectrum, unused, denying it from the competition. Carriers object to that claim, calling it baseless. But incentives remain for providers to drag their feet: spectrum warehousing forces competitors to pay even higher prices for other scarce spectrum, the necessity of constructing a larger network of costly cell towers to offer robust coverage, and fighting customers’ perceptions of inferior quality indoor phone reception.

Malone sees the future sustainability of the cable industry dependent on the high revenue broadband business.

Malone sees the future sustainability of the cable industry dependent on the high revenue broadband business.